Business

Rising import duty rate threatens 2024 growth target

Frequent hike in the exchange rate for the clearing of cargo occasioned by aggressive revenue drive of the Nigeria Customs Service (NCS) is translating to ballooning cost of imports and production among other effects, leaving businesses in the real sector of the economy groaning.

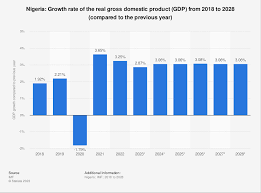

President Bola Tinubu, had, while presenting the 2024 budget proposal to a joint session of the National Assembly in November, said his administration was targeting a 3.76 percent economic growth in the 2024 fiscal year.

This was as he spotlighted national security, local job creation and poverty reduction as the top priorities of the 2024 Appropriation Bill which he called the ‘Budget of Renewed Hope.’

“A critical focus of this budget and the medium-term expenditure framework is Nigeria’s commitment to a greener future…We expect the economy to grow by a minimum of 3.76 percent, above the forecasted world average. Inflation is expected to moderate to 21.4 percent in 2024,” Tinubu had stated.

The situation, which is putting thousands of jobs at risk, is working against the sustained efforts of the Central Bank of Nigeria (CBN) to tame a high inflationary pressure, an ill wind that blows no economic agent any good.

Misery of Nigerian importers was again increased on Tuesday February 27, when the CBN raised the exchange rate for computing Customs duties at the nation’s seaports to N1, 506.352/$ from N1, 440.121/$.

The amount, which represents a 4.6 percent hike when compared to the old rate of N1,440.121/$ used as of Monday, February 26, 2024, is an increase of N66.231 more on a dollar needed to clear goods from the port.

With the apex bank’s policy that Customs should be using the rate on the date of submitting Form M for calculating duties, the adjustment means that importers opening Form M on Tuesday February 27, 2024, for any import trade, would have to look for more money to pay as import duties compared to the importer, who opened Form M the previous day, February 26, 2024.

CBN’s Director of Trade and Exchange Department, Hassan Mahmud, had asked Nigeria Customs in a circular to adopt the closing FX rate on the date of opening Form M for the importation of goods and for Import Duty Assessment. According to him, the use of the rate on Form M for cargo clearing would take effect from February 26, 2024. He said it would remain valid until the date of termination of the importation and clearance of goods by importers.

“This would enable the Nigeria Customs Service and the importers to effectively plan appropriately and reduce the uncertainties around varying daily exchange rates in determining their revenue or cost structure, respectively,” Mahmud had said.

The Chief Executive Officer, Centre for the Promotion of Private Enterprise (CPPE), Dr. Muda Yusuf, agrees that the decision to apply the FX rate on form M for calculating import duty is a laudable response because it would reduce the current uncertainty around imports.

Yusuf in a statement sent to our correspondent, however, pointed out that the apex bank’s intervention did not address the bigger and more troubling issue of the currently prohibitive cost of clearing goods at the ports which, he said, had risen by over 40 percent in the last two months.

“The high exchange rate for import duty assessment is fueling the already high inflation, increasing production and operating costs for manufacturers and other businesses, worsening the cost-of-living crisis, and putting thousands of maritime sector jobs at risk,” Yusuf, an economist, argued.

“There is also the added risk of cargo diversion to neighbouring countries and heightened smuggling, which could jeopardise the realisation of customs revenue target.”

The former Director-General, Lagos Chamber of Commerce and Industry (LCCI) called for the pegging of FX for paying Customs duty at N1,000 to the dollar to mitigate the current hardship in the country.

Keeping hope alive

The GDP projection was reaffirmed early last month by the CBN governor, Olayemi Cardoso, who said the Federal Government of Nigeria anticipated a 3.76 percent real GDP growth in 2024, slightly surpassing the estimated 3.75 percent for 2023.

“Inflationary pressures are expected to decline in 2024 due to the CBN’s inflation-targeting policy, aiming to rein in inflation to 21.4 percent, aided by improved agricultural productivity and easing global supply chain pressures”, Cardoso also said.

Similarly, in late January, the Nigerian Economic Summit Group (NESG), in its 2024 macroeconomic outlook report, titled “Economic Transformation Roadmap: Medium Term Policy Priorities”, said Nigeria’s GDP would grow at 3.50 percent in 2024.

According to the group, various reform programmes initiated by the government are expected to trigger an uptick in economic growth as strains on investment are addressed and low productivity in critical sectors resolved.

Conflicting realities

But the trajectories of macroeconomic indices are rather questioning the efficacy of the reforms. Data from the National Bureau of Statistics (NBS), showed that the country’s annual inflation rate jumped to 29.90 percent in January from 28.92 percent in December 2023, primarily fueled by a continuous surge in food prices.

According to the report, the food inflation rate in January 2024 quickened to 35.41 per cent on a year-on-year basis, which was 11.10 per cent points higher compared to the rate recorded in January 2023 (24.32 per cent).

During a media parley with journalists recently, Director-General of the Manufacturers Association of Nigeria (MAN), Segun Ajayi-Kadir, said the hike in the prices of products is unlikely to stop without an attendant solution to the soaring costs of production.

The MAN DG, who lamented the frequent hike in the interest rate for cargo clearance, said manufacturers were being saddled by increased production costs due to the current economic situation of the country.

He said, “Within a space of two weeks, they changed the assessment of import duties five times. Can a manufacturer do that? There is no reason the government cannot deliberately freeze the exchange rate for raw materials that are imported.

“President Tinubu, on his first day in office, said he was going to promote domestic manufacturing. You don’t do that by killing domestic producers. It is certain, there is no way I will import my raw materials at a very high cost and you expect prices to reduce in the market. It is not going to happen.”

The Monetary Policy Committee of the apex bank on Tuesday increased the benchmark interest rate by 400 basis points from18.75 percent to a record 22.75 percent, a move some analysts said would worsen the manufacturers’ woes.

But the CBN said the MPC members voted for a significantly high policy rate hike to drive down the inflation rate which, they said, could become more persistent in the medium term and pose more regulatory issues if not well-anchored.

Seven big firms operating in the country suffered severe losses in their operations for the financial year ended December 31, 2023, owing majorly to ravaging forex losses, high production and operating costs among others.

A review of their full-year 2023 financial results showed that they incurred whopping forex losses of about N1.24 trillion, leading to poor performance as they recorded loss before tax of about N415.43 billion.

The companies include Nestle Nigeria Plc, N195 billion, Nigeria Breweries, N153 billion, BUA Cement N69.95 billion, Lafarge Africa N21 billion, Guinness Nigeria, N49.1 billion, MTN, N740 billion and Cadbury Nigeria, N13.5 billion.