Business

Outrage as Nigerian govt detains senior Binance executives who came in for talks

In a shock move, the Nigerian government detained two senior executives at Binance as it continues to crackdown on cryptocurrency trading in an attempt to battle naira collapse, drawing angry responses from citizens and the global community who noted that the decision is a red flag.

Business Hallmark had reported that the detained executives flew to Nigeria following the country’s decision to ban several cryptocurrency trading websites last week but they were detained by the office of the country’s national security adviser and their passports seized, according to people familiar with the matter.

An adviser to the office did not immediately respond to a request for comment, according to Financial Times, while Binance also declined to comment.

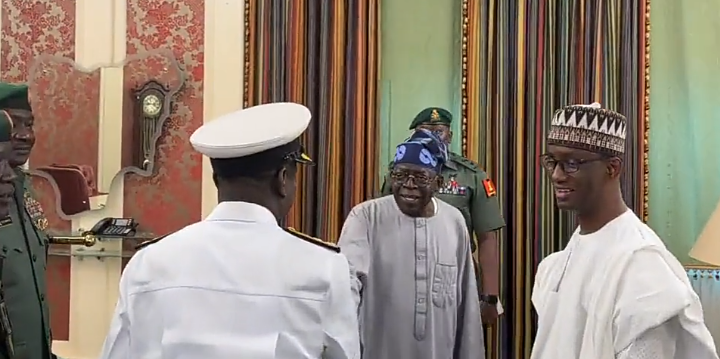

The move, however, has continued to attract outrage on X, with many arguing that the government of Bola Tinubu is only scaring away investors by portraying Nigeria as a country without the rule of law.

Ali, @TheBigAL999, a Pakistani national, in a reaction to the news warned that it could worsen Nigeria’s economic situation.

“Come on Nige.. I love you but this is a bad look. So many companies have millions stuck that they can’t access, you’ve made investing tough because nobody can get their money out. And now you are arresting execs,” he wrote. “This should be addressed, it’s bad PR, you guys need to figure this out.”

Another user z Thurayyah Ahmad, @Surayyah__ahmad, suggested that Nigeria is an unpredictable economy.

“No economic planning or financial forecast prepares one for Nigeria’s political environment. Porter’s forces and theories all failed!” He said.

On his part, Akwa Ibom 1st son, @ukocarter, noted that, “Binance executives who don’t live in Nigeria flew in to discuss business with the government, the government arrested them, detained them, and seized their passports. Genius move.”

Another X user, Chief Nomso, @Odogwu_Nomso, said, “You drew in Binance Executives into Nigeria, Tricked them into a meeting and arrested them unlawfully in NG. Everyone involved in this is Mentally Deranged.”

In a sarcastic post, Opeyemi Babalola, @BOTAD01, ridiculed the government, noting that, “This is something PDP government and Buhari should have done in the past. With this move, watch the dollar go down to N250 by this time next week.

“Akanbi, omo olodo ide, keep taking us to the permanent site.

“We love you.”

On her part, Weyimi B. Lube, @_weyimi, said, “Whose ‘genius’ idea was this and what was that person thinking???

“Congratulations investors are rushing into Nigeria for sure 🙄🙄

“My goodness!”

Another user, Tech Esq, @NOTIMEisNOTIME, wondered: “Do you know how crazy this is?

“BAT is moving from country to Country, canvassing people to invest in Nigeria, yet they detain binance executive.

“After, they will say its twitter people that is demarketing Nigeria.

“Yesterday, in his bit to “widen the tax net” he initiated a levy called expatriate employment levy that will extract $10k from expatriates on a yearly basis.

“HOW WILL THEY COME AND INVEST.”

Ahmad A. Yusuf, @Ahmad_YSF, said, “I wish I have the time and energy to do a thread on how binance really helped Importers in Nigeria. People just don’t know. But we all know where there’s demand and supply, price would definitely be competitive. This economic team is honestly an embarrassment.”

Dr. ‘Femi, @thefemianthony, on his part, noted that, “what frustrates me about the Nigerian Government is their tendency to shift blame onto others instead of taking responsibility for their own failures.”

Timi Olagunju ESQ, @timithelaw, remarked: “Expect USD to N2500 in Q2-Q4 2024. Yekini’s Government is brazenly de-marketing Nigeria and driving investors away by sheer ignorance.

“When Bosun tries to move us one step forward, his boss moves us two and half steps backwards.”

Another user, Dare Akinyemi, @Dharray007, said, “FT quoted Bayo Onanuga saying Binance fixes exchange rates, that reminds me of when Meffy said AbokiFX fixes exchange rate, we all know how it went.

“If Nigeria does not fix structural issues, they would soon run out of who to blame.”

The Nigerian government had last week begun crackdown cryptocurrency websites after a rapid devaluation of the naira that helped drive inflation to an almost three-decade high of 29.9 per cent.

The sites have emerged as an alternative for trading and establishing an unofficial price for the Nigerian currency. Following the detention of the executives, Binance halted trading of the naira against bitcoin and tether digital coins on its exchange.

On Tuesday Olayemi Cardoso, governor of the Central Bank of Nigeria said $26bn was moved through Binance in one year, while discussing the funds flowing through crypto exchanges.

“We are concerned that certain practices go on that indicate illicit flows going through a number of these entities and suspicious flows at best,” Cardoso told reporters after his first Monetary Policy Committee meeting on Tuesday. “In the case of Binance, in the last one year alone, $26bn has passed through Binance Nigeria from sources and users who we cannot odocausteluidentify” be added

According to Cardoso, Nigeria’s anti- corruption agency, police and national security adviser were co-ordinating an investigation into cryptocurrency exchanges. The authorities were demanding to see a list of Binance’s Nigerian users since its inception, a person familiar with the matter said.

Last week the telecoms regulator ordered telecoms companies to block access to some of the world’s largest cryptocurrency exchanges such as Binance, Coinbase and Kraken.

President Bola Tinubu’s government has been trying to attract overseas investment to boost the country’s struggling economy with a series of market-friendly reforms. These included trying to tidy up its messy system of multiple exchange rates and end its years-long currency peg. It has twice devalued the naira in eight months.

The dispute is a blow to Binance as it tries to reform its internal culture. In November the company paid $4.3bn in penalties to US authorities after pleading guilty to criminal charges related to money laundering and violating international sanctions rules.

Its former chief executive, Changpeng Zhao, also pleaded guilty to a criminal charge related to money laundering and resigned from his position.

Last week Bayo Onanuga, a special adviser to Tinubu, said Binance was “blatantly” setting the exchange rate for Nigeria and hijacking the central bank’s role as the currency rate setter.