Business

Union Bank Pre-tax Profit Up 33% in 2018

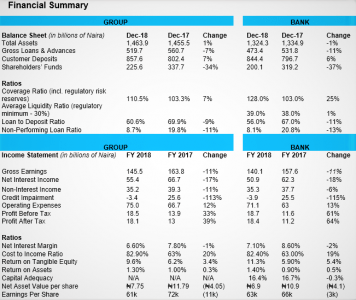

Union Bank grew its profit-before-tax by 33 per cent to ₦18.5billion in 2018 from ₦13.9bn as at December 2017, bolstered by impairment provision which by -113 per cent year-on-year to N3.4 billion.

The slow economic growth in the country had adverse impact on its gross earnings declined by -11 per cent to ₦145.5 billion compared to ₦163.8 billion in the previous year.

The dip in the bank’s revenue is traceable to interest income and non-interest income which dropped by -17 per cent and -11 per cent as its loan book was down 8 per cent.

But despite the decline in revenue, Union Bank operating expenses was up from ₦66.7 billion in 2017 to ₦75.0 billion in December 2018.

However, profit-after-tax rose by 39 per cent to ₦18.1 billion instead of ₦13 billion, helped by the credit impairment provision it made last year.

The bank was able to grow its total assets marginally by 1 per cent to ₦1.46 trillion despite gross loans and advances dropping -7 per cent to N519.7 billion in 2018.

Customer Deposits rose 7 per cent to N857.6 billion, while Shareholders’ Funds declined -34 per cent to N225.6 billion from N337.7 billion in 2017.

The bank made significant progress in cutting its non-performing loans -11 per cent to 8.7 per cent in 2018 against 19.8 per cent in the preceding year.

“Through an aggressive focus on recoveries and recognising fully provisioned loans on our books, we successfully reduced the Bank’s NPL ratio, which is now down to 8.1% in 2018 from 20.8% at the end of 2017, in line with guidance provided at the start of the year. In 2019, we will continue to maintain focus on recoveries while prudently rebuilding our loan book and maintaining a conservative risk profile,” said Emeka Emuwa, Managing Director.

He noted that the bank we successfully initiated the first tranche of its local currency bond programme to raise ₦13.5 billion.

“In 2019, we will double-down on our productivity efforts to deliver our financial targets. We are harnessing synergies across our business segments to ensure we maximize opportunities across entire value chains, while centralising key business and operational functions for better efficiency, and prioritizing customer experience across all our touchpoints,” he added.

The lender’s Return on Tangible Equity (ROTE) improved to 9.6 per cent from 6.2 per cent in 2017 demonstrating long-term shareholder value enhancement, explained Joe Mbulu, Chief Financial Officer, Union Bank.

“We will further support future growth and creation of high-quality risk assets in 2019 through a Tier II capital raise. This will boost our Capital Adequacy Ratio, which is currently at 16.4 per cent and remains above the regulatory limit.”