Business

Economic indicators portend challenging times for Nigerian businesses

By AYOOLA OLAOLUWA

Despite battling many economic headwinds occasioned by unfavourable government policies, fuel and foreign exchange rate crisis and high production costs that brought many of them to their knees in 2022, many Nigerian businesses will face increasing pressure to stay afloat in the new year, economic indices have indicated.

The Manufacturing Association of Nigeria (MAN), it would be recalled, had disclosed that no fewer than 400 companies had shut down operations in Nigeria since 2015 following the harsh operating environment triggered by the Federal Government’s economic policies.

According to MAN, about 50 of the affected firms were engaged in manufacturing sector before being suffocated by the harsh operating environment.

Unfortunately, 2023 may be worse for operators if economic indicators are anything to go by.

One of the challenges business owners will have to contend with in the new year is the payment of more taxes from government, despite already reeling from the negative impacts of multiple taxes.

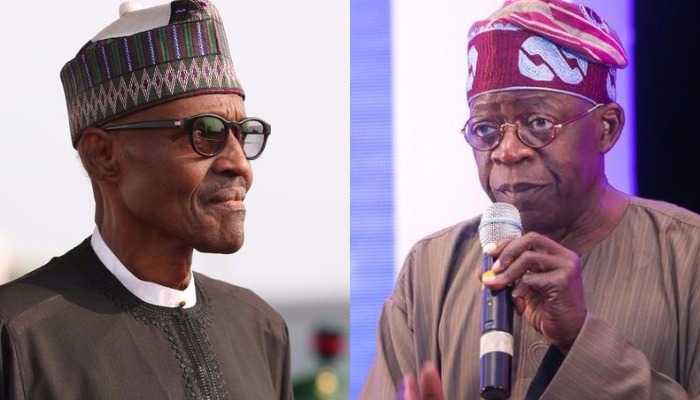

On December 20, 2022, President Muhammadu Buhari transmitted the Finance Bill 2022 to the National Assembly, seeking accelerated passage in order to secure more funding for the 2023 Budget.

The president said in the letter that the bill, when passed into law, would provide the fiscal support for the implementation of the 2023 federal budget.

The Federal Executive Council (FEC) had a week earlier approved the bill for transmission to the National Assembly for consideration.

The bill, among other proposals, proposed amendments to a number of fiscal laws such as the Federal Inland Revenue Service Act, company income tax, capital gains tax, customs excise tariff Act, stamp duties act and personal income tax.

An analysis of the bill still awaiting parliamentary approval and presidential accent, show that businesses will pay a lot more when it is passed and implemented.

One of the highlights in the proposed amendments is the National Youth Service Corps Trust Fund (Est) Bill, 2021 HB.1795.

The bill seeks to establish the NYSC Trust Fund (NYSCTF) for the purpose of providing sustainable source of funds for the NYSC, skill acquisition training, empowerment of corps members, training and retraining of the personnel of the NYSC as well as development of camps and NYSC formations and facilities.

It seeks to impose levy of 1% on net profit of companies operating in Nigeria.

Another is the Youth Entrepreneurship Development Trust Fund (Establishment) Bill, 2021 HB. 1448. The bill seeks to impose levy of one per cent profit as declared by each private entity in the country, which shall be used to provide financial support to Nigerian youths with entrepreneurship skills.

There is also the National Health Fund Bill 2021 HB. 1823. This bill seeks to provide a framework for the establishment of the National Health Fund with the sole responsibility of equipping and providing infrastructural and manpower development at federal hospitals across the federation.

Section 6 provides for the imposition, collection, administration and monitoring of levies and gifts amongst others. The bill in its current form, does not include specifics about what percentage will be imposed as levy.

Others include the Raw Materials Research and Development Council Bill, 2022 HB. 47 which seeks to amend the Raw Materials Research and Development Council and establish a new council with powers to do research on raw materials and related matters. It seeks to impose a levy of 2 per cent surcharge on all imports.

Not yet done, the executive, through the Tariff Technical Committee (TTC) of the Federal Ministry of Finance, is proposing an increment in excise duty paid on some products as follows: Tobacco: 30 per cent ad valorem rate with a specific rate of N8.40 per stick of cigarette in 2023 and 2024; Beer: N75/litre in 2023 and N100 /litre in 2024; Wines: 20 per cent ad valorem with a specific rate of N75 per litre in 2023 and N100 in 2024.

Other proposals include Spirits: 20 per cent ad valorem rate with a specific rate of N150 per litre in 2023 and N200 in 2024, in addition to the current specific of N10 per litre; Beverages: 20 per cent ad valorem to be introduced in 2023 plus the existing N10 per litre specific introduced in 2022 and many others.

Financial experts who spoke to BH on the proposed taxes warned that harsh levies and poorly thought out policies like the new bill had triggered capital flight and driven many vibrant manufacturing companies to neighbouring West African countries.

They advised businesses to brace for tough times as 2023 will be marked by shocks, risk and turbulence.

Apart from harsh government policies, Nigerian businesses will also grapple with inadequate power supply and high energy cost in the new year.

Most businesses, especially those in the manufacturing sector, are finding it more and more difficult to generate the much needed electricity to power their day-to-day activities.

According to a report, Nigeria has 201,000MW electricity deficit. While the national grid can only supply about 4,000MW, Nigerians look for alternative sources to cover the shortfall

While big manufacturing concerns have resorted to gas fired power plants to provide electricity, smaller businesses without huge pockets make do with diesel powered generators.

However, the high cost of diesel has driven most businesses out of business. The product which sold for about N280 per litre in January 2022, now sells for between N780 and N900, depending on the location.

Energy experts predict that the current diesel price may trend for the rest of the year going by happenings in the country and around the world.

“I don’t see the price of diesel coming down soon, as long as Nigeria continues to be a net importer of petroleum products.

“Agreed, Dangote Refinery is expected to come on board soon, but I don’t expect much difference as the price of the product is going to be decided by factors beyond our control right here in Nigeria.

“Apart from shipping, insurance and clearing costs the Dangote Refinery is going to save us, I am not seeing any other gains from where I am standing, at least for now.

“We can hope for the best when crude oil price crashes to below $50, but other variables like the high cost of doing business in the country may defeat that expectations.

“So, Nigerians should not expect much, at least until August or September when the new administration would have settled down a bit”, warned Engr. Dayo Akinpelu, an oil and gas expert based in Lagos.

While small and medium range businesses are grappling with soaring costs of diesel, big manufacturers are also facing scarcity of gas to power their plants.

BH findings revealed that though gas used in powering power plants is relatively cheaper to diesel, the product is not readily available.

While a standard cubic metre of gas cost between N160 to N195 in Lagos, it is much more higher in other states, especially those far from the Escravos Lagos Pipeline (ELPs) which supply gas to businesses and organisations through a delicate networks of pipelines.

Sources in the petroleum industry informed our correspondence that gas supply to businesses and organisations through the Escravos Lagos Pipeline that service the Lagos-Ogun Industrial axis which accounts for over 60% of Nigeria’s manufactured goods, has dropped drastically in recent months.

With the situation projected to linger, many businesses will be affected by underutilisation and subsequent massive job losses in the new year, experts predicted.

Meanwhile, the continued depreciation in the value of the nation’s currency will continue to burden the operations of businesses, especially those who rely on imported materials to produce.

Except for a select few, most Nigerian businesses do not have access to foreign exchange at the Central Bank of Nigeria’s official rate of N461.

A paint producer based in Lagos, Segun Ige, lamented that many paint makers find it difficult to replenish their raw materials stocks as prices have surged.

“Though prices have remained largely the same in India, Turkey, China, Italy and other countries where we get stocks, the value of the naira has continued to drop.

“That in essence, means that for every dollar you need, you are going to need more naira to purchase it.

“For instance, around this time last year, I bought a dollar for less than N500. But now, it sells for around N760 in the market. That is more than N300 excess.

“We can’t continue like this. Things must change soon or many businesses will soon be out of circulation. As at 2018, I had four production lines which were producing at full capacity. Today, only one line is producing. Government mut intervene to nip the coming disaster in the bud”, the entrepreneur moaned

In the new year, the aviation sector, experts claimed, will be one of the worst affected by the worsening forex crisis.

“Airlines, ground handling companies, aircraft maintenance centres and aviation fuel suppliers are committing more naira to source dollars for aircraft spares, aircraft leasing costs, flight crew training, insurance premiums and other obligations.

“As predicted by the Association of Airlines Operators of Nigeria (AON), more airlines will go into extinction by the end of the year”, a top airline executive who did not want his identity in print told BH.

Meanwhile, the organised Private Sector (OPS) has raised the alarm that government’s policies were pushing manufacturing and other businesses out of existence.

Made up of five business groups, the Manufacturers Association of Nigeria (MAN), Nigeria Association of Chambers of Commerce, Industry, Mines and Agriculture (NACCIMA), Nigeria Employers Consultative Association (NECA), Nigeria Association of Small-Scale Industries ( NASSI) and Nigeria Association of Small and Medium Enterprises (NASME), the OPS rejected the Federal Government’s proposed increase in excise duty on food and beverages, especially on alcoholic, non-alcoholic beverages drinks and tobacco.

According to the group, there were no fewer than 17 bills pending in the National Assembly aimed at imposing more levies on the private sector, with negative implications on business’ sustainability of businesses.

“In 2018, businesses were confronted with the re-introduction of excise duty on soaps and detergents, Cosmetics, fruit Juice, telephone recharge card vouchers, corrugated paper, paper board, carton boxes and cases, toilet papers, etc, and a few years later, 2022 to be specific, excise duty on carbonated drinks was introduced at N10 per litre.

‘’Against this backdrop, the proposed increase in excise duty for beer (N40), alcoholic wine/hot drinks (N50), a stick of cigarette (N4.20) and sugar sweetened beverages (N10) plus 20 per cent ad valorem is not welcoming to the industry.

‘’We, therefore, see the proposed increase in excise duties as the last straw that breaks the camel’s back if implemented”, the OPS warned.