Business

Capital market agog over Airtel’s listing

By FELIX OLOYEDE

Despite the postponement of the planned listing Airtel Africa on the Nigerian Stock Exchange (NSE) by two trading days, investors and dealers are optimistic that it would further deepen the market and give the telecommunication sector large chunk of market capitalization.

The telco which recently floated on the London Stock Exchange, was bid to list shares worth N270 billion ($750 million) on the Nigerian equity market on Friday, but was put off to Tuesday, July 9 due to inability to complete listing process.

Airtel which is the second largest telco in African and third in Nigeria, just behind MTN and Globacom, which joined the NSE last month, saw its shares decline 3.75 per cent to 77 pence on debut trading at the London Stock Exchange on June 28.

But financial experts believe investors will receive Airtel shares with positive sentiment as it has a lot of growth potentials.

Airtel listing on the Nigerian equity market would deepen the market and create additional investment opportunity, said Ayodele Akinwunmi, Head, Research, FSHD Merchant Bank.

He noted that before the listing of Dangote Cement, banks accounted for over 40 per cent of market capitalization, and the entrance of MTN into the market has further reduced the concentration on banks and Dangote Cement. The listing of Airtel would further diversify the market, which is good for investors.

“MTN listing encouraged Airtel to come into the market and as time go by, this may also encourage 9mobile and Globacom

to join the Nigerian equity market,” Akinwunmi posited.

According him, the telecommunication sector is a huge investment area that is still under harnessed in Nigeria and the country’s financial inclusion drive means good business for the telcos.

‘’Though the floating of Airtel Africa may not be able to reverse the downturn in the market, it is a positive development as it will deepen the market and increase investment outlet’’, David Adonri, Managing Director, Highcap Securities told BusinessHallmark in a telephone conversation.

“The postponement of Airtel listing could dampen enthusiasm of investors as they were already prepared to buy on that day, the delay may send the wrong signal and affect their confidence,” he mentioned.

The Nigerian bourse had a five-day losing streak last week, shedding -2.32 per cent to close at 29,966.87 at the close of business on Friday and it has so far lost -6.87 per cent this year.

Investors have developed cold feet in the market due to the slow pace of economic growth in the country, despite the relative stability in the oil prices, which is the backbone of the Nigerian economy.

The country’s economy only grew by 2.1 per cent in the first three months of this year, compared to 2.4 per cent it achieved at the end of 2018 and the International Monetary Fund (IMF) and World Bank expect Nigerian economy to grow 2.2 per cent and 2.1 percent this year.

Meanwhile, Moses Ojo, Head, Research and Business Development, PanAfrican Capitals, like Akinwunmi allayed the fear that the postponement could affect investors’ confidence, arguing that Airtel had explained earlier that if it fails to conclude registration process by Friday, it would have to put the listing off by two trading days.

“It is going to increase market capitalization by nothing less that N2 trillion. It will give investors more options. It will also serve as benchmark for MTN that was earlier listed,” he further enunciated.

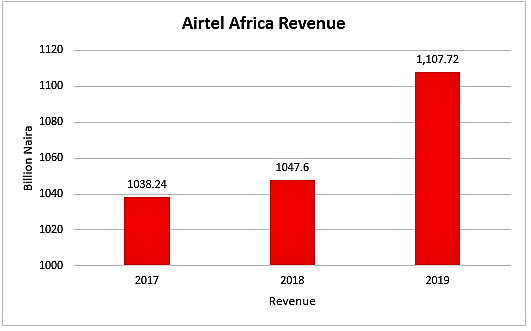

Airtel Africa grew its revenue by 5 per cent to N101.77 billion ($2.91 billion) at the end of 2018 with Nigeria contributing the largest chunk as it has 35.9 per cent, compared to 35.8 per cent and 28.9 per cent income contributed by East Africa and the rest of Africa respectively.

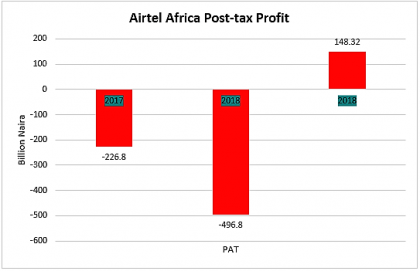

The telco suffered N49.68 billion ($138 million) loss after tax last year, but aims to reverse this year, by growing revenue by 6 per cent to N1.11 trillion ($3.08 billion) and up post-tax profit by 13 per cent to N148.32 billion ($412 million) at the end of 2019 financial year.

The firm’s earnings before interest, taxes, depreciation, and amortization ( underlying EBITDA), which is used as an indicator of the overall profitability of a business, stood at N410.04 billion ($1.14 billion) in 2018 and it is target to ramp it up to N479.52 billion ($1.33 billion) at the end of this year.

Airtel Africa has 98 million customer base, and 24 per cent of the market share in Nigeria, just below MTN which has 164 consumer base.