Business

Wema Bank struggles to transition to full-fledged national bank

– Its massive head office belies its smallness

At the height of its glory in the late 50s, Nigeria’s longest surviving indigenous bank, Wema Bank Plc, was unarguably one of the most notable and promising financial institutions in the country.

Its progressive initiatives and unwavering dedication to service delivery made it a bank of choice among banking customers, especially in the South Western part of the country.

From a humble beginning as Agbonmagbe Bank Limited on May 2, 1945, the bank flourished under its visionary founder, Late Chief Mathew Adekoya Okupe, extending its tentacles to Ebute-metta, Sagamu, Abeokuta, and Ijebu-Igbo, Osogbo and other trade and industrial centres in the South West as the bank of choice for many customers.

When the investment arm of the Chief Obafemi Awolowo-led Western Region government, Western Nigeria Marketing Board (WNMB), decided to acquire the bank which was renamed Wema Bank Limited in 1969, it didn’t come as a surprise to many.

The bank has since grown to become a force in the nation’s banking industry, offering retail banking, Small and Medium-sized Enterprise (SME) banking, corporate banking, treasury, trade and financial advisory services to its customers.

However, 79 years after it opened its doors for business, the bank has not been able to shed its unenviable toga of being a regional bank despite obtaining a licence from the Central Bank of Nigeria (CBN) to operate as a national bank.

Apart from the South West and Lagos zones, where the bank is well entrenched, it has negligible presence in some South-South states of Edo and Delta, as well as the Federal Capital Territory (FCT), Abuja.

The situation is quite different in the South East, South South states of Rivers, Akwa Ibom, Cross River and Bayelsa, as well as the Northern part of the country, where the bank has little or no visible presence, barring a branch or two in some states, which are located in the capitals.

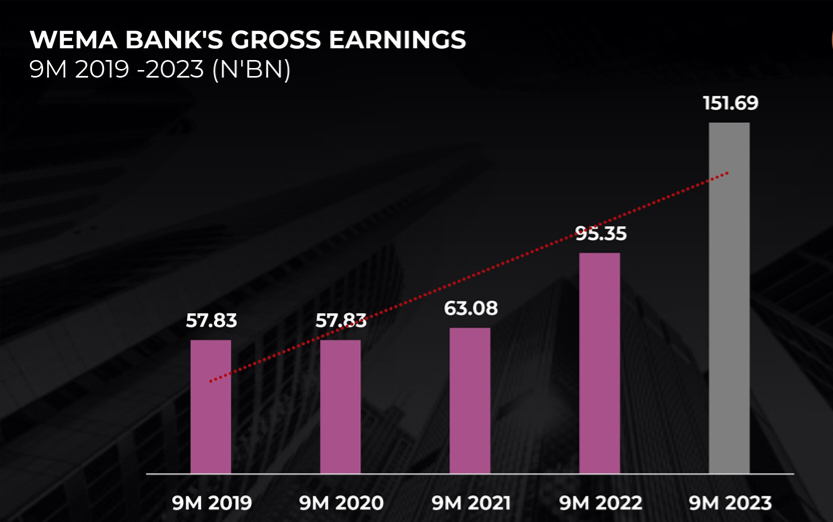

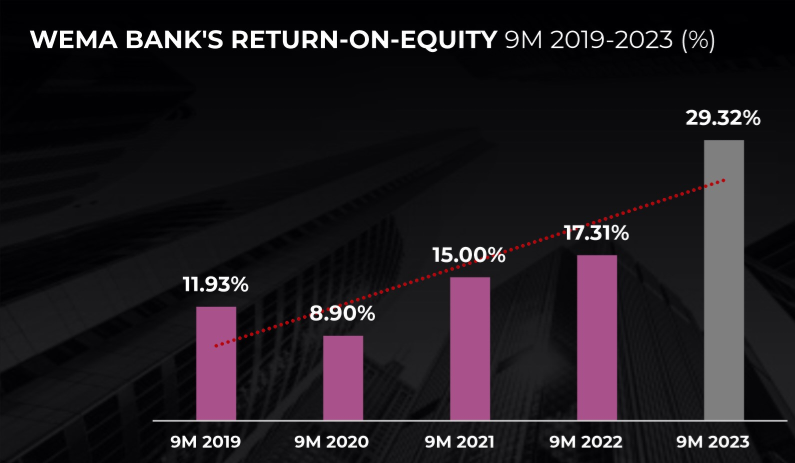

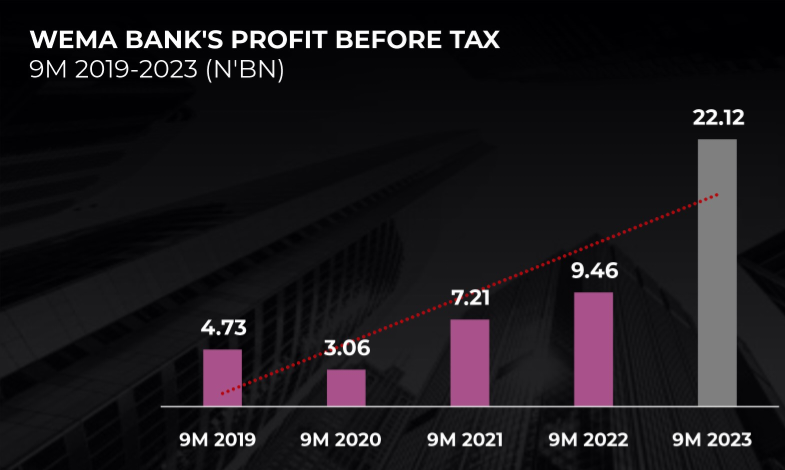

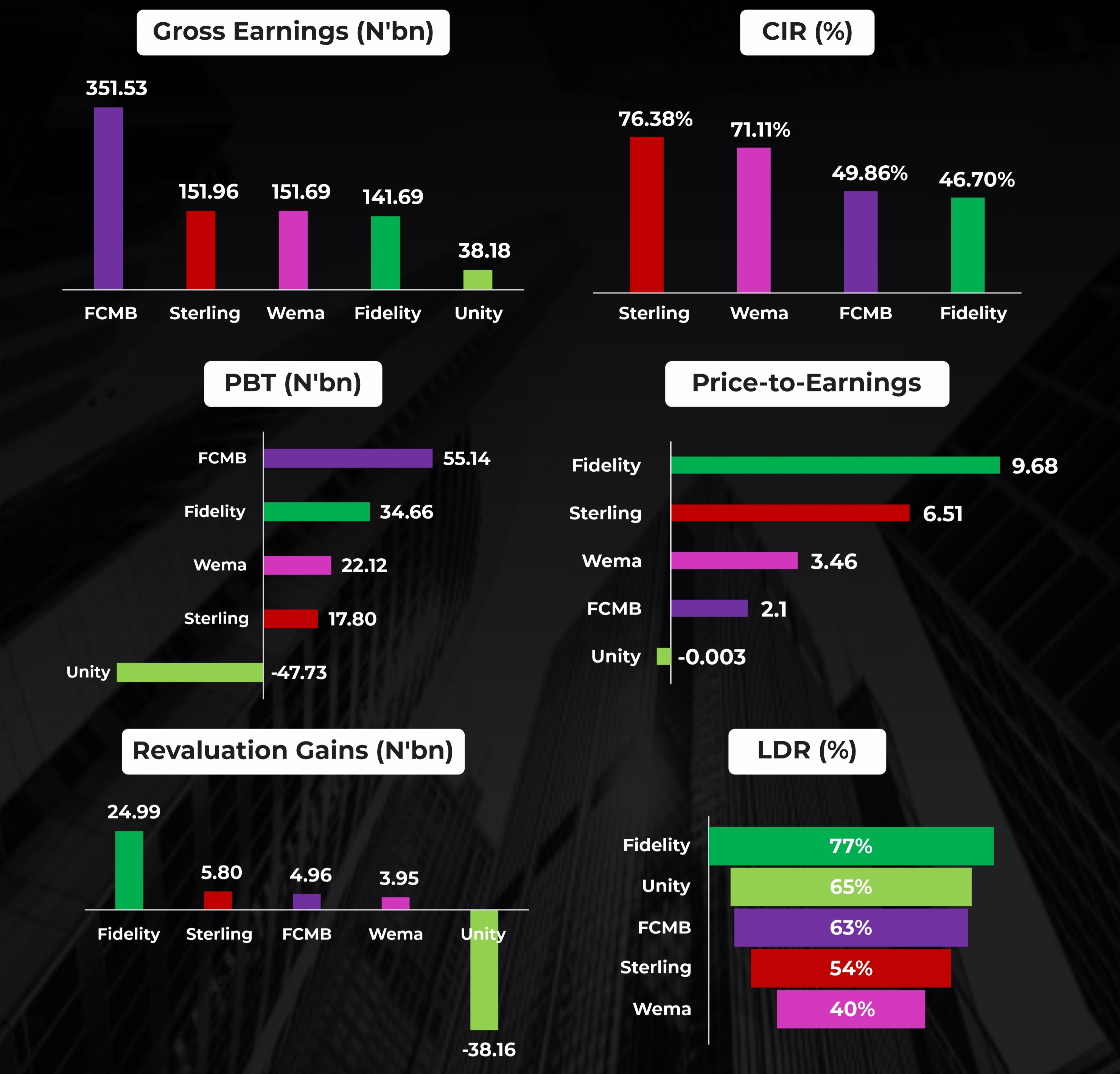

According to Business Hallmark’s findings, Wema Bank’s inability to transform into a national bank (despite having a national licence) has limited its growth and profitability, compared to much more prosperous tier-1 banks that were set up several years after it birthed in the country.

The development has forced many financial observers to predict that Wema Bank Plc will find it difficult to scale through CBN’s new recapitalisation exercise, except it get help from its second largest shareholder, Odua Investment Company Limited (OICL) owned by the six South West states of Lagos, Ogun, Oyo Ondo, Osun and Ekiti.

BANK’S STRENGTH

Wema Bank is the 11 biggest bank in Nigeria and 34th most valuable stock on the Nigerian Exchange Group (NGX) as of Friday, February 23, 2024, with a market capitalization of N107 billion. The bank’s Capital Adequacy Ratio (CAR) is 13.31% as of September 2023, 3.31% above the regulatory minimum.

The bank, it was learnt, succeeded in the completion of its N 40 billion capital raising exercise, which ended in December 2023. Proceeds from the rights issue, coupled with stocks appreciation, BH learnt, helped push Wema Bank’s market capitalisation from about N60 billion it was in November 2023 to its current valuation of N107 billion.

Also, Wema Bank’s assets grew from N1.41trillion in 2022 to N2.30trillion (63.23% appreciation) at the end of December 2023, while loans and advances rose by 53.88 per cent to N802.36 billion and deposits were up by 60.21 per cent to N1.87 trillion.

Likewise, shareholders fund grew to N123.02billion, about 49.05 per cent appreciation in the period under review.

It should be noted that the bank has been able to achieve this feat through the adoption ALAT, the first fully digital bank in Nigeria, which allows users to carry out all of their banking needs using a mobile phone, Personal Computer (PC), or tablet without having to enter a physical bank.

With the launching of ALAT on May 2, 2017, Wema Bank became the first commercial bank in Nigeria to launch a digital service to counter the onslaught of fintechs on banks.

ALAT was set up as a branchless, paperless bank, completely removing the need for commencing or completing transactions at a physical location.

Signing up starts with downloading the bank’s app, available on both Android and iOS, or visiting its web application.

Registration is completed by uploading one’s verified signature and selfie, accompanied by other identification documents like National Identification Number (NIN) and Bank Verification Number (BVN) and takes an average sign-up time of five minutes.

Advantages of ALAT include securing a debit card, a process that is usually tedious in banks. However, with ALAT, customers are afforded in-app card requests and activation, as well as free card delivery within 24 hours to three maximum to any Nigerian address.

Also, Wema Bank’s ALAT provides multiple personal savings options, including savings goals and group savings options, which come with up to 10 percent interest; three times the regular bank rate in the country.

Expectedly, the innovation has proved to be extremely successful with many Nigerians, especially tech savvy youths, preferring it to other banks services.

BH findings revealed that the general response to ALAT exceeded expectations. For instance, the bank acquired more than 250,000 customers responsible for well over N1.6billion in general deposits during its first year. It went up to N6.1 billion in 2022 and around N8billion in 2023.

“With ALAT, sales have been growing steadily. It is also seeing a consistent increase in the number of monthly active users”, a source in the bank told our correspondent.

WEAKNESS

The bank, despite its seemingly impressive performance, is boxing below its weight. In spite of valiant efforts by successive managements, it has remained a tier-2 bank, overtaken by relatively newer but more successful banks like Zenith, GTB, Stanbic IBTC, Fidelity, and Access Bank.

One evidence of the bank not living up to expectations is its relatively smaller geographical spread. According to data mined on the bank’s official website, it currently has about 149 branches and service stations across the nation, compared to Zenith, GTB, UBA and Access Bank with 393, 235, 460 and 583 branches respectively.

Further checks revealed that over 80 percent of Wema Bank’s branches are located in the South West geopolitical zone.

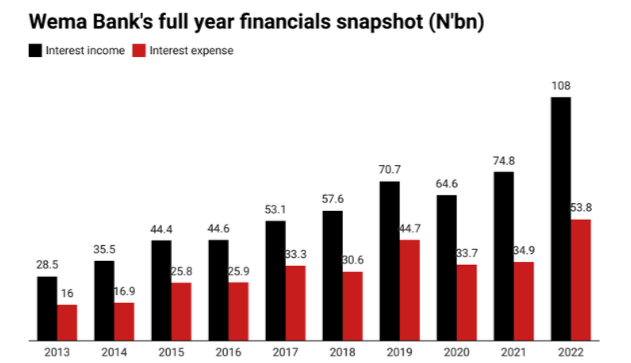

Also, the bank’s liabilities have also been growing. For instance, its liability at the end of December 2023 grew to N2,196,422 million compared with N1,359,322 million in 2022, N1,105,344 million in 2021 and N920,376 million in 2020.

Another issue haunting Wema Bank is its unenviable relationship with the first Indigenous bank in Nigeria, the defunct National Bank of Nigeria (NBN) largely owned by the Western Region Government of Nigeria.

The bank (NBN), which began operations in 1933, was rocked by mismanagement and financial corruptions perpetrated by the political elites of owner states in the 50s and 60s, as well as the subsequent looting of the bank by successive military administrations in the 70s, 80s and 90s after it was acquired by the Federal Military Government.

The bank became distressed in 1992 and was subsequently liquidated. Many Yoruba elites made up of businessmen, civil servants, farmers and professionals, BH investigations revealed, lost their wealth and life savings, when the bank unexpectedly went down in 1992.

Majority of the bank’s customers, who lost their funds became bankrupt, with many of them either committing suicide or dying in penury. The bank made a surprise return after being sold to Odua Investment Company Limited and Stanmark Assets, starting operations in September 2000.

However, it could not meet the Charles Soludo’s CBN recapitalisation target of N25 billion (from N2billion), which led to a remarkable reduction in number of banks from 89 to 24. At the end of the day, National Bank of Nigeria merged with Wema Bank.

Merger

In retrospect, the merger between Wema Bank and NBN is proving to be a bad decision. BH reliably gathered that most Yoruba people of the South Western region have not forgotten the role National Bank played in pushing many homes and businesses into penury.

According to a survey conducted by BH, six out of 10 Yoruba still see Wema Bank as a continuation of the defunct National Bank of Nigeria.

“To me, National Bank is Wema Bank and Wema Bank is still National Bank. I can’t easily forget how my parents funds were looted, which led to their untimely deaths.

“It also made some of us their children to drop out of school. I have been able to reach, where I am today by sheer perseverance and hard work. So you want me again to go and put my money in a bank that is run by government and caused my family untold hardship”, asked Wasiu Ajibade, a businessman based in Osogbo, Osun State.

When informed that the bank is now a limited liability company and no longer fully owned and controlled by the six South West states, Ajibade insisted that he won’t be banking with the financial institution as long as the Odua Group remains a shareholder.

“You want to tell me that the six South West states don’t have some form of control over the bank? Please bury the though. Nothing you tell me will make me do business with the bank, never!”

Ajibade’s sentiment is shared by many South Westerners, who still believe that Odu’a Group owns the largest equity in the bank.

However, BH checks on the ownership structure of Wema Bank revealed contrasting accounts. For instance, while independent sources put Odu’a Group equity at between 7.736% and 10.01%, data on the Odu’a Group’s website stated that its holdings in the bank amounts to only 3.09% shares, with the remaining 96.91% owned by other investors.

Meanwhile, the bank itself failed to divulge information on its ownership structure.

MANAGEMENT

Whether by mere chance or deliberate efforts, Wema Bank has had the good fortune of producing men with extraordinary intellect, courage and leadership qualities to pilot its affairs.

These are men that left their indelible mark not only on the bank, but the Nigerian banking industry as a whole. Worth mentioning are late Samuel Igbayilola Adegbite, Tunde Lemo, Adebisi Omoyeni, Segun Oloketuyi, Ademola Adebise, as well as the incumbent CEO, Moruf Oseni.

However, one name stood out among the lot: Samuel Adegbite, regarded by many as ‘the man who built the modern Wema Bank’.

The bank’s rise to prominence cannot be complete without mentioning the contributions of Adegbite, who started his banking career as a clerk in Standard Bank of West Africa (now First Bank of Nigeria Plc) in 1961.

An achiever of no mean repute, Adegbite, wrote his name in history with the way he resuscitated ailing Wema Bank in the 80s and turned it into one of Nigeria’s most prominent banks.

Unlike most government appointees, who are more of boot-lickers and ‘yes men’ to men in power, Adegbite’s unusual courage in convincing the then military controlled South West owners of Odu’a Group, owners of Wema Bank, to divest their majority shareholding in the bank, thereby turning them to minority shareholders, has remained a fairytale in many homes and offices up till today.

According to a former executive director in Odu’a Group, the broadening of Wema Bank’s ownership structure gave the investing public and customers more confidence in the bank.

“The interfering hand of government was minimized while a sense of professionalism was introduced in recruiting staff and managing the bank. This reflected in bountiful returns to the bank’s subsequent financial records”, the ex-Odua Group boss stated.

To his credit, Wema Bank acquired a new corporate headquarters, Wema Towers, on Marina in 1997. Apart from providing a more conducive environment for work compared to its old head office on the rowdy Nnamdi Azikiwe Street, Lagos Island, the new headquarters has boosted the bank’s corporate image. However, many people believe that the building overstretched the bank’s resources that it never recovered from it, which explains why small in spite bot it’s massive building, as its liabilities constrained its expansion at the time of banking boom.

Also Adegbite’s management style, which was conservative, micro-managing and old fashioned left the bank in the lurch, as new comers, driven by vision and technology held sway, and bright, upward mobile bankers shunned it.

Like Adegbite, another CEO that changed the fortunes of Wema Bank Plc is Segun Oloketuyi. Appointed as CEO in June 2009 with the task of returning the bank to profitability, Oloketuyi performed beyond expectations.

Before his appointment as CEO, Wema Bank had recorded negative earnings in excess of N45 billion and was declared a bank in grave financial situation by the CBN.

However, under Oloketuyi’s leadership, the bank’s sliding fortunes were completely reversed, leading to its recapitalization and return to profitability.

Oloketuyi also helped the bank to regain its national banking license from the CBN, which has allowed it to increase its market share and customer base by expanding to other geopolitical zones in the country.

History of Wema Bank won’t be complete without mentioning the duo of Adebisi Omoyeni and Tunde Lemo. However, the former CEOs will be remembered more by their vicious fight for control, which rocked the bank to its foundation and almost led to its demise.

Another transformational leader that impacted positively on the bank is Ademola Adebise, a tech genius turned CEO.

Under his watch, the software engineer revolutionised the banking industry, creating a seismic shift with the creation of ALAT, the first fully digital bank in Nigeria, which allows users to carry out all of their banking needs using a mobile phone, Personal Computer (PC), or tablet without having to enter a physical bank.

With ALAT, Wema Bank led other banks in the race to challenge the onslaught of fintechs on banks.

NEW CBN CAPITALIZATION REQUIREMENT?

While the CBN Governor, Yemi Cardoso, has announced that the bank will soon embark on another recapitalisation exercise, he failed to mention the new capitalization requirement, which currently stands at N25 billion, though many banks have more than tripled the amount.

However, some economists and financial experts, who spoke with our correspondent on the development, all agreed that the new requirement will not be less than N250billion to N300billion.

According to a financial expert Dr. Peju Johnson, she arrived at the figure based on the current naira and foreign exchange rates.

“In 2005 when Soludo put banks capitalization target at N25 billion, Naira traded at an average of N135 to a dollar. In essence, that N25 billion then amounted to about $185.1million.

“Fast forward to February 2024, the same $186.6million is now N277.8billion at the exchange rate of N1,500 to $1 if the CBN decides to retain that figure.

“What this means is that banks should be looking for about N280 billion each to meet the recapitalisation requirement”, Dr. Johnson explained.

Also speaking, CardinalStone Securities, a non-bank securities trading firm in its Banking Sector FY 2024 Outlook, projected that banks gunning from international banking licenses will need to boost their capital from N25 billion to N909.27billion, while those wishing to operate as regional banks will need about N181.85billion.

“Banks may be expected to boost capital base to between N181.85billion (for regional banks) and N909.27billion (for international banks), given 2024 real GDP of $472.6billion and exchange rate of N841.61/$ as at December 20, 2023.

“In this case, the majority of banks are likely to scale this hurdle, with some tier-1 banks even boasting capital bases above 2.1x of the threshold implied by this scenario analysis and with Zenith Bank at the peak.

“However, the ambitious target of reaching an economic size of $1trillion in seven years may require an even higher range for capital base requirements. Tier-1 international banks like Zenith Bank and UBA are likely to surpass the implied thresholds.

“We will continue to monitor developments in this space to see what the apex bank eventually settles for as well as the structure of the directives and timelines”, CardinalStone Securities stated in the report titled, ‘Nigerian banks: On the cusp of a new dawn’.

IMPLICATIONS

If the CBN goes ahead to fix recapitalisation targets for regional and national/International licences at N250 billion and N200 billion and above as experts projected, it is crystal clear that the management of Wema Bank will need to choose out of these three options: either embark on another round of raising the extra N150 billion for regional licence or N800 billion for national/International licence from the capital market (IPOs/right issues) which is unlikely to succeed; dilute its control by inviting institutional investors to take up equities in exchange for their funds, and lastly, explore the option of merging with other banks.

BH’S VERDICT :

Wema Bank will most likely scale through the recapitalisation exercise (regional banking licence) leveraging on the financial muscles its current institutional investors like the Odu’a Group and Petrotrab Limited.

However, it will be almost impossible to raise the N900 billion required for a national/International licence, except the bank is willing to be swallowed up in a merger by a much bigger competitor or investor.

Wema Bank Plc, it would be recalled, became a public limited liability company in 1987 and was listed on the Nigerian Stock Exchange in 1990 under the symbol WEMABANK.

In February 2001, the bank was granted a universal banking license, solidifying its position in the financial landscape.

_____________________________

Wema Bank Ownership Structure

Name of Owner/% Ownership

1 Neemtree Limited. 27.54%

2 Odu’a Investment Company Limited. 10.01%

3 Petrotrab Limited 8.54%

4 SW8 Investment Limited 8.02%

5 Other Private Investors 45.89%

Total 100.0%