Opinion

Sugar tax: Penny wise, pound foolish!

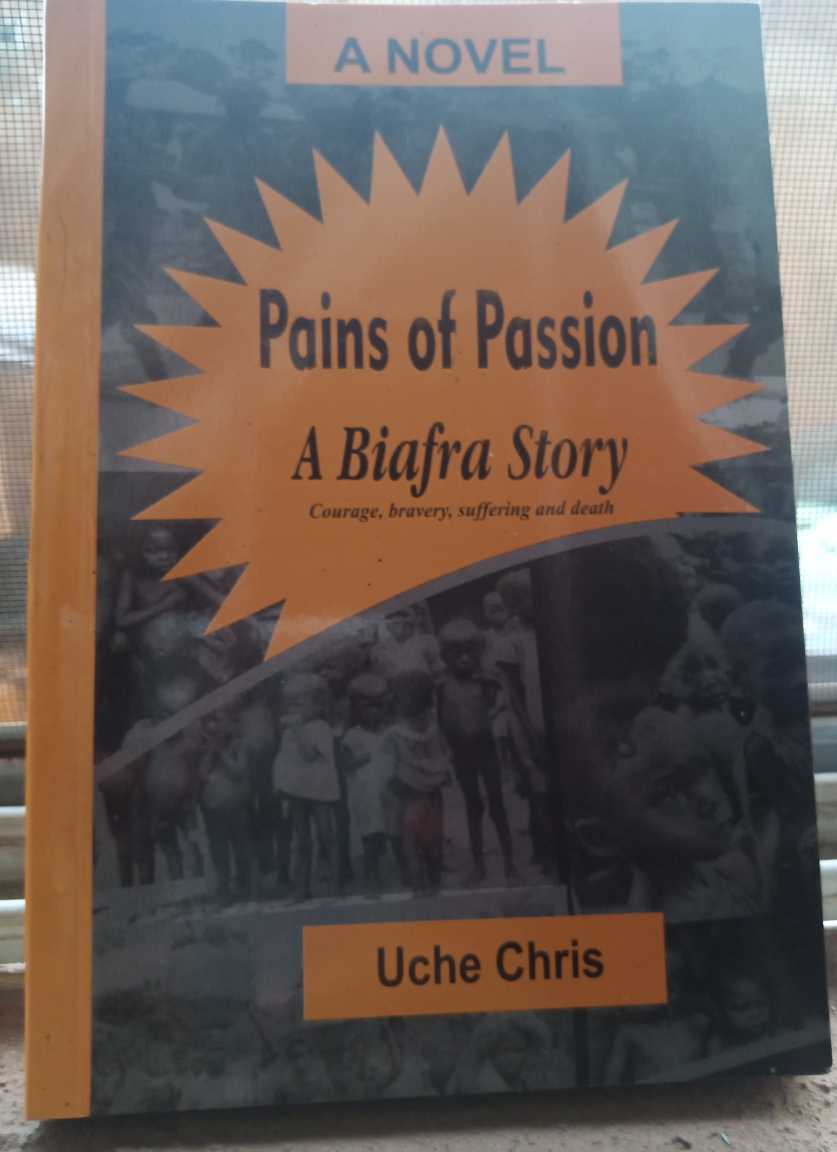

By Uche Chris

There is an uncanny contradiction in the proposed increase on Sugar sweetened beverage tax by the Federal Government to shore its non oil revenue, and ostensibly for health reasons by reducing sugar consumption, which is expected to curb sugar related illnesses and lower health budget of government. This is an overstretched, long and convoluted argument that cannot stand any cursory interrogation.

Government is simply portraying itself as desperate, confused and uncoordinated. It beats conception that government could willfully be seen as undermining its own well conceived and structured policy of promoting local sufficiency in sugar production. It is paradoxical to be pushing two different objectives on an issue at the same time. How do we explain this?

Government is simply succumbing to the pressure of immediate revenue shortfalls and desperately looking for easy and quick ways of least resistance, and the beverage sector appears to provide the needed solution. First, it would not have any political consequence for the government, as it would have been with direct personal tax. Second, there is an ostensibly ready pretext, a bogey man for such tax on sugar: health.

There has been an orchestrated campaign against sugar consumption by self serving non for profit groups. The argument about the health implications of much sugar intake and government involvement in curbing its consumption is misplaced and high handed. It is simply a matter of choice; people have a right to choose what to eat or drink. Government responsibility should be to inform and educate the people through public enlightenment of the health implications.

Most things we consume have health problems, such as red meat and oil, but government does not see those as harmful. It is not really about what we eat but the way we eat and associated abuses. Most commercial consumers of sugar are large multinationals that promise huge revenue potentials for government.

However, the proposed tax hike comes just a year after the N10 per litre tax imposed by the 2021 Finance Act, which came into force in 2022 and stipulated a moratorium or holiday of, at least, three to five years before further review. For government to jettison its own law by pushing for the increase points to its obvious desperation for money using health as pretext. Coming against a well crafted and much-praised highly strategic Nigeria Sugar Master Plan (NSMP) with the aim of achieving self-sufficiency in sugar production within a decade, the tax is needless. The NSMP received approval from the Federal Government in September 2012, and its implementation commenced on January 1, 2013.

The government’s endorsement of the NSMP and its adoption, as the guiding framework for sugar sector development underscored its commitment to leveraging agriculture and industrial manufacturing to diversify the nation’s economy and revenue streams. This initiative was poised to create significant employment opportunities for the citizens, marking a pivotal step in the nation’s economic and agricultural transformation.

Key to this initiative were three Nigeria’s biggest industrial conglomerates —Dangote, Flour Mills, and BUA — enlisted as anchor players for the initial decade. Guiding this monumental effort to fortify local sugar production was the National Sugar Development Council, acting as the pivotal policy platform.

The nagging question is, how could government be promoting sugar production to achieve local sufficiency to save foreign exchange in import and even earn forex from export; while simultaneously discouraging its consumption by the main commercial users. This is a real conundrum and an irresolvable dilemma.

Again, the producers expectedly would have made heavy investments in its production, encouraged by the Sugar Master Plan, which without guaranteed patronage from the commercial users would be jeopardized. This a classic case of Nigeria’s habitual policy inconsistency, which has been the peril of the economy and national development.

Again, beneath the surface, a complex economic conundrum unfolds.The primary sector set to be affected by this proposed tax hike is the Food and Beverage industry—a significant contributor to Nigeria’s economic landscape. Local industries heavily depend on domestically sourced sugar. This sector is a big employer of labour and a higher tax incidence on it will likely impact negatively on cost of production, which also will affect adversely their capacity to maintain current job level, and completely vitiate any possibility of expansion to increase employment.

The inevitable outcome of higher taxes on sugar-sweetened beverages is the likely surge in the prices of these products. In a nation, where consumers are, particularly, price-sensitive, this price increase is poised to lead to a reduction in demand for these goods.

If the government is genuinely committed to realizing self-sufficiency and fortifying the local sugar industry through the NSMP, then why simultaneously increase tax on sugar consumption that has the potential to stifle the very industry it seeks to promote?

There is urgent need to create a more harmonious and balanced approach, one that promotes local sugar production while ensuring economic stability and job security.

As the argument rages and the nation charts its course towards a more sustainable future for its sugar sub-sector, policymakers are urged to heed the concerns and insights raised by industry stakeholders. The ultimate goal is to find a harmonious equilibrium that not only resurrects the sugar industry but also nurtures a thriving, competitive, and robust economic landscape, thereby moving Nigeria closer to its vision of becoming a leading sugar producer in Africa.