Cover Story

Etisalat set to bounce back

AYOOLA OLAOLUWA |

After a period of turbulence and uncertainty, the nation’s fourth largest telecommunication firm, Etisalat Nigeria Limited, appears to be swimming out of troubled waters.

The troubled firm, already written off by many, successfully reached an amicable settlement with creditors over $547m debt after the intervention of the Central Bank of Nigeria (CBN) and the Nigeria Communications Commission (NCC), thus saving the nation a major crisis capable of disrupting the telecommunications and banking sectors.

GENESIS OF CRISIS

Business had looked rosier for the telecommunication giant after it commenced operation in Nigeria in 2008. The company with a current subscriber base of about 21 million was awarded best network based on quality of service indices by the Nigerian Communications Commission. Other achievements include brand of the year, best customer service and most innovative mobile operator. However, things soon changed for the worse.

Four months back, the telecommunications giant found itself in the eye of a storm, when a consortium of local banks and their foreign affiliates, staged two failed bids to take over the troubled telecommunications firm over its failure to repay $547m, the balance of a loan of over $1.2 billion it secured from the consortium in 2013.

Etisalat had obtained the $1.2 billion (N377.4 billion) syndicated loan in 2013, from a consortium of 13 Nigerian banks, including Access Bank, Zenith Bank Plc, Guaranty Trust Bank Plc, First Bank Limited, Fidelity Bank Plc, First City Monument Bank (FCMB), Stanbic IBTC, Ecobank, United Bank for Africa (UBA) Plc and Union Bank of Nigeria Plc.

The loan, which involved a foreign-backed guaranteed bond, was to finance a major network rehabilitation upgrade and expansion of its operational base in Nigeria.

While Etisalat Group of UAE, the parent company, pledged shares to the tune of $235 million, about $600 million (N115billion), the total loan package was secured with asset by Etisalat.

However, the troubled telecommunications firm failed to meet its agreed debt servicing obligations with the banks. It only paid about half of the initial loan (about $504 billion), according to official figures, with total outstanding sum of about $574 million, consisting $227million and N113billion.

According to BH findings, several factors, including foreign exchange devaluation, economic downturn, and multiple taxations, among others could be blamed for the company’s woes.

According to industry experts, the massive foreign exchange devaluation made it difficult for Etisalat to repay the loan which was in foreign currency. A 35% devaluation of the naira in 2016 prompted the company to make more local currency available for loan repayment.

The economic crisis in the country also resulted in a reduction of average revenue per user, which implied a corresponding revenue reduction for the firm. The gradual switch from voice to data spending also had dwindling effects for Etisalat as bigger operators like MTN and Globacom currently dominate the data market with cheaper plans.

Theft and vandalism of telecommunications infrastructure like fibre optics also bedevilled the mobile network operator. All these resulted in delayed network expansion and loss of service and income.

CBN, NCC’s INTERVENTION

In their desperate bid to recover the loan, the banks reported the matter to telecoms sector regulator, the Nigerian Communications Commission and financial sector regulator, Central Bank of Nigeria, threatening to take over the firm.

The CBN and NCC intervened and CBN succeeded in persuading the banks to drop their threat to take-over Etisalat, after all parties agreed to restructure the loan, with May 31, 2017 as the new repayment deadline.

Unfortunately, Etisalat again failed to meet the deadline. Further negotiations later collapsed, resulting in the banks issuing a final defaulting note and enforcement notice on June 9, 2017 to Etisalat, to commence the process to take-over of Etisalat after it reneged on the agreed repayment deadline, effective June 15, 2017.

The notice requested EMTS Holding BV, a special purpose vehicle established in Netherlands, to transfer 100 per cent of its shares to United Capital Trustees Limited, legal trustees of the banks by June 15, 2017. An extended deadline was given for the completion of share transfer by 5 pm on Friday, June 23, 2017.

Following the collapse of negotiations on the debt with the banks, Mubadala Development Company, the majority shareholder in the company, said that it had pulled out of Etisalat Nigeria and was transferring 45 per cent of its stake and 25 per cent of its preference shares in its Nigerian subsidiary to United Capital Trustees Limited, the legal representative of the lending banks.

NCC, however, stopped the move after informing the banks that the Nigerian Communications Act (NCA) says issuance of a telephone mobile license is personal to the licensee and not transferable to a third party without the written approval of the commission.

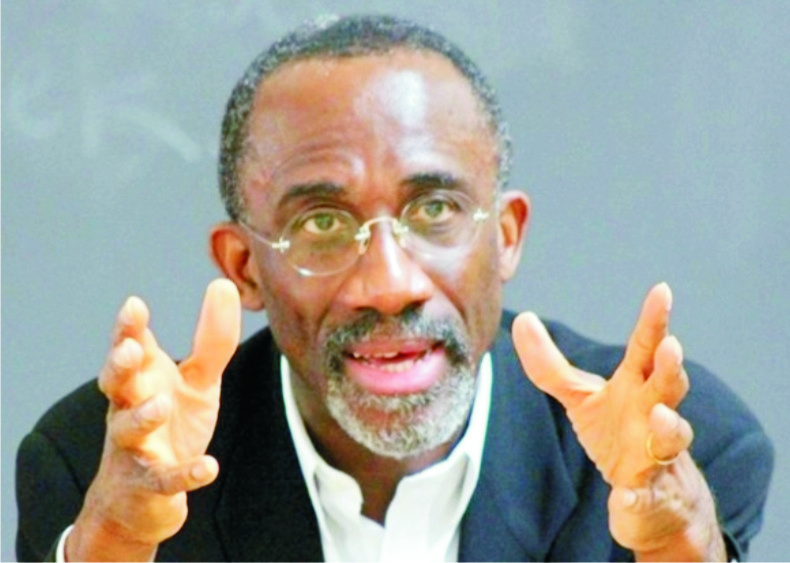

The crisis culminated in the resignation of the company’s chairman, Hakeem Belo-Osagie, chief executive officer (CEO), Mr. Matthew Willsher, and chief financial officer (CFO), Mr. Wole Obasunloye.

Their resignation came few days after its Emirati non-executive directors (NEDs), representing the interests of Mubadala Development Company and Emirates Telecoms Group Company (Etisalat Group) also stepped down from the board.

The intervention of CBN and the NCC later paid off after a prolonged mediation when a final settlement was reached between the warring factions. The deal culminated in the appointment of a new board of directors and management for Etisalat, led by Dr. Joseph Nnanna as Chairman and Mr. Boye Olusanya as the Chief Executive Officer. Other members of the board are Mr. Ken Igbokwe and Mrs. Funke Ighodaro, who is the new Chief Financial Officer.

BH reliably gathered that the two regulators, CBN and NCC forced the resignation of the Hakeem Bello-Osagie led board and management on June 30th to pave the way for the appointment of a new board.

Explaining the reason for the intervention of the two regulatory bodies, Acting Director, Corporate Communications Department, CBN, Mr. Isaac Okoroafor said:

“Although, it should ordinarily not be the role of a regulator to decide how individual bad loans are resolved, the CBN believes that Etisalat is a systemically important telecommunications company with over 20 million subscribers that if not well handled, may have domino effects on the banking system itself”.

He further explained that the CBN and NCC, sensing that banks might go ahead in the usual way and downsize the company’s over 4,000 staff, reached an agreement to intervene and implore the consortium of banks to reassess its position in dealing with Etisalat.

Okorafor explained that the collaborative move by the regulators was aimed at foreclosing the outcome of job loss and asset stripping and to ensure that Etisalat remains in business and is able to pay back the loans.

Reacting to the development, a telecom sector expert, Dr. Thompson Ona, praised the CBN and NCC for their quick intervention in preventing what could have been a death knell on the telecoms company.

“What happened to Etisalat over the past three to four months on this loan saga should be of concern to every Nigerian. If the precedent of allowing the banks to take over a telecommunications company is created, Nigeria may not be able to deal with the domino effect on many fronts. What expertise do the banks possess to run a telecommunications company? Where is Mobitel today after a bank took it over?

“Etisalat has employed a lot of Nigerians who are bread winners in their respective homes. If this situation had led to loss of jobs, can you imagine the number of people that would be affected?

“Most importantly, how can we convince a foreign investor to come and invest in the sector which we incidentally are positioning to take over as the mainstay of the economy from oil? That is why I commend the two regulators, particularly the NCC for stopping the banks from taking over the firm”, he said.

Meanwhile, the new management of Etisalat has reassured all its workers that there will be no job losses as a result of the change in management. According to an elated worker of the company, the new management at the weekend reassured its worried staff that nobody would lose his or her job as a result of the change in management.

“They assured us that our jobs are secure and challenged us to work even harder to ensure we cover lost grounds. The atmosphere here is peaceful as usual,” he said.

It would be recalled that Etisalat entered Nigeria’s growing mobile telecommunications market in 2008 after paying $400 million to acquire the Unified Access License (UAL), which offers it a mobile license and spectrum in the GSM 1800 and 900 Mega Hertz (MHz). Established as Emerging Markets Telecommunications Services but operating as Etisalat Nigeria, the company is the product of a strategic partnership between the United Arab Emirate’s Etisalat and Mubadala Development Company, an investment vehicle owned by the Government of the Emirate of Abu Dhabi.

Together, the two companies owned 70 per cent of the shareholding while Nigerian investors owned the remaining 30 per cent. Despite its late entry into near saturated market, Etisalat emerged the fourth largest telecoms operator with 21 million subscribers due to innovative and quality services confirmed by various industry awards including two awards from NCC as Best Network based on quality service and for excellent customer service.

However due to the challenges of economic recession, dollar scarcity and the stringent foreign exchange policy the company could not service the loan as agreed with the bank.