Business

FBNH projects strong year end result

By OKEY ONYENWEAKU

With the business environment growing leaner, financial institutions such as FBN Holdings (FBNH) have started to re-strategize to turn tight economic corners. The Holdco has embarked on new initiatives to push down costs and beef up earnings.

Indeed, analysts note that a review of the third quarter operating performance of the Holdco in 2018 shows the strains but also the promises of the finance powerhouse’s fresh initiatives. The groups Profit Before Tax dozed off from N55.4 billion in 2017 to N51.3 billion in 2018, representing a 7.4% slide on a year –on- year basis. Interest income also dipped from N356 billion in 2017 to N337 billion in 2018, representing a 5.3% year-on- year tumble.

Similarly, the lenders Profit after tax slid from N45.8 billion in 2017 to N44.9 billion in 2018, or a 1.9% decrease year on year.

Similarly, the lenders Profit after tax slid from N45.8 billion in 2017 to N44.9 billion in 2018, or a 1.9% decrease year on year.

Earnings per share (eps) remained flat at N1.22, basically unchanged from the prior year in 2017.

However, analysts note observe that the Holdco impressively posted an improved profit after tax (PAT) for the first-half (H1) of the year 2018 rising by 13.6 percent in 2018 to N33.5 billion from N29.5 billion posted a year earlier.

Profit before tax (PBT) of the lender rose 9.3 percent to N38.9 billion from N35.6 billion declared in the same period of 2017.

Gross earnings grew 1.6 percent to N293.3 billion from N288.8 billion posted in the H1 period of 2017.

FBNH adopted a new strategy in 2017 which improved its results for 2017 surpassing industry expectations.

FBNH brought down non-performing loans (NPLs) in its core commercial banking operations and contained its loan losses. The group grew its income from investment securities which also helped to give the bank a leap in net earnings.

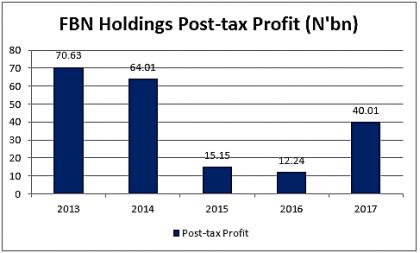

FBNH’s profit-after-tax for 2017 went up 178.8 percent to N47.8 billion, the highest leap the holding company has achieved in over five years.

The group, which resolved last year to keep risk assets in check and peg single obligor limit to N30 million, reduced its impairment charges on loan loss by 33.5 percent to N150.42 billion. And its NPL ratio (delinquent loans to total loans ratio) dropped from 24.4 percent in 2016 to 22.8 percent at the end of last year, though this is still the highest among the eight tier one banks in the country, analysts believe its downward direction is instructive. Non-performing loans were pruned by 11 percent to N520 billion as FBNH religiously implements reforms to reduce the size of toxic loan assets.

“Although high NPLs still pose a major challenge to FBN Holdings, it has made significant progress in reducing bad loans,” said Kayode Tinuoye, a financial analyst at United Capital Plc.

The Holdco’s group managing director, Mr U.K. Eke, noted in remarks on the accounts, “We recognise the need for accelerated resolution of our legacy assets to demonstrate sustained improvement in asset quality as the progress we made during the year was moderated by developments in Q4 which kept our performance below guidance. This was largely as a result of the impairment of 9mobile, which was across the industry, as well as the foreign currency translation impact on our existing portfolio. These are one-off events and we assure that appreciable progress would be made on NPL in 2018 in line with our 3-year strategic plan,” he explained.

A few months ago, Moodys, an international rating agency had commended FBNH in most of its operational indices, changing the out look on long-term ratings to stable from negative.

Moody’s Investors Service, after a critical assessment of the bank’s books affirmed First Bank of Nigeria Limited’s (FBN) B2/Not Prime long-term and short-term local currency deposit ratings and the bank’s B3/Not Prime long-term and short-term foreign currency deposit ratings. The rating agency also has affirmed FBN’s B2/Not Prime long-term and short-term, local currency and foreign currency Counter party Risk Ratings (CRR) and the bank’s baseline credit assessment (BCA) and adjusted BCA at b3. Moody’s changed the outlook on long-term ratings from negative to stable.

”The rating agency noted the bank’s improvements in its foreign currency liquidity. By cutting back foreign-currency lending and paying off some its borrowings, FBN will improve the coverage of its foreign currency borrowings by liquid foreign currency assets (cash and bank balances, loans due from banks and securities for trading) to about 2.5x from 1.9x at year-end 2017. Moody’s expects foreign currency liquidity to continue improving.” The rating agency had said.

With markets still likely to struggle with economic uncertainty and public policy misadventures in 2017, FBNH may have to distil the key elements of its formula for sustaining profitability in 2018 and project the strategy into the new year. The strong economic winds ahead (with inflation at 11.2% and unemployment at 36% by Bureau of Statistics figures) may require more than an umbrella and rain jacket.

In the last three years, the banking industry faced severe challenges emanating from lack of collective vision for the economy.

The macro-economic environment has not favoured deposit money banks (DMBs) in recent months. Besides inability to create risk assets, a major plank through which banks make profit, the banks have experienced marginal growth in gross earnings.

Net interest income of DMB’s have also been on the decline since the recession which ended in 2018. Given the weak economy, the banks have operated in a high interest environment which appear to scare away potential clients. Insecurity in the country, especially in the North East has been a source of worry to the banks which exposure to the agric sector is rising by the day.

Analysts are wont to believe that the future does not hold much hope for the economy and the country in the short-run, especially with the continued dependence on Oil for survival.

Supporting the inclement environment for the survival of businesses in Nigeria, Ms Arunma Oteh, World Bank Vice President and Treasurer, had recently voiced doubts that Nigeria would be able to achieve sustainable growth without being strategically focused.

How would banks navigate this hardship and deliver good yield for its owners? Many have asked

Strong banks have as a result returned to the drawing board to draw up plans to surmount the back-breaking challenges.

Despite all these challenges , the First bank’s management believes that its success story arose from innovations and reinvention of products and services aimed at satisfying customers’ needs and aspirations.

believes that its success story arose from innovations and reinvention of products and services aimed at satisfying customers’ needs and aspirations.

“At First Bank, our purpose is to put our customers and stakeholders at the heart of our business.

“For over 124 years of our existence, we have focused on providing excellent financial services to meet the needs of our esteemed customers.

“We continue to improve on our products and also create new ones that suit their specific financial needs.” Adesola Adeduntan, MD, First Bank Limited.Despite the weary equities market currently, analysts believe that FBNH stock is a good buy at N6.95 per share as at November 30, 2018 given the P/E Ratio at 4.87.

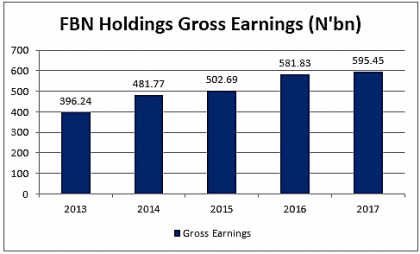

The group has not disappointed in the past five years as it continues to grow its revenues stronger and stronger. For instance; the bank gross earnings rose 50 per cent from N396.2billion in 2003 to N595.4billion in 2017.

Net operating income also rose 50.06 per cent from N296.4 billion in 2003 to N444.8billion in 2017. A deeper analysis also revealed that profit before tax fell from N91.337billion in 2003 to N37.7 billion in 2017. Its loan and advances to customers, however rose from N1.7 trillion to N2.001 trillion in 2017.

Whereas FBNH plc is a top lender with qualitative services, but its blend with digital banking will to a great extent determine its future.

With its performance, First Bank of Nigeria has ranked among the top five institutions in different indices in the industry. FBN Holdings Plc engages in the provision of commercial banking and financial services. It operates through the following business segments: Commercial Banking Business Group; Merchant Banking and Asset Management Business Group (MBAM); Insurance Business Group among others.