Business

Investors scramble for Nigerian tech startups, as sector rakes in $1.41bn funding in 2021

By OBINNA EZUGWU

Year 2021 is yet to end, but for Nigeria’s tech startups, it is already time to take stock of what has been an amazing year, during which time they raked in over $1.41 billion in funding, more than any country on the continent, and look set to take on the globe in 2022 and beyond.

Overall, African startups have raised $4.8 billion already this year, a higher amount than the figure raised in the previous three years combined, according Briter Bridges Intelligence, a London-based company that tracks investments into African startups. Still, the continent’s startups are poised to end year with $5 billion as more deals are expected at the tail end of the year, according to Bridges, and Africa’s most populous country, Nigeria, is leading the pack, proving a true giant in the startup space; what it had failed to do in everything else that is positive.

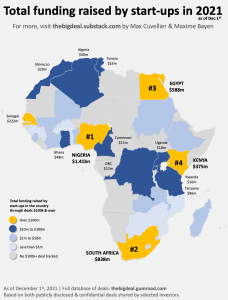

Latest figures from thebigdeal.substack.com, a platform that regularly tracks funding for the continent’s start-ups, show that of the over $4 billion raised by African startups as at December 1, 2021, Nigeria accounted for $1.41 billion, nearly 30 percent of the total. South Africa followed with $838 million, Egypt third with $588 million, Kenya fourth with $375 million, while Tanzania completed the top five with $96 million. Ghana, Nigeria’s West African neighbour had $48 million to place outside the top five.

Last week two Nigerian tech firms, MainOne lead Mrs Funke Okpeke and Ulesson announced major investment inflows. MainOne Optics attracted $320m while Ulesason founded by Simi Shagaya received $15 million.

But the Nigerian startups success story tells another story – the story of two Nigeria: one led by a ruinous political elite who have, through decades mismanagement of the nation’s oil and sundry natural resources, succeeded in creating a nation-state that houses about 90 million extremely poor people, the most of any country in the entire globe, according to the World Bank’s World Poverty Clock; a country where insecurity and hopelessness walk in the streets.

Then, there is another emergent Nigeria led by its educated, tech savvy youth population, who are, through innovation, creating an oasis in the midst of the desert of chaos, and who now represent in many people’s reckoning, the only silver lining in a country variously described as failed or failing state.

Both groups represent two forces pulling in opposite directions. Courtesy of the former category, the country has dropped from Africa’s top 10 investment destinations, taking position number 14, as Egypt maintained the number one nation, according to a report by RMB, a division of FirstRand Bank Limited, titled, ‘Where to Invest in Africa 2021.’ But courtesy of the later group, the country will end 2021 top investment destination for startups, and this for many is where the country’s hope for the future lies.

“The only opportunity that I see for us as a country is in that tech space,” said Dr. Bongo Adi, senior lecturer at Lagos Business School. “The reasons are quite obvious. When you come to fintech, Nigeria’s fintech ecosystem is more advanced than what you find in the rest of the world. It is more advanced than what you find in the U.K. or even in the U.S. That goes to tell you that there is a lot going on here.

“Of course, we also have that in other countries. We have that in China and we have that in the India, but the thing about Nigeria and Africa is that they are coming with real solutions, solving problems of, especially, financial inclusion. These are things that are badly needed across the globe; and that’s why they are leading in that space.

“So, yes, it is an opportunity that needs to be consolidated. There has to be some kind of supporting policies from the government.”

Africa will be ending 2021 with seven ‘Unicorns’ – a term coined in 2013 by Aileen Lee, a Silicon Valley venture capitalist, used to describe a privately held, fast-growing startup in place for less than 10 years with a valuation greater than or equal to $1 billion – five of which are based in Nigeria, including Flutterwave, Interswitch, Opay, Andela and Jumia – an e-commerce giant listed on New York Stock Exchange, though which has had struggles recently.

The others being Egypt based Fawry, a leading digital transformation and E-payment platform offering financial services to consumers and businesses, and Senegal’s Wave, a free invoicing and accounting software with credit card processing and payroll services.

There is a wave of optimism around these startups, and for good reason. They have achieved rapid growth in less than a decade, providing the pathway for many others to follow.

Today, Nigeria is a startup hub, with a solid financial services industry more advanced than what’s obtained in many countries of the global North.

Flutterwave – which was founded in 2016 by a team of ex-bankers, entrepreneurs and engineers led by its CEO, Olugbenga GB Agboola and 30-year-old Iyinoluwa Aboyeji, its former managing director who would move on to co-found Andela – reached a valuation of over $1billion after raising $170 million in a Series C round led by growth-equity firms Avenir and Tiger Global, in March.

Olugbenga Agboola, CEO, Flutterwave

Today, it provides intelligent payments gateway for more than 90,000 businesses that use its platform to carry out payments in 150 currencies, via multiple payment modes, including local and international cards, mobile wallets, bank transfers and barter. It currently leads the digital transformation efforts of Standard Bank across Africa, and has partnerships with Airtel, 9PSB, MTN Mobile Money, among others.

Last month, it acquired Disha, a platform that enables digital creators to curate, sell digital content, portfolios and receive payments from their audience worldwide. Flutterwave’s acquisition aims to improve the process of digital content creation for Disha users, enabling them to earn value for their creativity using the platform’s new payouts and collections solution.

Interswitch – a Lagos based digital payments firm founded in 2002 by Mitchell Elegbe, who serves as its managing director and chief executive officer – is a pacesetter in the digital payments system in Nigeria. It achieved unicorn status in 2019 following acquisition of its 20 percent minority stake by an American multinational financial services corporation, Visa Inc in a $200 million investment deal.

Mitchell Elegbe, Chief Executive Officer, Interswitch

Now an African Payment giant, Interswitch has customers in 23 countries of the continent. It entered East Africa in 2011 when it bought a 60 percent stake in Bankom then Uganda’s only fintech company, before going on to acquire a majority shareholding in Paynet Group, East-African payments provider.

In 2013 Interswitch entered into a deal with Discover Financial Services and Verve, went global to be accepted in the U.S. etc.

Currently, Interswitch provides much of the platform for “switching” rails for most of Nigeria’s banking sectors and ATMs card, with over 12, 000 ATMs on its network. It processes over 500 million transactions per month in a market that is seeing skyrocketing growth in electronic payments.

With well over 15 million users on quickteller, 32 million consumers who make use of its Verve chip and PIN cards, the most widely used in Nigeria, and Quickteller processing over 42 million transactions monthly as at mid 2019, a year it also ended with N30 billion revenue; Interswitch is indeed a fintech behemoth.

Andela – co-founded by American tech entrepreneurs, Jeremy Johnson, its CEO; Christina Sass, president, as well as Iyinoluwa Aboyeji from Nigeria and Canadian Ian Carnevale, Andela is a Nigeria based, African outsourcing startup launched in Lagos in 2014, to help global companies overcome shortage of skilled software developers, now with offices in Kenya, Rwanda, Uganda and the United States.

Andela

It made headlines in June 2016 when it received funding from the Chan Zuckerberg Initiative, an organisation owned by Facebook founder, Mark Zuckerberg and his wife, Priscilla Chan, thus becoming first Africa based firm to receive funding from Zuckerberg, and would in 2017, raise $40 million in Series C funding from CRE Venture Capital, DBL Partners, Amplo, Salesforce Ventures and TLcom Capital, becoming one of the most highly funded African companies.

In January 2019, the company raised $100 million in another round of funding, and October 2021, won unicorn status after raising $200m in a Series E funding round led by Japan’s investment firm, Softbank Group.

Opay – Chinese-backed, Lagos-based, and Africa-focused fintech company has since launching operation in 2018, gone from a startup initially known for its ride hailing services in Lagos, to a financial services unicorn worth $2 billion.

It had in August, raised $400 million from a round led by SoftBank, with Sequoia Capital China, and five other large firms participating, to cement its position as one of Africa’s fastest rising start-ups.

The company says it processes over $2 billion in transactions every month, with over 300,000 agents across the country and more than 5 million registered app users.

Nigeria today boasts of thriving tech-fuelled financial services industry, driven in most part, by its youth population who are already bucking the trend. While recent years have, for instance, witnessed sharp drop in Foreign Direct Investments (FDIs) into Nigeria, startups have continued to attract millions dollars from America, Europe and Asia.

Nigeria’s National Bureau of Statistics (NBS), had in a recent report, said FDI into the country dropped to $77.97 million in Q2 2021, from $154.76 million recorded in Q1 2021, the lowest in 11 years. But tech based startups, particularly in the areas of fintech, agritech, education technology, e-commerce, information technology, legal tech, mobility, digital freight and payment platforms, among others, defied this trajectory and are now poised to end the year with $1.5 billion.

Apart from the unicorns, many, including Kuda Bank, Mono, Paystack, iROKOtv, Autochek, among others, are witnessing sustained growth and could join the billion dollar club in the near future.

“They represent the hope of Nigeria,” said Pat Utomi, a professor of political economy and management expert. “People talk so much about Lagos, of course Lagos has become the Nigerian economy; it is not oil, it is Lagos. Lagos is 70 percent of Nigeria’s economy today. Who are those driving it? It is these young men and women coming back after going to some of the best universities in the world.

“They start out from their parent’s homes probably in Lekki and you will be amazed at what they are doing. Some of them are developing software in Nigeria; in Lagos for Canadian companies. I met a group of them on a flight to Canada.”

History is replete with economies revived, after falling apart, by a diaspora population. It was the returning of the Japanese in Germany that stimulated Japan in post Mehiji era. Today, Indians born outside of India are returning to lead a tech revolution. They also head the world’s leading technology companies, holding sway at the Silicon Valley.

Parag Agrawal, who was appointed last week as Twitter’s CEO, has joined at least a dozen other Indian-born techies in the corner offices of the world’s most influential Silicon Valley companies.

From Microsoft’s Satya Nadella, Alphabet’s Sundar Pichai, Twitter’s Parag Agrawal, to the CEOs of IBM, Adobe, Palo Alto Networks, VMWare and Vimeo, Indians are making their mark in the U.S. boardroom, despite the fact that they account for just about 1% of the U.S. population and 6 percent of Silicon Valley’s workforce.

The success story of tech in Nigeria gives such hopes, too, according to Prof. Utomi who particularly took note of the educational record of Nigerians in the United States.

Africa startup funding. Credit: The Big Deal

“We need that critical foreign mass,” Utomi said. “When I read statistics that suggest for example that Nigerians are the most highly educated migrant population living in the United States, I say to myself that the future is bright because those kids are the ones that will save Nigeria, and they will come when the time is right.”