Editorial

Editorial: Agenda for economic advisory team

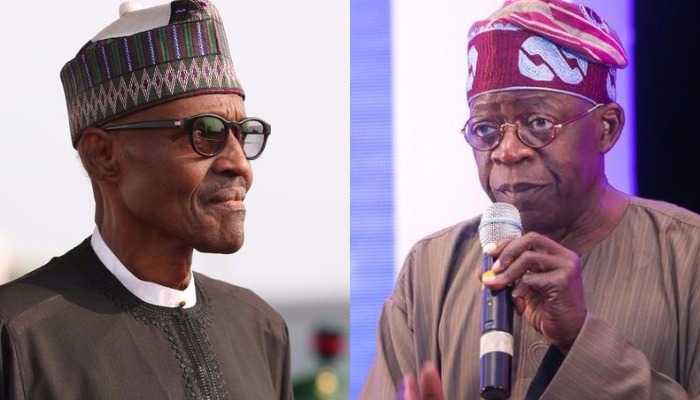

Arguably, perhaps, the most widely acceptable, and applauded decision ever taken by President Muhammadu Buhari since he was sworn for his second term in office in May this year was the constitution two weeks ago of the Economic Advisory Council (EAC). The constitution of the EAC to replace the Vice President Yemi Osinbajo-led Economic Management Team (EMT) was in the view of this newspaper a well thought decision and the timing cannot be more auspicious, given the challenge of nationhood and economy confronting the nation.

As a newspaper that is imbued with noblest of thought for the nation firmly anchored on market economy, liberalism and democracy, we commend the President for the decision and the calibre of members of the advisory team. It is interesting and also a symbol of the seriousness with which President Buhari attached to the new economic team that they will report directly to him by-passing the usual bureaucratic bottlenecks.

But we are quick to point out that the Economic Advisory Council is not a new phenomenon in the administration. Earlier, in his first term, Bismarck Rewane led similar advisory team that met once before it fizzled out. Therefore, there is strong fear and foreboding regarding this latest attempt as to whether the team will be given enough latitude and power to do their job, and more seriously whether their advice will be allowed enough traction since all of the team members made their names as liberal economists which runs counter to the President’s predilection toward command economy and bloated government.

Femi Adesina, presidential spokesperson in announcing the constitution said the council would be reporting directly to the president. Adesina said the EAC, which will be chaired by Prof. Doyin Salami, would advise the president on economic policy matters. He said that would include fiscal analysis, economic growth and a range of internal and global economic issues working with the relevant cabinet members and heads of monetary and fiscal agencies.

“The EAC will have monthly technical sessions as well as scheduled quarterly meetings with the president. The chairman may, however, request for unscheduled meetings if the need arises,’’ he said.

According to the statement, Dr. Mohammed Sagagi and Dr. Mohammed Adaya Salisu (Senior Special Assistant to the President, Development Policy) will serve as vice-chairman and secretary of the council respectively. Other members of the council are Prof. Ode Ojowu, Dr Shehu Yahaya, Dr Iyabo Masha, Prof. Chukwuma Soludo and Mr Bismark Rewane.

As expected, given the calibre of stars in the team, many Nigerians have hailed the President’s decision just as experts, industrialists and the Organised Private Sector (OPS) have set agenda for the new team. Emir of Kano Muhammadu Sanusi II, Alhaji Aliko Dangote, the Manufacturer Association of Nigeria (MAN), the Nigeria Employers’ Consultative Association (NECA) and some financial and economic experts have also tasked the new economic advisory on realignment of fiscal and monetary policies.

Dangote, said “the constitution of the Economic Advisory Council is a proactive move, by putting together tested and respected patriots, who are independent and always ready to put the country’s interest first and ahead of themselves.” He then urged the Federal Government to take advantage of this rare opportunity to strengthen the economy and put the country on the path of growth, job creation and competitiveness.

We believe strongly that by constituting the council, the President has brought in people that will advise him on the economy. The composition of the 8-man council is apt as they were drawn from outside government circles hence would be free to offer the President candid advice on the economy.

It is our advice to the team that it should focus more on tackling fiscal policy as the Central Bank of Nigeria focuses on monetary policy, as we expect the fiscal and monetary policies to work together in the direction of stabilizing prices and stimulating growth of the economy.

The task before the team is onerous, but surmountable, and we believe the success of the current administration’s drive to revamp the economy would depend on how it reflects on the life of the citizenry and the quality of advice it avails itself of the team. For us at BusinessHallmark, and for the Nigerian economy to achieve substantial economic recovery it would require thrift spending as well as strict utilization of capital outside the country.

The economic policy is not just about domestic policy planning but in our view, also about the international economic policy so we need these two to complement each other so that at the end of the day, both the domestic and the international are aligned to produce a substantial economic growth as we had during the 5-year Economic Development Plan.

The success of the team will also depend on Nigerians. Thus, we advise Nigerians to also cooperate to enable the government revamp the economy. The economy comprises of the government, business and household factors. So assuming the two do what is expected of them that is government and business, households should also try to rationalize their spending and be more productive so that the three sectors individually or where possible working together to take on inflation, poverty and self employment and other symptoms of low economic growth that created a lot of social dislocation in the wider society.

This newspaper firmly believe the agenda for the new economic team would largely be determined by the traditional scope of Fiscal Policy; the economic conditions of Nigeria today, and the president’s preferred responses in reconciling or harmonizing the scope of his fiscal policy and the economic conditions of Nigeria.

The ongoing controversy over the announcement of a proposed increase of VAT by 50% from 5% to 7.5% to support increases in spending by the Federal Government highlights that there is no implied intention, in the short run, to go beyond bookkeeping measures as a response to the fiscal deficit that an uncompetitive national economy has engendered.

This newspaper urges the economic advisory team to strongly advise the President to immediately go beyond the surface of government taxation and spending to both address the persistently sluggish recovery of the economy after every downturn and the un-competitiveness of the Nigerian economy itself.

From experience, with strong presidential support, it will be possible to consider other revenue sources that would not put unnecessary pressure on private investment and consumption which could undermine national economic competitiveness. Whereas it makes sense to sustain the commendable effort of widening the tax net, hiking current tax rates as a stance to reduce the fiscal deficit against the backdrop of a contraction or a weak recovery cannot be the best fiscal policy option.

Thus, this newspaper shares the view that government should be advised to come hard on spending by the MDAs. The only reason some expenditures are being incurred is because the National Assembly has provided for them in the budget. It won’t be an offense if the MDAs saved the provisions to reduce the unproductive deficit spending.

There is also the need for a law to make it culpable for line procurement officers and contractors who jettison basic costs in the build-up to contract sums. There would be significant savings if this measure was to be adopted. Perhaps up to 30% of most capital expenditures might be saved.

It is our considered view that another area of waste is allowing too many items in the federal budget beyond what can reasonably be completed within a presidential tenure as MDAs beg for any amount when they are defending their budgetary proposals.

Understandably, economic team should note that the challenge today is not just constrained output or oil theft, but governance in the oil industry. The two ministers of petroleum need to focus on and resolve uncompetitive cost structure in both upstream and downstream operations to rescue public finance from collapse in the short to medium terms.

The team should also take cognisance of the fact that both fiscal and monetary policies should aim at enhancing the competitiveness of the economy to mobilize domestic and offshore savings for investment in Nigeria.

We stress that the team would consider the need for the country to have a long-term national plan. The citizens need to know where the country should be in 2050 and how we will get there in terms of the resources. Even in the short and medium term, they should quickly look at where we are and how to reshape policies to take us in the right direction. The issue of current level of consumption, investment, government spending and revenue, and the international economy must be looked into to fast-forward growth of the economy with the next budget year and beyond.

We urge that the team should also propose strategy for easy access to domestic credits by investors and provision of relevant incentives for domestic and foreign investors. It should also conduct impact analysis on the Economic Recovery and Growth Plan (ERGP) for enhanced implementation.

There is a need for a robust engagement with the capital market regulators and operators to identify measures to leverage the capital market to boost economic growth and development. The team should reverse the recent increase in Value Added Tax (VAT) without further delay as it will do more harm than good in the present circumstance.