Business

CBN’s interest rate hike unlikely to tame inflation – Report

The decision of the monetary policy committee (MPC) of the Central Bank of Nigeria (CBN) to raise interest rate from 11.5 percent to 13 percent is unlikely to tame the country’s high inflation rate, a report by Analysts Data Services Resources (ADSR) has said.

The MPC had in its recent meeting on the 23rd and 24th of May, 2022 raised the Monetary Policy Rate (MPR) by 150 basis points (bps) to 13% from 11.5%.

The decision to raise the rate was unanimously agreed upon by all the eleven members of the Committee.

While six members voted for an increase by 150bps, four voted for an increase by 100bps and one voted for an increase by 50bps.

According to the ADSR in its monthly bulletin for June, the hike in MPR was expected following the trend of raising rates in major economies across the world.

It noted that most central banks are taking a tightening position on the Policy Rates to curb rising inflation caused by the rise in global prices of commodities and consumer spending.

The report, however, noted that rates hike, from available experience, has impact on inflation mostly when done in quick successions.

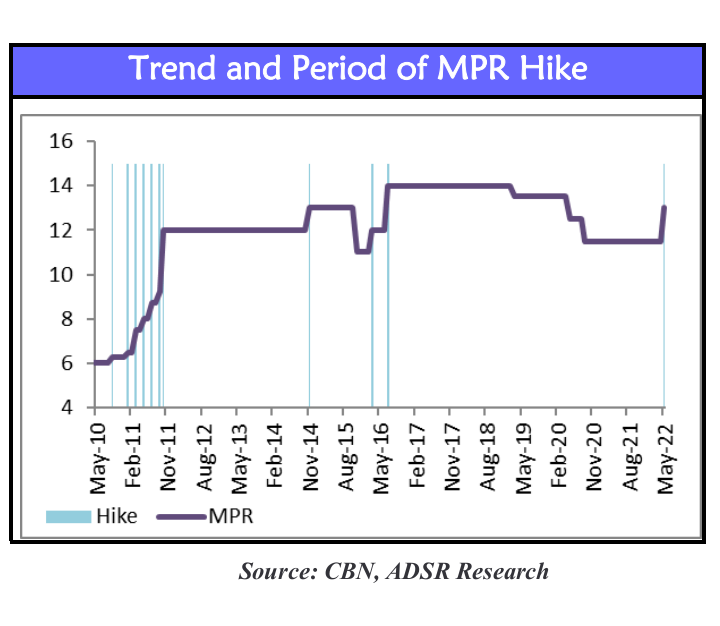

It noted that the recent hike in MPR comes 5 years and 10 months after the last one in July 2016 when it was raised by 200bps from 12% to 14%, and since the 2016 increase, the committee has retained the rate in 30 out of 33 times and only adjusted it downward 3 times.

“The MPR is an interest rate used by the central bank as an instrument of monetary policy to influence the behaviour of the main monetary variables in the economy. This rate is very key in managing major economic indicators, especially inflation and others, such as economic growth, unemployment, savings and investment as well as capital flows and exchange rate,” the report said.

Figure shows the trend of Nigeria’s MPR in the last 12 years, indicating the period when upward changes were made.

“For investment, policy and general planning purposes, it is crucial to examine the likely impact of the MPR hike on selected economic variables, drawing lessons from what has happened in the past. This is the purpose of this piece. We look at the behaviour of selected economic variables in the period around hike in MPR from 2010 till date.

Inflation rate: The MPR was raised eleven times from 2010 till date.

According to the report, between September 2010 and September 2011, the MPR was raised six times and subsequently the hikes were less frequent. It is observed that inflation rate took a downward trend in the immediate period following successive hikes.

“The rate hike in 2014 and the first hike in 2016 did not tame the inflation rate as it continued on an upward spree till the second hike was done in 2016. These suggest that hike in MPR does not necessarily lower inflation rate except when multiple rate hikes are introduced in succession.”

“Maximum lending rate: The maximum lending rate spirals upwards after each hike in MPR. During the period of successive hikes, this upward movement occurs almost immediately after the hike is introduced, as banks quickly transfer such increase to their creditors.

“Therefore, increase in the MPR often leads to increase in the cost of borrowing.

“Treasury bill rate: Using the 91-day Treasury bill rate as an example, a jump is often observed following an increase in the MPR. However, such jumps are seen to reverse subsequently, but not back to the level at which they were before the MPR hike.

“Exchange rate: Multiple MPR hikes in the 2010 and 2011 period coexisted with relatively stable official exchange rate. But in other periods when MPR hikes were not done in succession, it appears they served as a prelude to exchange rate adjustment (devaluation).

“Stock market index: The All-Share Index is observed to fall immediately the MPR is raised; but the market would subsequently bounce back after a period of about a quarter, provided no other macroeconomic shocks or market-specific negative event occur.

“The foregoing suggests that the recent MPR hike by the Monetary Policy Committee of the CBN will likely have some immediate effects on the Nigerian economy; with some policy implications. For instance, lessons from over a decade impacts of such hikes suggest that it may require more than a single-period MPR hike to tame inflation as the latter appear to be more influenced by supply and cost factors than demand factors, which are relatively more responsive to monetary policy.

“Factors that may discourage the CBN from considering another hike around this time will include whether the Apex Bank has an existing plan to adjust the currency upward and/or the extent to which increased return on fixed income investment is able to attract foreign capital inflows. All these will have impacts on the performance of the country’s stock market, since it is easier for the market to recover from a single than multiple hikes.”