Headlines

State of the Banks: How banks are managing economic headwinds

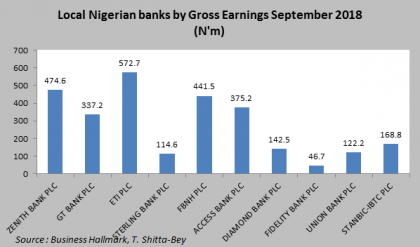

Nigeria’s urban money managers have become magicians of sorts, with the local economy groping for growth as gross domestic product (GDP) shuffles ahead at a sleepy 1.5 per cent (as at the second quarter of the year); local banks and their managers are still putting up respectful performances in the nine months to September 2018. A reel of financial data released by deposit money institutions (DMBs) for September show that the average after tax earnings growth of ten selected banks has nudged ahead by 12 per cent on a year-on-year basis.

Nigeria’s urban money managers have become magicians of sorts, with the local economy groping for growth as gross domestic product (GDP) shuffles ahead at a sleepy 1.5 per cent (as at the second quarter of the year); local banks and their managers are still putting up respectful performances in the nine months to September 2018. A reel of financial data released by deposit money institutions (DMBs) for September show that the average after tax earnings growth of ten selected banks has nudged ahead by 12 per cent on a year-on-year basis.

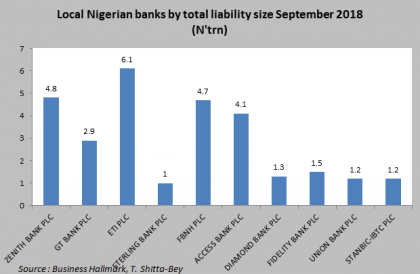

To be sure, the total assets of ten deposit money banks selected in a Business Hallmark survey for the 9 months to September 2018 has bumped forward a notch or by 3 per cent in the first three quarters of the year while net profit margins scurried to an average annual year-on-year growth of 10 per cent. This may not be riveting but it still remains impressive compared to the overall growth of the economy. The total liabilities of banks surveyed by Business Hallmark also went up as deposit growth became a vital tool for competitive advantage; liabilities jerked forward mildly by 9 per cent as banks continued to aggressively chase down retail customers. The challenge over the period has been that banks have found it difficult to convert short-term by way of bank deposits into near and medium-term lending assets. ‘’ the asset conversion cycle has become a stick in the mud for banks, as we increasingly see sliding short-term treasury yields at between 12 and 13 per cent (down from 18 per cent a year earlier) and slower aggregate bank lending’’, says Chris Okenwa, managing director of FSS Securities and one time market trader for investment bank, Capital Bancorp Limited. According to Okenwa, ’’how efficiently local banks start to convert customer deposits to loans and advances will separate the men from the boys and perhaps, ominously, the living from the dead’’.

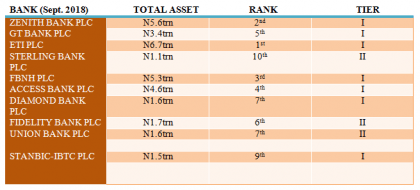

This gloomy outlook given the recent structure of bank balance sheets is understandable but may not pan out to be as dire. Banks seem to be settling into clearly-defined categories by size of their books, the quality of their management and the efficiency of internal resources, especially their application of emerging financial technology (Fintech). The neat separation between tier I and tier II banks of the past is fast becoming a blur as more banks appear to be shifting from one category to the other without official reclassification by the Central Bank of Nigeria (CBN). Tier I banks have long been considered ‘too-big-to-fail’ as the collapse of any one of these banks, it has been argued, could disrupt the safety of the financial system as a whole. So analysts have increasingly begun to ask whether the CBN should reclassify these money centre institutions in the light of recent financial performances? To be sure, one or two of these banks have dropped out of the big, wide and safe category of net lenders to the interbank market to a somewhat less savoury status; others, on the other hand, have bulked up and become stronger, less burdened by bad loans and possibly better run.

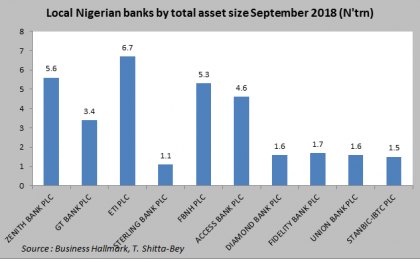

Asset size seems to be a critical index of bank stability; the bigger the asset size of a bank, the stronger the bank is, right? Not really, large asset sizes could be as much of a headache as large deposits, in both instances, say analysts; a lot depends on bank managers. Contemporary nine month results for selected banks show that the league table of asset size looks like a roll call of the strongest tier I banks in the business, with minor adjustments for a list of tier II banks with bigger aspirations.

ETI (a bit of a surprise) clearly has the largest total asset base of all banks in the country with a total asset size of N 6.7trn as at September 2018 followed by Zenith Bank (which many thought was the largest Nigerian bank by assets) with an asset base of N5.6trn and FBNH Plc with an asset base of N5.3trn (despite its risk asset troubles). These, no doubt, are among the country’s top three money lenders, deposit takers and non-lending asset creators. Trailing these top three is Access Bank with an asset base of N4.6trn and then the most highly priced financial jewel on the local stock exchange, GT Bank, with a total asset size of N3.4trn. Diamond Bank, Fidelity Bank, Union Bank and StabicIBTC have a combined average total asset base of less than N2trn (or N1.6trn in actual terms).

Profits, the devil in the detail

Profits, the devil in the detail

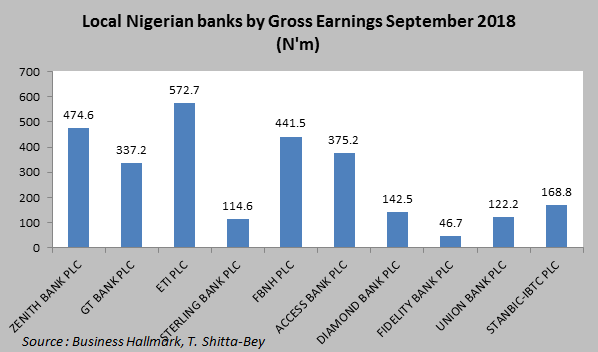

Corporate profit figures have not grown spectacularly on a year- on- year basis through to September 2018, but the numbers still remain decent nonetheless. Zenith Bank saw its profit before tax rise from N152.6billion in 2017 to N167.3 billion in 2018, a rise of 9.8 per cent. GT Bank also saw PBT growth year-on-year of 9.3 per cent from N150 billion in September 2017 to N164.2 billion in September 2018. ETI, Nigeria’s largest bank by asset size saw the pan African banking group’s profit before taxation scale up by a staggering 39 per cent from N69.4 billion in 2017 to N96.3 billion in 2018. According to Segun Atere, chief market analyst at Apel Assets and Trust, ‘’investors are slightly gung-ho and still seem excited about the sector, but truth be told, the splash of recent profit figures are modest compared to historical average five-year growth up until 2015 . This is certainly no time to bring out the Champaign glasses yet’’.

Argues Apel’s chief number cruncher, ‘’profit numbers are no doubt growing faster than the broad economy but they continue to lag behind inflation (11.48 per cent) and show a potential erosion of capital value in real numbers after adjustment for aggregate annual price increases. All though there are lovely outliers like ETI’’, he observes. Besides most recent bank earnings growth has come from a simmering down of loans and advances to customers and a cutting back of credit exposure to strategic sectors such as oil and gas and power industries. ‘’That kind of portfolio realignment, can only be temporary beneficial’’, argues Oluwarinu Olawale of Capital Express Securities. According to Olawale, ‘’the banks short term tactics of derisking their balance sheets by knocking down their loans to previously high risk sectors is brilliant, but it needs to equally be balanced by more creative application of thought to how banks can take additional earnings off the table from transactions that meet changing customer preferences. If risk assets (in other words loans) do not grow, then how the heck do banks expect to increase their earnings going forward?’’ she quizzes. ‘’They simply appear to be kicking the profit dilemma down the road’’.

Here come the Fintechs, run, run, run!

In the last decade and a half from 2000 to 2015 banks seem to have had a pretty easy job of keeping their customers satisfied by being hooked to a standard silo generic products; restrictive in character and inflexible in operation. That is about to end. The new financial system is rapidly chaning as financial technology companies such as Systemspec with their iconic payment solution Remita are reconfiguring the financial payment landscape and making old ways of doing business effete. Executive Director of Systemspec, Aderemi Atanda, ‘’the financial service delivery system in Nigeria will never be the same again. Those that thought that the customer as kings and queens was a mere clever catch phrase to keep the natives happy, are having a sharp (and in some instances brutal) perception of reality. The customer is actually lord of the manor’’.

Atanda points out that, ‘’bank products used to be designed in the comfort of chilly bank back offices with features and character imposed on customers. Today that approach to customer service provision is a prescription for getting a bloody nose.’’ He argues that banks nowadays can only build successful products or services on the back of clever data mining and taking a targeted approach to product design and service delivery from a bottom up rather than from top down approach. The Systemspecs boss insists that, ‘’going forward banks are going to have to decide on either collaborating with Fintech companies to reduce the costs of research and development that will be involved in the ‘commodity’ of banking service or they may decide to go it alone and bare the full cost of in-house service development. The consequence of the latter could be devastating for their bottom lines’’, he warns.

Whether bankers like it or not, their business is becoming a ‘’commodity’’ customers pick of the shelf from their various mobile digital devices. The lower cost of finding substitutes between service providers has put increasing pressure on banks to retain customers at higher costs. This has put a bigger squeeze on operating margins and a twist to desire of banks for superior service quality, ‘’ thereby putting the fear of unsatisfied customers at the centre of the commercial calculations of bank officers’’, notes Atanda soberly.

This explains why the once towering revenues posted by these banks from their spanking new digital platforms have fizzled to more modest figures. But it has also spawned a generation of digital denizens who conduct the bulk of their businesses without ever visiting crowded (or perhaps these days not so crowded) banking halls. The speed of transactions and the efficiency of service delivery in the new financial ecosystem is perhaps one of the most robust on the African continent, regardless of the usually offhanded casual putdowns by some observers who compare the payment system in Nigeria with developments in the much smaller East Africa market.

Nigerian banks in the coming year will have to deepen the digital service delivery space as they come to the full realization that their service delivery demography is pressed tightly between the ages of 18 and 35 years and that this statistically right-skewed demographic powerhouse takes technology for granted as they, in the words of Systemspecs Atanda,’’eat, live and dream a digital reality’’.

Recession proofing; hope is not a method

Asset and equity returns for banks in the last twenty four months have been squashed, pummeled and squeezed by an economy that has battled to find sustained growth. But return on assets (ROA) for the top banks have ranged from between 1.1 per cent and 3.2 per cent as return on equity (ROE) equally skittered between 6.1 per cent and 32.71 per cent.