Headlines

T-Bill maturity improves banks’ liquidity

FELIX OLOYEDE

The liquidity challenge which banks have been grappling with in the last five days eased on Thursday, underpinned on the maturity of securities.

The liquidity challenge which banks have been grappling with in the last five days eased on Thursday, underpinned on the maturity of securities.

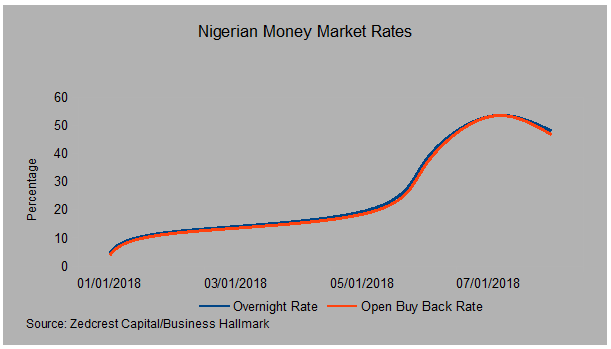

Overnight (OB) rate dropped -5.08 per cent to 48 per cent, while Open Buy Back (OBB) fell -6.33 per cent to 46.67 per cent after reaching 10 month high on Wednesday, forcing the Central Bank to shelve a plan Open Market Operation (OMO) auction, due to the liquidity squeeze that hit the financial industry.

The apex bank, meanwhile, redeemed N68.8 billion worth Treasury Bills which matured on Thursday, helping to improve liquidity in the banking sector. But it also sold Treasury bills worth N23.42billion in two OMO auctions on Thursday.

According to data obtained from CBN website, the T-Bills auctioned were 98day bill valued at N120.67 million, maturing on May 17, 2018 and 252day bill worth N23.3 billion maturing on October 18, 2018.

According to data obtained from CBN website, the T-Bills auctioned were 98day bill valued at N120.67 million, maturing on May 17, 2018 and 252day bill worth N23.3 billion maturing on October 18, 2018.

The treasury bills that matured today accounted for the drop in money market rate. We might see rates go up tomorrow, because the CBN also carried out OMO auction today,” said Kunle Ezun, research economist, Ecobank .

He added that liquidity in the financial system would further improve when FAAC allocation is released to the three tiers of government next week.

Usually, two weeks after FAAC release, sales of treasury bills, FX and OMO auctions dry up liquidity in the financial system, explained Johnson Chukwu, managing director, Cowry Asset Management Company Ltd.

“We should see rates moderate in few days, because of today’s maturity. And next week FAAC inflow will further ease liquidity,” he added.

“We expect rates to close slightly lower tomorrow, as banks are not expected to bid aggressively at OMO due to tight liquidity and high funding costs,” researchers at Zedcrest Capital Ltd collaborated.