Business

Anxiety mounts over MTN’s Future

UCHE CHRIS

From every indication, this may be the last straw for the South African company, MTN. Informed sources believe that it was a strategic move by government to ensure that the company never recovers, thereby providing a convenient pretext to acquire it. As the biggest and arguably most profitable company in the country, government is somewhat jittery and troubled by its operations especially as a foreign owned firm.

Still reeling from the previous fine which was occasioned by its disregard to the regulation requiring all telcos to register their SIMs before issuance to subscribers, in a bid to track users especially those who perpetrate crimes, such as terrorism and kidnapping, MTN is at present pitched in the battle for its survival. MTN is expected to list on the Nigeria Stock Exchange, NSE, this year according to the schedule and terms of settlement for the SIM registration offence.

The Central Bank of Nigeria had a few weeks ago imposed an $8.134 billion profit refund penalty and another $2.3 billion tax liability for fraudulently repatriating its equity investment as loans without proper approval in breach of existing laws in the country. CBN also slammed four banks with a fine of N5.87 billion for their involvements in the transactions in violation of laws and regulations including the Foreign Exchange (Monitoring and Miscellaneous) Act 1995 and the Forex Manual 2006.

Standard Chartered Bank, a South African bank, like MTN, received the highest fine of N2.5 billion, followed by Stanbic IBTC, another South African bank, which received N1.9 billion, while Citibank, an American bank, got N1.3 billion. However, Diamond bank owned by Mr. Pascal Dozie, and chairman of MTN, received N250 million. An official source described the situation, “as a conspiracy by South Africans against Nigeria”.

MTN has denied the allegations insisting that it did no wrong as it did in the SIM case only to later accept under threat of license revocation. However, Stanbic IBTC , says “it was not aware at the relevant time the affected investors in the MTN Private Placement in 2008 had obtained forex loans from local banks for the purpose of their investment and it was not mandated under any law to investigate whether an invested fund is borrowed or not but rather to ascertain that an investor had transferred the necessary funds to the stipulated assets”.

But this seems contrary to all the existing regulations and laws, especially the Know Your Customer policy, which requires banks to ensure adherence to the purpose of transactions involving their customers. The $8.5 billion was the profit from the investment of $402 million which was transferred out of the country under the guise of equipment purchase finance.

Also, some of the transfers were made to tax havens (private accounts) instead of the head quarters in South Africa, making them proceeds of money laundering. MTN is also accused of false claims of capital inflow, which were actually proceeds from over-invoicing; that the forex sourced from local banks were subsequently repatriated as profit of investment thereby worsening the pressure on the naira.

In its reaction, MTN said that “The allegations are false and based on completely false information”.

But in 2007 when MTN published the its accounts it reclassified the investment as only $29 million as equity and $399 million loans contrary to the Certificate of Capital Importation, CCI, issued by Standard Chartered bank.

But in 2007 when MTN published the its accounts it reclassified the investment as only $29 million as equity and $399 million loans contrary to the Certificate of Capital Importation, CCI, issued by Standard Chartered bank.

“That means that MTN provided false information and used banks to convert their equity to loans without approval from the CBN as required by law,” said a government source.

MTN invested $402 million from 2001 to 2006 and made a profit of $8.1 billion, about 20 times of the original investment.

Informed official sources hinted that the cup of MTN is full and there is urgent need to make an example of it citing the previous case where it was fined by the NCC.

“The war on corruption would not be successful if the business community is not brought in to the hilt. We cannot be humiliating politicians while business people are ripping off the country; they must pay like every other person in the country to ensure that the entire system is effectively sanitized”.

Another source also believes that the focus on MTN goes beyond the war on corruption. He said that this government has not been completely enamoured of the private sector and the attention on MTN is part of its anti business orientation and policy. It was learnt that the strategic position of the telco as the largest and most lucrative company fit government plan to flex its muscle against the private sector by taking up a role through the back door.

It would be recall that this government has not hidden its disdain and anger toward the privatization of some government establishments such as NITEL, PHCN, Nigeria Airways etc – firms that provided huge patronage for the northern leadership – by previous administrations, and has been seeking opportunities to redress it. Last month, for instance, government through the minister of Aviation Hadi Seriki, announced the setting up of Air Nigeria as successor company to the defunct NAL.

Sources said government had deliberately imposed the issuance of Initial Public Offering on MTN as part of the settlement for the earlier infraction on the SIM registration regulation to avoid direct government involvement. However, MTN’s reluctance to follow through with the condition informed the current action against it to either stampede it into taking steps toward fulfilling the terms or provide the convenient pretext to nationalize it.

Already MTN is seen as a “rogue company” in the eye of the law and government will be justified to take any punitive action against it. Informed sources said that given the strategic importance of the network which controls about half of the subscriber base, government led by President Buhari is infinitely affronted that there is no significant northern representation in its ownership. There is also the security implication of its dominance.

The source defended such eventuality stressing that government is fully covered by extant laws to either revoke the licence of the network or take over its assets.

“The laws are there and very clear: Executive Order six, recently issued by the government and the money laundering Act empower government to confiscate assets from proceeds of crimes; while under the NCC Act the licence of any network involved in criminal activities can be revoked. MTN has got no legal defence,” the source asserted.

According to the source, it is either MTN sheds part of its ownership to allow Nigerians and particularly northern interest, share in it or loses everything because government is determined to enforce its laws and protect the economy. The source added that the network has abused its privilege and government goodwill, insisting that no person or company is above the law.

Already, there is palpable anxiety in the banking sector over the MTN crisis as several banks will be adversely affected in the event of failure or takeover. A meeting of the bankers Committee is being envisaged soon to review this issue and take a position to guard against any systemic run on the industry.

Mr. Funso Aina, head corporate communications, MTN, would not comment, insisting that their position has been stated in a previous statement.

In the statement, MTN said it “received a letter on August 29, 2018, from CBN alleging that Certificates of Capital Importation (CCIs) issued in respect of the conversion of shareholders loans in MTN Nigeria to preference shares in 2007 had been improperly issued. As a consequence, they claim that historic dividends repatriated by MTN Nigeria between 2007 and 2015 amounting to $8,1 billion need to be refunded to the CBN.

MTN Nigeria strongly refutes these allegations and claims. No dividends have been declared or paid by MTN Nigeria other than pursuant to CCIs issued by our bankers and with the approval of the CBN as required by law.

The issues surrounding the CCIs have already been the subject of a thorough enquiry by the Senate of Nigeria. In September 2016 the Senate mandated the Committee on Banking, Insurance and other Financial Institutions to carry out a holistic investigation on compliance with the Foreign exchange (monitoring and miscellaneous) Act by MTN Nigeria & Others.

In its report issued in November 2017, the findings evidenced that MTN Nigeria did not collude to contravene the foreign exchange laws and there were no negative recommendations made against MTN Nigeria.

MTN Nigeria, as a law-abiding citizen of Nigeria, is committed to good governance and to abiding by the extant laws of the Federal Republic of Nigeria. The re-emergence of these issues is regrettable as it damages investor confidence and, by extension, inhibits the growth and development of the Nigerian economy.

We will engage with the relevant authorities and vigorously defend our position on this matter and provide further information when available.

However, Engr. Lanre Ajayi, former President of ATCON, told BusinessHallmark that there is more to the issues than meets the eyes, noting that why should government wait 10 years to review transactions alleged to be in violation of existing laws and regulations.

“We are not trying to defend or justify criminality; if anybody falls foul of the law, such a person or company should be dealt with. But it is not right and proper for the company to be singled out for punishment when there were government officials also involved; we have not heard anything said about such people who abetted such activities; such people were careless and negligent and should be sanctioned too.

“Even the issue of tax raises more questions than answer; why should the Attorney General be involved when it should be the responsibility of the FIRS. Nigeria should be careful because the world is watching and investors will respond appropriately to any action of government”, he said.

Mallam Abubakar Malami, AGF had last week given the four indicted banks in the allegations a two week ultimatum to pay the N5.8 billion. But the CBN did not wait that long as it debited the banks on Friday. All these suggest some political agenda and motive in the entire episode.

However, Mr. Deolu Ogunbanjo, National President, National Association of Telecoms Subscribers, NATCOMs, called for caution, stressing that the parties are still discussing and the final decision has not yet been reached; therefore until he details are available we should reserve some conclusions.

“I believe things will be worked out by the parties; the important thing is that they are still talking even though they still maintain their positions. By next week (this week) the picture will be clearer, then we will know the next step”, he said to Hallmark.

Last week Alhaji Atiku Abubakar, a former vice president who is running to be presidential candidate for the main opposition People’s Democratic Party criticized government on the move, saying the way the central bank has targeted MTN will only serve to discourage foreign investors, noting that it was a political move to appeal to President Buhari’s voting base.

“Even in a worst-case scenario where there were breaches of financial laws and regulations, there are much better ways to deal with it than by the public exposure that MTN has been subjected to,” Abubakar said in Lagos. “It is bound to send the wrong signal to foreign investors. We should resolve it in a business-like manner, not a punitive manner.”

Abubakar was deputy president when MTN began operating in Nigeria in 2001 and was part of the government’s drive to create a mobile phone network to help address woeful telecommunications in the country. The South African company was at the forefront of that initiative, and had about 66 million local customers at the end of June, according to the Nigerian Communications Commission.

“The Nigerian government and authorities are trying to get their house in order,” Dobek Pater, managing director of telecoms advisory firm Africa Analysis, said by phone from Rwanda. “From history MTN does not have a squeaky clean reputation, and there have been some transgressions in the past,” an online media reported Friday.

However, Vestact Chief Executive Officer Paul Theron said the move was “pathetic, nationalistic and immature” and will “severely weaken Nigeria’s economy in the years to come.”

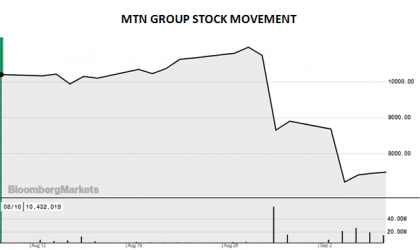

The shares gained 1 percent to 77 rand by 4:31 p.m. in Johannesburg on Thursday. The stock is still down 45 percent this year. MTN has declined more than 60 percent since October 2015, when its troubles with Nigerian regulators over the disconnection of lines were first announced. The stock fell 18 percent on the first day of the announcement.

Moody’s Investors Service has placed the company’s rating of Ba1, four steps into junk territory, on review for downgrade by weekend, citing the “uncertainty around the potential implications” of the Nigerian penalties.