Business

Access Bank boosts earnings with lower costs

FELIX OLOYEDE

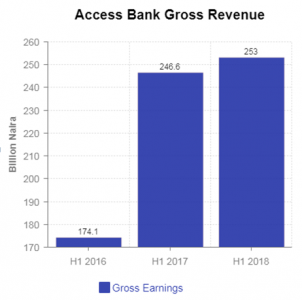

The bank experienced 12 per cent grew year-on-year in pretax profit to N45.84 billion propelled by 29 per cent drop in impairment provision for loan losses to N7.34 billion and gross earnings which was up three per cent to N253 billion in the first six months of the year.

The growth in revenue was driven 15 per cent rise in interest income, although non-interest income decline 22 per cent, weakened by 53 per cent dip in net trading on the back of foreign exchange income gain of ₦33.8 billion, which was down 157per cent during this period.

However, net fee & Commission income appreciated 21 per cent to₦30.1billion, bolstered by increase in credit related fees and commissions and E-business income, which appreciated 53 per cent and67 per cent respectively. Also, other operating income accelerated by a whopping 143 per cent to ₦10.3 billion underpinned on income from asset management and other financial services.

However, net fee & Commission income appreciated 21 per cent to₦30.1billion, bolstered by increase in credit related fees and commissions and E-business income, which appreciated 53 per cent and67 per cent respectively. Also, other operating income accelerated by a whopping 143 per cent to ₦10.3 billion underpinned on income from asset management and other financial services.

The bank’s shareholders have something to cheer about as it declared 25 kobo interim dividend. “The economic environment is harsh. If they were able to come up with good strategy to make good profit in spite of the fact the revenue didn’t really grow, one has to praise their efforts. I think they have performed well,” he further noted.

Access Bank has done well with the declaration of 25 kobo interim dividend in H1 2018, despite the challenging environment, said David Adorin, Managing Director, Highcap Securities Ltd.

Access Bank has done well with the declaration of 25 kobo interim dividend in H1 2018, despite the challenging environment, said David Adorin, Managing Director, Highcap Securities Ltd.

This was collaborated by Adele Akinwunmi, Head, Research, FSDH Merchant Bank, who lauded the bank’s ability to grow its interest income and non-interest income amidst lull in the macroeconomic environment. He explained that Access Bank diverted its credit creation from customers to banks, because of the weak macroeconomic environment. “In essence, it was little bit of a flat performance. They had some savings from tax. If they had not made a loss from foreign exchange revaluation, it would have been a better performance,” he reasoned.

Meanwhile, although Access Bank grew deposit by 7 per cent to N2.41 trillion in H1 2018, it was more frugal with loan disbursement as its risk asset slide 3 per cent to N2 trillion and, total assets climb 7 per cent to N4.37 trillion. Shareholders’ fund on the other hand, plummeted 11 per cent to N460 billion during this period. Understandably, the bank’s loan-to-deposit ratio declined 15.6 per cent to 58.7 per cent.

The bank explained that slowed lending activities to the various sectors due tounfavourable macroeconomic indices was responsible for the decline in its risk assets in the first six months of the year.

Nigerian economic growth slowed to 1.5 per cent in H1 2018, compared to 1.95 per cent recorded in the previous quarter despite growth in the non-oil sector. The country’s economy is heavily dependent on oil for foreign exchange and government gets over 70 per cent of its revenue from the oil sector. Although oil prices have risen almost 40 per cent to $77.46 b/d in the past on year, this has not really reflected in the Nigerian economy.

Even so, Access Bank better managed its cost in the first six months of the year, cutting operating 6 per cent to N98.2 billion in H1 2018, compared to N105.1 billion in the corresponding period last year. This drop was as a result of reduction in profession fees (-59 per cent); administrative fees (-34 per cent); communications expenses was halved and advertising and marketing expenses were pruned 31 per cent. However, cost-to-income was up 220 basis point impelled operating income, which plunged this during period. “We will continue to intensify our focus on our cost optimization and value for our spend,” the bank to its shareholders in its half year investor presentation.

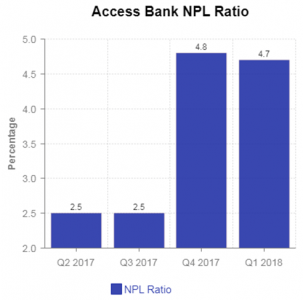

Moreover, with the slump in loans and advances, the lender’ NPL ratio fell marginally to 4.7 per cent instead of 4.8 per cent, but it was 88 per cent higher than recorded in H1 2017. And its NPL coverage ratio stood at 105.0 per cent at the end of June this year. The bank would need to have to further tighten its risk management to prevent its NPL ratio from going above the 5 per cent regulatory threshold.

Moreover, with the slump in loans and advances, the lender’ NPL ratio fell marginally to 4.7 per cent instead of 4.8 per cent, but it was 88 per cent higher than recorded in H1 2017. And its NPL coverage ratio stood at 105.0 per cent at the end of June this year. The bank would need to have to further tighten its risk management to prevent its NPL ratio from going above the 5 per cent regulatory threshold.

Access Bank was one of the nine consortium banks that issued $1.2 billion Etisalat Nigeria facility that went toxic. The affected banks have made provision for this loan.

The weak growth in revenue impeded Access Bank liquidity as liquidity ratio weakened by 2.2 per cent to 43.2 per cent in Q2 2018. This is still well above 30 per cent liquidity ratio requirement of the Central Bank. More so, capital adequacy ratio also decelerated marginally by 0.8 per cent to 20.8 per cent, while the regulatory benchmark is 15 per cent.

“Capital adequacy ratio (CAR) of 20.8% down 170bps (Dec’17:20.1%) due to reduction in risk weighted assets despite an increase in the translation rate,” Access Bank explained in its presentation for the quarter.

Akinwunmi noted that he does not expect any surprise from the bank’s performance at the end of the year, since the half year result was audited, which painted a true picture of the state of things in Access Bank. He projected a flat or marginal growth after the end of the year as the macroeconomic fundamentals do not inspire growth.