Business

Operating income growth, lower impairment charges lift Ecobank profit up 31%

By FELIX OLOYEDE

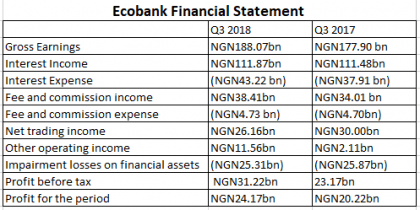

Ecobank puts up an impressive financial performance, helped by significant growth in other operating income, fee and commission income and cut in its impairment charges on loan losses.

The commercial lender’s post-tax profit grew by 31 per cent to N75.72 billion in September 2018, compared to N57.95 billion it posted in the same period last year, while its pre-tax profit was also up 39 per cent to N96.25 billion, the bank’s nine-month financial statement has shown.

Although revenue increased marginally 1 per cent to N572.7 billion, slowed down by interest income, which rose barely 0.2 per cent during this period.

But significant rise in other operating income, which leaped 164 per cent to N17.62 billion, fee and commission earnings, which increased by 12 per cent to N115.66 billion and -26 per cent decline in impairment charges on loan losses, buoyed the pan-African bank nine-month performance.

Total assets grew 5 per cent to NGN 6.70 trillion despite Ecobank loans and advances dipping -6 per cent to NGN 2.65 trillion, while deposits from customers up 10 per cent to N4.75 trillion.

Commenting on the bank’s performance, Ade Ayeyemi, Group CEO, Ecobank said, “Profit before tax for the nine months ended September 2018 increased by 39 per cent or 48 per cent on a constant currency basis to $314 million. Our return on tangible equity was 19.9 per cent compared with 15.6 per cent in the previous year.

Commenting on the bank’s performance, Ade Ayeyemi, Group CEO, Ecobank said, “Profit before tax for the nine months ended September 2018 increased by 39 per cent or 48 per cent on a constant currency basis to $314 million. Our return on tangible equity was 19.9 per cent compared with 15.6 per cent in the previous year.

“The initiatives we took in phase-one of our 5-year strategic plan are starting to show results in our financial and business performance. The risk profile of our credit portfolio is improving; we are increasingly becoming leaner and more cost efficient; and thanks to our digitisation strategy, broadening our products and services to include the unbanked. Thus, we are seeing encouraging growth in trade loans, remittances, cards and e-banking, and foreign exchange and fixed income sales in some of our regions. Loan growth, however, has been tepid, despite the fact that we are seeing strong deposit generation in all of our businesses and regions, largely because we are seeing limited credit opportunities that meet our risk appetite.”

He further noted that the bank remains excited about the prospects for our diversified pan-African banking business model and in its operating regions.

He added, “Economic activity is forecast to grow in Africa and we believe the firm is rightly placed to benefit from this growth. At the same time we are also keenly planning for any contingencies that will arise from any one of the global geo-political uncertainties.”

The Group CEO and Group CFO who are both signatories to the financial statements of ETI, were granted a waiver by the Financial Reporting Council (FRC) of Nigeria allowing them to sign the ETI financial statements (without indicating their FRC registration numbers) together with the Chairman on behalf of the board.