Brands

Chipper Cash raises $13.8 million Series A funding

Adebayo Obajemu

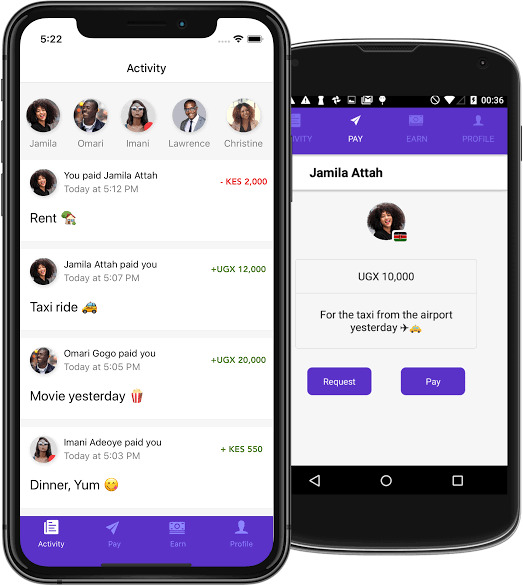

Chipper Cash in its bid to improve its operation and increase liquidity has raised $13.£ million Seried A funding.

The company which offers payment services across African countries (including Nigeria), has said.

Business Hallmark’s findings revealed that the funding round was led by Deciens Capital, a US-based venture capital and private equity firm.

The fresh capital would enable the fintech firm (i.e., Chipper Cash) to recruit about thirty new talents for its operations in places like Lagos, Nairobi, London, New York, and San Francisco where the company is based.

The latest fundraising brings the total amount so far raised by the company to $22 million. This is happening barely two years after the payments company was established by two African students in the USA – Maijid Moujaled from Ghana

The service was introduced to the Nigerian fintech space following its establishment. And today, it is one of the top players in the field where it competes with the likes of Paga, Paystack, and even Opay.

Perhaps what is unique about Chipper Cash is the fact that its P2P payment service attracts no fees. It should, however, be noted that the company also offers fee-based, merchant-focused service called Chipper Checkout, which enables the fintech to generate revenue.

TechCrunch spoke to Ham Serunjogi, one of the co-founders, about the company’s performance. He said:

“We’re now at over one and a half million users and doing over a $100 million dollars a month in volume.”

The latest fundraising follows a recent trend whereby Africa’s fintech startups have been attracting the most venture capital investments. In 2019 alone, African fintechs were responsible for an estimated $2 billion in VC fundings.

A bulk of those funds come to Nigeria, which has arguably become Africa’s fintech capital.

The fintech revolution in Nigeria has happened in less than a decade, disrupting the modus operandi in the financial services industry whilst availing financial services to those who were hitherto un-banked