Business

Besieged Naira fights for survival

By FELIX OLOYEDE

The pressure on the naira has intensified as foreign investors scrambled for scarce dollar in the country, moving their investments to a safer haven.

Portfolio investors are willing to buy the dollar at any cost in Nigeria and other emerging markets, which has adversely affected the local currencies.

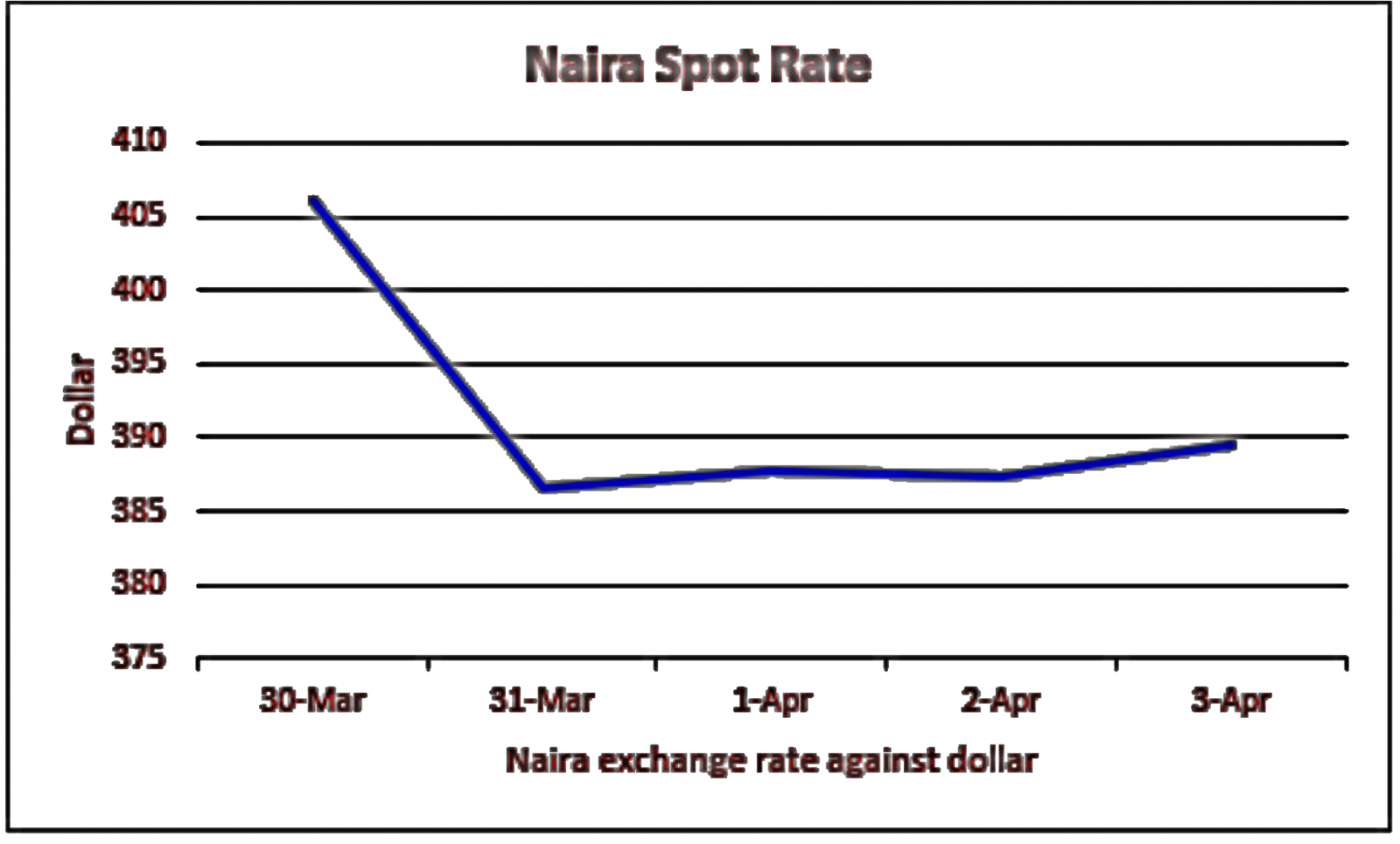

The naira has weakened further by 2.51 per cent to N389.55/$ as at 1.07 pm Nigerian time on Friday at the spot foreign exchange market since the Central Bank of Nigeria (CBN) devalued the currency from N362/$ to N380 on March 20.

The currency trades between N415/$-N420/$ at the parallel market, which has been shut down for about two weeks, pushing the naira to the weakest level in almost three years; it was sold for N383/$ at the Investors and Exporters (I&E) forex window on Friday, having opened at N388.40 and traded high at N397.35.

Aminu Gwadabe, President, Association of Bureau de Change Operators of Nigeria (ABCON), said price discovery is currently being witnessed in the country’s forex market, which is good for the market.

He noted the apex bank has succeeded in unifying rates across the different segments of the forex market.

“Since the lockdown, activity has been a bit slow in the forex market. But we have seen a rush to the door. Offshore investors are repatriating their funds and they are willing to buy at any rate,” Oluwaseyi Akinbi, an analyst with Zedcrest Capital told Business Hallmark.

He projected that rates may retreat a bit when the lockdown subsides, adding that the outlook expects the naira to weaken further, due to the low crude oil price and the impact of the coronavirus.

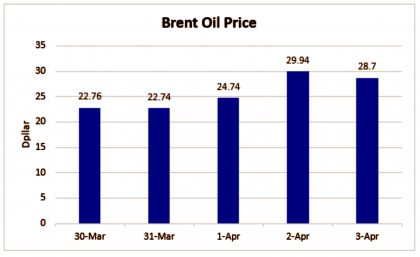

He reasoned that the upsurge of about 25 per cent in oil between Wednesday and Friday to $33.90 per barrel for Brent, would not significantly impact Nigeria’s currency.

Nigerian external reverses haves depleted 3.03 per cent in the last one month to $35.16 billion on April 1, as the rumble between Saudi Arabia and Russia over oil output cut and the coronavirus pandemic have caused prices to crash from $66.25 at the beginning of the year.

The CBN injected $12 billion into the Nigerian forex market in 2019 as it aggressively defended the local currency, empowered with its foreign reserves which reached over $45 billion in May.

Johnson Chukwu, Managing Director, explained to Business Hallmark that the current pressure is not peculiar to the naira, saying foreign investors are pulling out of most emerging markets, which has taken a significant toll on the currencies.

South Africa, which is African second-largest economy, has seen its rand dip 24.4 per cent this year and Angolan Kwanza has weakened 10.8 per cent during this period.

Meanwhile, Moody’s recently warned that the depreciation of the naira would mount more strain on assets of commercial lenders which are struggling to raise them to the CBN benchmark.

Banks with dollar-denominated loans without appropriate receivables will be paying more in naira terms because of the devaluation of the local currency.

Akinbi argued that it is not only the Nigerian economy that is hurt by the weakening of the naira, saying banks which failed to hedge the dollar-denominated facilities would be currently biting their fingers.

“I think the banks are better positioned because we just experienced something similar to this not long ago. People have become savvier concerning hedging themselves against losses from foreign exchange volatility,” Akinbi maintained.

Union Bank raised $250 million Eurobond in 2018, but Zenith Bank was fortunate to have in September 2019 repaid its $500 million Eurobond before maturity, which was supposed to be due in 2022; it would have been caught in the devaluation web.

Access Bank, First Bank of Nigeria Limited and Ecobank Nigeria also redeemed as much as $1.1 billion worth of outstanding Eurobond notes issued in 2014 before maturity last year.

However, the Nigerian banking industry, before the current headwinds, has succeeded in cutting down its toxic assets as non-performing loans as a percentage of total credit has fallen to 9.3 per cent as at mid-2019 from 12.5 per cent a year earlier, while the CBN’s threshold is 5 per cent.

Nevertheless, it is not only the country’s forex market that has been hit by the COVID-19 pandemic and the oil price crash, but the Nigerian equity market has also shed over 21.3 per cent this year.

Total transaction in the local bourse declined 36.93 per cent from N235.46 billion in January to N148.50 billion at the end of February.

A breakdown of data from the Nigerian Stock Exchange showed that total domestic transactions dipped 53.27 per cent from N165.14 billion in January to N77.16 billion in February 2020, while total foreign transactions increased marginally by 1.46 per cent from N70.31 billion in the previous month to N71.34 billion in February.