Business

Rising inflation hobbles GDP growth, economic recovery

BY EMEKA EJERE

The road to the much desired recovery of the nation’s struggling economy is getting rougher by the day, with recent developments suggesting that early reforms of the Federal Government are aggravating supply-side pressure to undermine efforts to tame inflation.

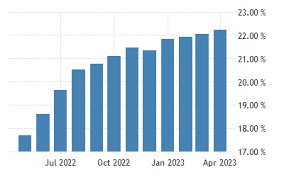

Business Hallmark reports that inflation rose to 25.80 percent in August 2023, 1.72 percent points higher than the 24.08 percent recorded in the previous month.

This is in total defiance of successive hikes of the benchmark interest rate by the Central Bank of Nigeria (CBN) to save the economy from the devastating effects of untamed inflation. The apex bank had raised rates from 11.5 percent to 18.75 percent, resulting in about 700 basis point increase.

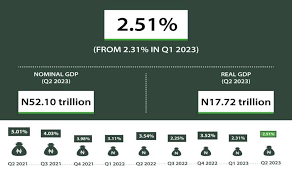

Data from the National Bureau of Statistics (NBS), showed that Nigeria’s Gross Domestic Product (GDP) growth rate slowed to 2.51 percent year-on-year in the second quarter of this year (Q2 2023) compared to 3.54 percent recorded in Q2 2022. This, however, represented an increase of 0.20 percent compared to 2.31 percent recorded in the first quarter of 2023.

GDP Q2

The Second Quarter GDP Report revealed that the major driver of the economy remained the services sector, which recorded a growth of 4.42 percent and contributed 58.42 percent to the aggregate GDP.

KPMG Nigeria took a conservative view of Nigeria’s economic growth rate for this year in relation to its earlier estimate after the country’s statistics office reported a year-on-year deceleration in the GDP growth rate for the three months through June.

The pace of growth for 2023 is now seen at 2.7 per cent in contrast to an initial forecast of 2.9 per cent, the consultancy said in a commentary. KPMG revised the original projection downwards after estimating Africa’s biggest oil economy needs to expand by 3.3 percent at the very least for the second half of the year to keep alive the dream of 2.9 percent growth for 2023.

“Q2 2023 is the quarter, where the impact of subsidy removal, FX unification and other reforms of the new administration had its major impact on squeezing household consumption demand and firms’ costs of operations as well as reduced private investment,” it said.

Manufacturers’ concerns

The Manufacturers Association of Nigeria (MAN), lamented the slow recovery from the impact of the naira crunch, which caused about 30 percent decrease in sales amidst other challenges. This is even as the association noted that all the major performance indicators in the sector declined in the second quarter of 2023 (Q2’23).

This was contained in the Q2’23 MAN CEOs Confidence Index (MCCI) survey by the association. The MCCI survey, which is conducted quarterly by MAN, shows the perceptions of manufacturers on developments in the macroeconomic environment.

The survey deplored the slow recovery from the cash crunch, high cost of energy, unavailability of forex, high transportation cost and the abrupt removal of subsidy towards the end of the second quarter of 2023.

In the course of the survey, manufacturers identified and ranked the current challenges of the manufacturing sector in order of severity of impact. Based on the ranking, high cost of energy was top on the list of major manufacturing challenges. This was followed by high cost of credit/inadequacy of loanable funds, multiple taxes/charges/levies/same tax policy for local producers and importers, unavailability of raw materials/delay in receiving imported raw materials/high cost of raw materials and scarcity of forex/high exchange rate/poor allocation of forex.

Inflation

Commenting on the development, Director General, MAN, Segun Ajayi-Kadir said: “Government capital expenditure should address the issues of economic infrastructure of roads, electricity, water among others that support industrial sector businesses.

“The absence of economic infrastructure contributes significantly to high cost of operating environment, which obstructs the development of manufacturing in Nigeria.

“ Sequel to the above trends, it is highly expedient that the government strives to ensure the harmonization of fiscal and monetary policies that will pave the way for a stable macroeconomic environment needed to promote productivity in the manufacturing sector and improve the ease of doing business.”

The catalyst

The Chief Executive Officer of the Centre for the Promotion of Private Enterprise (CPPE), Dr. Muda Yusuf, said the micro small and medium enterprise (MSMEs) sector holds the key to Nigeria’s economic prosperity if there is the right operating environment.

Yusuf, who spoke at the 2023 business roundtable with the theme ‘MSMEs: The Catalyst for Nigeria’s Economic Rejuvenation and Growth’, organised by the National Association of Small and Medium Enterprises (NASME) on Friday in Lagos, said MSMEs can generate over 20 million jobs, noting that the sector has been struggling because it does not receive the right attention from the authorities.

According to him, the mortality rate among MSMEs in Nigeria is high because of the numerous headwinds in the Nigerian business environment.

“These challenges include the structural constraints, especially around infrastructure, the naira exchange rate depreciation and related liquidity crises in the foreign exchange market, galloping inflation, weak purchasing power, regulatory compliance costs, high transaction costs at the ports, the multiplicity of taxes and levies, high cost of logistics, insecurity effects on the agricultural sector, the influx of cheap Asian products into the Nigerian markets and the cost of fund,” he said.

On the way forward Yusuf said: “The systemic issues of infrastructure should be addressed as a matter of utmost priority. The immediate focus should be on electricity supply and logistics. Unless we have these two critical infrastructures in place, it will be very difficult to ensure a competitive industrial sector and to make possible the transformation of the sector.

“We should fix the foreign exchange liquidity and currency depreciation issues. MSMEs with annual turnover of N50 million and below should be exempted from corporate tax and value-added tax (VAT). This is in addition to tackling the problem of multiple taxes and levies on small businesses both by state and non-state actors.”

A couple of days ago, U.S Deputy Secretary of Treasury, Wally Adeyemo, stated that there is no quick and easy solution to Nigeria’s economic challenges. Adeyemo, who stated this at a forum with business leaders at the Lagos Business School, observed that the country lacks a macroeconomic framework to attract more dollar-denominated foreign direct investments into its economy.

He said, “There is no quick easy solution to those challenges, I want to be honest about that. That is what true partners are. But ultimately, we know that by helping to make investments in Nigeria economy in your businesses, especially, SMEs, we can help build a type of ecosystem that can help Nigeria be successful over time.”

Forex crisis

Nigerians’ stampede for dollars showed no sign of abating on Friday, with the naira falling to another record low even after the CBN announced the coming on board of the newly nominated Governor Olayemi Cardoso in an acting capacity.

The local currency fell to an all-time low of N995 per dollar, losing 0.51 percent of its value compared to N990/$1 on Thursday at the parallel market, otherwise known as black market. With the current exchange rate, naira has year-to-date weakened by 34.82 percent from N738 per dollar at the beginning of the year.

At the Investors’ and Exporters’ (I&E) forex window, Nigeria’s official foreign exchange market, naira depreciated by 1.32 percent as one dollar was quoted at N747.76 on Friday as against N738.00/$1 quoted on Thursday.

The continued naira depreciation has been attributed to strong demand for the greenback. According to Stears Africa FX Monitor, a data and intelligence company, fiscal policies, external trade, and global market trends, including inflation rates, interest rates, policy events, and geopolitical factors are also key influencers affecting the performance of the currency.