Cover Story

How PZ makes investors beg for more but….

Full year results for PZ-Cussons ended on a happy note in May as the company’s profit after tax soared by a hefty 73 per cent rising from N2.1 billion in 2016 to N3.7billion in 2017. The company’s fairy tale result has had several investors emptying their piggy banks as the company’s share price jumps on the emotional high of analysts and traders. From a low of slightly under N15 per share in May the company’s stock price rose to N23 or a rise of 53 per cent in July before climbing a couple of notches by August to N26 per share. Gratefully investors are lapping up a year–to-date growth of 79.24 per cent as against a year-on-year return of 43.21 per cent; but with a price earnings multiple of 31 current investors in the stock seem to be fiercely (and some might say recklessly) aggressive.

Full year results for PZ-Cussons ended on a happy note in May as the company’s profit after tax soared by a hefty 73 per cent rising from N2.1 billion in 2016 to N3.7billion in 2017. The company’s fairy tale result has had several investors emptying their piggy banks as the company’s share price jumps on the emotional high of analysts and traders. From a low of slightly under N15 per share in May the company’s stock price rose to N23 or a rise of 53 per cent in July before climbing a couple of notches by August to N26 per share. Gratefully investors are lapping up a year–to-date growth of 79.24 per cent as against a year-on-year return of 43.21 per cent; but with a price earnings multiple of 31 current investors in the stock seem to be fiercely (and some might say recklessly) aggressive.

PZ’s one year return easily trumps treasury yields of between 14 and 16 per cent. So are investors in PZ-Cussons likely to ride a gravy train? That depends on a number of factors that still need to be worked out. Although the company’s profit after tax rose by a whopping 73 per cent between 2016 and 2017, actual sales figure growth was significantly modest rising by a stodgy 14.5 per cent.

When profit speaks up

PZ’s 2017 profit margin on sales rose from 3.1 per cent in 2016 to 4.2 per cent in 2017, a 35.6 per cent leap. Despite this rise, however, PZ’s profit margins are wafer thin. Growing operating costs have gobbled up most of the company’s Spartan rise in revenues. However there are indications that the company has tried to rein in direct production costs as its cost of goods sold (COGS) as a proportion of sales fell from 91.2 per cent in 2016 to 83.4 per cent in 2017, an approximate 8.5 per cent slide in the direct production costs. Operating margins, nevertheless, glided up from 8.8 per cent in 2016 to 16.1 per cent in 2017 underscoring the fact that the company has worked aggressively in getting costs under control (and perhaps also gained from more stable foreign exchange rates). As true as this is, however, the household appliances manufacturer still has ways to go before establishing comfortable breakeven margins. Fixed costs continue to dog operations as power, logistics and salary expenses challenge the company’s bottom line.

The company which is a composite manufacturer of a variety of products ranging from soaps (Imperial leather, Carex, Cussons baby, Joy) to Robb, and Venus range of beauty products at the personnel care end of the business, has challenges with its product complexity as it straddles personal consumer goods market, electrical appliances and food. The company manufactures home care brands such as Zip and Morning Fresh liquid soap. In the area of electrical appliances it retails the Haier Thermocool and TEC brands of appliances such as air conditioners and refrigerators. It’s last manufacturing and sales category is Foods, the company sells the Yo, Mamador, Nunu, Devon’s Kings and Olympic milk brands.

The high import component of its activities took a swipe at gross revenues last year as the naira went into a dive slumping from N160/$ in 2014 to N360/$ for the better part of 2017. The falling value of the naira and the limited access to foreign exchange was a major problem for PZ for most of 2016. The Central Bank of Nigeria’s introduction of an autonomous foreign exchange market and its more frequent and sizeable funding of forex trade has helped to reduce the cost of inputs and improved operational results, but the outlook is still tenuous.

Getting operations right

At the level of operations PZ numbers look good but could be better. Working capital shrunk from N21 billion in 2016 to N18 billion in 2017, a slide of 14 per cent. This is also reflected in a drop in the personal consumer goods company’s current ratio (a measure of liquidity) which fell from 1.8 in 2016 to 1.4 in 2017. If analysts adjust for the stocks of materials kept in the companies warehouses between 2016 and 2017 (sometimes called a company’s ‘quick’ ratio) matters get even worse as PZ’s quick ratio fell from 1.1 in 2016 to 0.7 in 2017 meaning that the company’s liquid assets can barely cover short term liabilities when stocks of unfinished goods and raw materials are considered as unimportant.

PZ also has increasing difficulty in turning assets into sales, an indication of this is that the company’s asset turnover ratio fell from 0.93 in 2016 to 0.88 in 2017, meaning a naira of assets generate a sale of 93 kobo in 2016 but earned 88 kobo in 2017. The fall in asset turnover speaks to a major rise in the company’s stock of finished and unfinished goods, inventories rose from N19.3 billion in 2016 to N28.7 billion in 2017, a rise of 49 per cent or almost an additional half of the previous year’s stock. This could mean that the company has been finding it harder to sell its goods and has, unfortunately, been stuck with slowly moving products despite the banner sales growth of just under 15 per cent.

The liquidity challenge is mirrored in a fall in available cash as the company’s cash holdings fell from N12.9 billion at the end of the 2016 financial year to N8.02 billion by financial year end 2017. The 38 per cent drop in cash means the company had a difficult time meeting short term payment obligations in the course of the one year production cycle. Analysts are of the view that this would also have meant that the credit days available to the company may also have shrunk. Rotimi Ogunwale, senior vice president of Imperial Finance and Trust observes that,’ when it rains it tends to pour, when companies find themselves in cash tight situations they also lean to creditors as a hedge by getting extensions on credit days made available’.

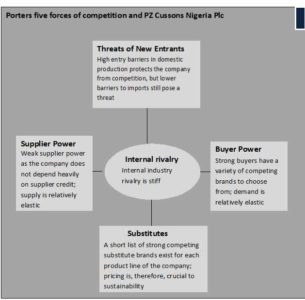

Ogunwale’s observation may be correct in respect of PZ; the company’s figures show that the manufacturer actually got its trade credit stretched by 157 per cent from N5.4 billion in 2016 to N2.1 billion in the contemporary period of 2017. But this is a bit of a sleight of the hand. A slight rearrangement of the appliance makers balance sheet shows that while credit days on hand in 2016 was 30days (or about a month) in 2017 it actually rose to 50 days or one and two-third months. The longer recent credit days that the company enjoyed reflected a higher dependency on supplier financing. This has a good and bad side to it; on the bad side the company gets slightly higher cost of financing but on the good side the suppliers allow the company to defer cash outflow. Supplier power is likely to be low for PZ giving the company ability to manoeuvre pass its rivals, although increasing credit days given by its suppliers could weaken its price advantage over time.

What about PZ’s debts?

The company has avoided a debt trap that would have been so easy to fall into during a recession; the company has no significant long term liabilities on its balance sheet thereby freeing it from severe consequences of a potential rise in interest rates if inflation worsens from its current 16.05 per cent. The real bother is that the company’s tax liability rose from hefty N1.23 billion in 2016 to a thundering N2.42 billion in 2017, a staggering 97 per cent leap.

The smell of luxury soap and the freshness of a clean bath is something to relish but PZ’s financials for 2017 as pretty as they look at first blush still have ways to go before putting sparkly smiles on the faces of investors.