Business

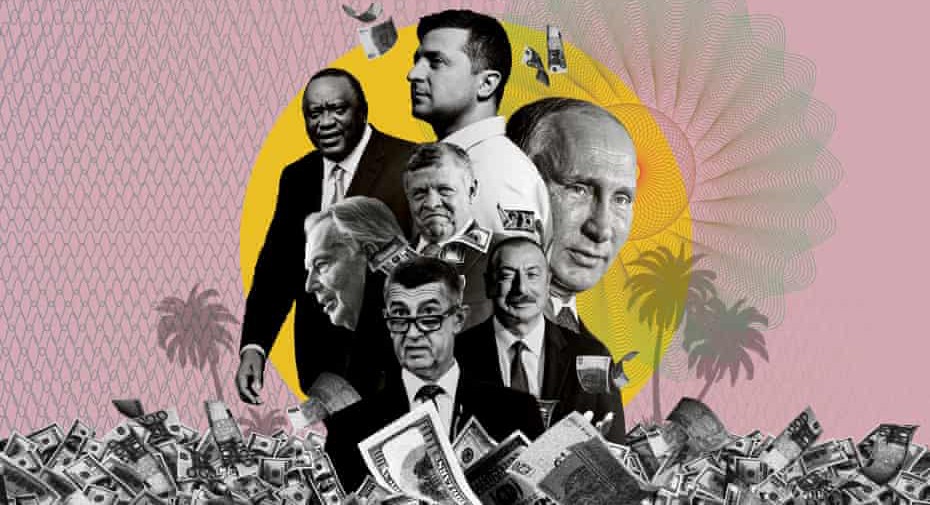

Pandora Papers: When hidden wealth is exposed

BY EMEKA EJERE

Nigerians are anxiously waiting for the next line of action by relevant government agencies over alleged tax evasion by some Nigerian past and current public officials named in the recently leaked Pandora Papers.

This is even as chairman of the Code of Conduct Bureau (CCB), Mr. Mohammed Isah, has assured that unlike former Senate President, Bukola Saraki, who stood trial at the CCT over allegations of false declarations but was acquitted based on “technical grounds,” public individuals in Nigeria who are found to be involved in the Pandora Papers’ exposè would have no escape route around the law.

The International Consortium of Investigative Journalists and the Organized Crime and Corruption Reporting Project had released details on October 3 of a sprawling investigation into offshore banking and tax evasion schemes, exposing about 11.9 million documents from 14 offshore service providers that help high-end clients establish companies in notorious tax havens.

Known as the Pandora Papers, it turned out to be the biggest ever exposé on the financial dealings of the super-wealthy. The confidential documents contained in the papers showed high-level officials, oligarchs, and billionaires using shell companies to move wealth offshore, anonymously buy real estate or luxury goods, and avoid paying huge sums of tax revenue.

Tax havens, also known as offshore financial centres, are countries with low or no corporate taxes that allow non-residents to set up businesses there easily. They can even exist within a country, like Delaware in the USA and the Isle of Man near the UK.

Tax havens typically limit public disclosure about companies and their owners. They are also called secrecy jurisdictions as the information can be hard to extract. They earn vast amounts of money by charging fees for their services. They also create work for lawyers, accountants, and secretaries.

Mauritius, a well-known tax haven, has said 5,000 people would lose jobs if the country stopped offering offshore banking services, findings have revealed.

The leaks provoked widespread anger for reasons not far-fetched. Tax revenues help keep countries afloat and support vital services in society, such as education and health, especially during large-scale economic downturns like those that have resulted from the COVID-19 pandemic.

The Pandora Papers revealed not everyone is paying their fair share, suggesting the less affluent are being forced to cover the difference. The revelations are particularly galling for people in nations where taxes are being raised to pay for essential services and due to the economic fallout of COVID-19 lockdowns.

Some have argued that tax evasion exacerbates two of today’s most pressing issues, climate change and rising inequality. Sven Giegold, a Green party lawmaker in the European Parliament, says, “Global tax evasion fuels global inequality. It also prevents states from providing the services and infrastructure that would allow every person a similar opportunity to succeed.”

The consensus position of the discerning public is that, like the Panama and Paradise Papers of 2016 and 2017 respectively, the latest leaks reinforce the need for countries to strengthen collaboration in curbing illicit financial outflows and solidifying systems for tackling tax evasion.

The Pandora Papers list a total of 35 current and former national leaders and at least 400 other public officials and 100 billionaires from about 100 countries. Some notable names on the list include former British Prime Minister, Tony Blair; President Sebastian Pinera of Chile; his Kenyan counterpart, President Uhuru Kenyatta; United Arab Emirates’ Prime Minister and Dubai ruler, Mohammed bin Rashid al-Maktoum, and Gabonese President, Ali Bongo.

Past and current Nigerian officials exposed by PREMIUM TIMES in the Pandora Papers series include former Anambra State Governor and former Vice Presidential candidate of the opposition Peoples Democratic Party (PDP), Peter Obi; acting Managing Director of the Nigerian Ports Authority (NPA), Mohammed Bello-Koko; and former Minister of Aviation and serving senator, Stella Oduah.

Others are Governor Abubakar Bagudu of Kebbi State, Governor Gboyega Oyetola of Osun State as well as his associates including former Lagos State Governor, Bola Tinubu, and Ogun State Governor Dapo Abiodun.

What next?

The important question on the lips of many Nigerians is what happens next about the people involved in this tax avoidance scheme. This is not the first major tax avoidance scandal as the Panama Papers scandal had made similar revelations five years ago.

Business Hallmark’s investigations revealed that, in response to the Panama Papers scandals, lawmakers in the U.S. have so far introduced legislation that requires trust companies, lawyers, art dealers, and others to investigate foreign clients seeking to move money and assets. The proposed law, known as the Enablers Act, represents the most significant reform of anti-money laundering rules since 9/11.

It was also discovered that politicians in Chile went even further, voting to impeach President Sebastian Pinera, setting up a trial in the nation’s senate over allegations that he favored the sale of a family property while in office.

In Nigeria, the Economic and Financial Crimes Commission (EFCC), was late last month said to have asked Obi to report at the agency’s Abuja headquarters on October 27 for questioning following revelations that he incorporated offshore holdings, which he did not declare to the CCB when he served as a governor, apart from allegedly operating foreign accounts and hiding his wealth in tax havens to evade taxes.

But no sooner that the report circulated than his media aide Valentine Obienyem stated that Obi was yet to receive the letter from the EFCC, which he read on social media like others.

“From what is circulating, the letter appears to have been sent to an office he is no longer part of and is yet to reach him. However, Obi being a law abiding Nigerian will honour all legitimate invitations from government agencies at all times,” Obienyem said.

Efforts to get the EFCC spokesman, Wilson Uwujaren, to give update on purportedly ongoing probe yielded no results as he could not take his phone call nor respond to text messages sent to his phone as at the time of filing this report

While speaking on the CCB’s efforts at investigating those indicted in the Pandora Papers revelations, Mohammed Isah, the chairman of CCB, told journalists at a recent media briefing in Abuja that the bureau was collaborating with members of the civil society organisations (CSOs) who participated in the revelation.

“The CCB has already initiated investigation on both public officers in Nigeria that appeared in the Pandora Papers’ leaks,” Mr Isah revealed, adding, “There are other public officers whom we are looking for more details about their roles in the Pandora Papers’ investigation.”

However, former second Vice-President of Nigeria Bar Association (NBA), Mr. Monday Ubani, told Business Hallmark that he does not expect anything to come out of the matter since those involved are mostly present and past government officials who are not ready to probe themselves.

“Nothing will come out of it. Those present and past government officials mentioned there, do you think they are going to probe themselves? Ubani queried.

‘‘So, I will be surprised if anything comes out of it,” he added.

Also speaking with Business Hallmark, former President of Chattered Institute of Bankers of Nigeria (CIBN), Mazi Okechukwu Unaegbu, observed that since most of the people involved are politicians, nobody is going to believe them when they’re talking. He called for thorough scrutiny of their tax records.

Unaegbu, an ex-bank chief, who is also a lawyer, said “Most of the people involved are politicians and nobody will believe them when they’re talking.

“Although there is no probe yet, what the relevant agencies should do is to look at their tax situations because the major allegation there is tax evasion, which is a very serious issue.

“It should be ascertained if they paid taxes out of those monies before taking them offshore. If they did, then they will be free. But if they didn’t, they should go for it.”

In its editorial of October 12, 2021, The PUNCH noted that to curb corruption, asset declaration should be subject to public scrutiny to boost transparency. Concealing details of declared assets, the paper said, undermines the spirit of the code.

“Given the CCB’s limited capacity, how could the veracity of the trillions in declared assets be determined when such details can never be assessed by the public”, it queried.

“That the Buhari regime, which claims to be fighting corruption, sees nothing wrong in this defective status quo and has even failed to send a bill to the parliament to address this anomaly explains why the whistle-blower policy is failing.”

Incidentally, in what looked like lending credence to The PUNCH’s submissions, the CCB chairman recently in Abuja identified inadequate manpower and poor funding as major hindrances to the operations of the bureau.

“Our staff are poorly paid, we have less than 800 personnel across the country for 10 million public officers whom we are investigating their assets,” Mr. Isah lamented, warning of the “danger ahead if new persons are not recruited to replace the deceased and retired.”

On budgetary allocations, he said some persons were out to “strangulate” the bureau by starving it of funding. We get N36 million as overhead per release, and this year, we have received nine releases of N297 million.”

“Of all its mandates, verification is one of the most, if not the most tedious exercise. It is capital intensive. Despite the above, and the fact that the bureau is poorly funded considering our budgetary allocation, we are determined to go ahead with the process to ensure the success of the fight against corruption,” he assured.