Headlines

Nigerian banks’ assets rise by 43.6% to N35.1trn in 5yrs

FELIX OLOYEDE

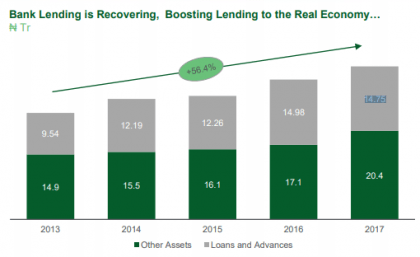

Increased reserves, aggregated credit and loans and advances have pushed total assets of commercial banks in Nigeria up by 43.6 per cent. from ₦24.5 trillion in 2013 to ₦35.1 trillion in 2017, Mr. Godwin Emefiele, Governor of the Central Bank of Nigeria (CBN) has disclosed.

Speaking at Federal Government Investors presentation in New York at the end of September, he noted that the 27 banks operating in Nigeria, which has remained fairly stable since a 2004 wave of consolidation reduced the number from 89 but were recently reduced to 25.

It would be recalled that the CBN on 21 September 2018, the apex bank revoked the operating license of Skye Bank, due to its failure to meet prudential benchmarks, especially for being perpetually being illiquid.

It would be recalled that the CBN on 21 September 2018, the apex bank revoked the operating license of Skye Bank, due to its failure to meet prudential benchmarks, especially for being perpetually being illiquid.

“Several measures have been undertaken to contain risks to financial stability and strengthen banking sector resilience, including increased provisioning, strict limits on net FX positions, and prohibition of dividend payments by banks with low Capital Adequacy Ratio,” Emefiele explained.

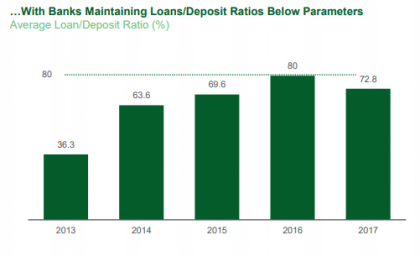

More so, Nigerian banks loans and advances rose 55 per cent from N9.54 trillion in 2013 to N14.75 trillion in 2017, while loans-deposits ratio also jumped from 36.3 per cent in 2013 to 72.8 per cent in 2017.

More so, Nigerian banks loans and advances rose 55 per cent from N9.54 trillion in 2013 to N14.75 trillion in 2017, while loans-deposits ratio also jumped from 36.3 per cent in 2013 to 72.8 per cent in 2017.

He further stated that the CBN deployed the Credit Assessment Analysis System, intensified the monitoring of the implementation of Basel II/III standards and continued to subject domestic systemically-important banks to enhanced regulation to strengthen its supervisory and surveillance activities.

The CBN governor added that the apex bank has also been taking steps to integrate global best practices in financial reporting and disclosure with the implementation of IFRS 9.

“The Bank undertook an impact assessment of banks’ total provisions and capital showed that capital adequacy was moderated by the huge regulatory risk reserve balances of the banks,” Emefiele asserted.

He also revealed that that the country’s foreign exchange reserves increased by 35.4 per cent in the last one year to US$44.9 billion as of 20 Sept 2018.