Business

Tax laws: Tinubu insists January 2026 rollout despite Reps’ revolt, students’ protest threat

President Bola Tinubu has doubled down on plans to roll out Nigeria’s new tax laws from January 1, 2026, dismissing growing calls from lawmakers, students and civil groups for a suspension amid allegations of unlawful alterations to the Acts and an ongoing court challenge in Abuja.

In a State House statement on Tuesday, the President said the reforms would proceed as scheduled, describing them as a historic opportunity to rebuild the country’s fiscal architecture and strengthen the social contract.

Tinubu said the tax laws, some of which took effect on June 26, 2025, were not intended to raise taxes but to drive harmonisation, fairness and efficiency in the system. He acknowledged the controversy generated by claims that certain provisions were altered after passage by the National Assembly, but insisted that no issue serious enough had been established to justify disrupting the reform process. According to him, trust in governance is earned through consistency and sound decision-making, not through what he described as hasty, reactive actions.

The President’s insistence comes as resistance to the reforms widens within the legislature. The Minority Caucus of the House of Representatives has demanded an immediate halt to implementation, warning that enforcing laws under investigation could amount to a constitutional violation. The caucus said the National Assembly remains the lawful custodian of all Acts and cautioned Nigerians against recognising any tax laws not duly authenticated by the Clerk of the National Assembly and the President.

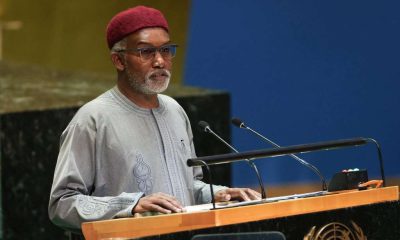

The controversy erupted after Abdussamad Dasuki, a Peoples Democratic Party lawmaker from Sokoto State, told the House that the versions of the tax laws circulated by the executive differed from those approved by lawmakers. His claims prompted the House to constitute a seven-member ad hoc committee, chaired by Borno lawmaker Muktar Betara, to probe the alleged discrepancies and report back.

Public opposition has also intensified. The National Association of Nigerian Students (NANS) has threatened nationwide protests if the Federal Government proceeds with implementation from January 2026. In a statement, the students’ body said it was unacceptable to enforce a law whose authenticity was under scrutiny, while also faulting the Federal Inland Revenue Service for what it described as inadequate public enlightenment.

Prominent opposition figures, including former Vice President Atiku Abubakar and former Anambra State governor Peter Obi, have similarly questioned the process and called for a review of the laws to prevent a constitutional crisis.

Despite the pushback, the executive arm has remained defiant. The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, said after a recent meeting with Tinubu that the Nigeria Tax Act and the Nigeria Tax Administration Act would still take effect on January 1, 2026.

Meanwhile, the battle has shifted to the courts. The Federal Capital Territory High Court, Abuja, on Monday ordered accelerated hearing in a suit seeking to stop the implementation of the 2025 Tax Acts but refused to grant an interim injunction. The court fixed Wednesday, December 31, for hearing of the motion on notice.

In his statement, Tinubu assured Nigerians that the Federal Government would continue to act in the overriding public interest, pledging to work with the National Assembly to resolve any issues while maintaining the integrity of the tax reform process, even as political and legal pressure continues to mount.