Business

Nigerian equity sustains rebound, appreciates 0.2% this week

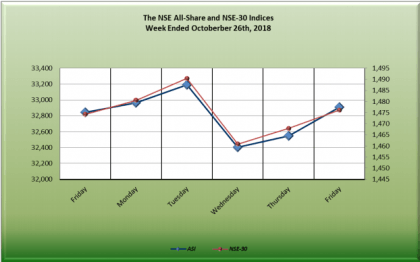

The release of third quarter financial statements by companies had a positive run on the Nigerian Stock Exchange (NSE) this week, which ended 0.2 per cent better than the previous week.

The release of third quarter financial statements by companies had a positive run on the Nigerian Stock Exchange (NSE) this week, which ended 0.2 per cent better than the previous week.

The All-Share Index (ASI) and Market Capitalization gained 0.2 per cent to close the week at 32,907.33 and N12.014 trillion respectively, on the back of impressive performance by the financial service sector of the market.

Banks have posted better-than-expected financial results in Q3 2018, which has made it an investor’s toast.

Equity Market closed higher on Friday gaining 1.11 per cent, sustaining the previous day’s positive sentiment.

Equity Market closed higher on Friday gaining 1.11 per cent, sustaining the previous day’s positive sentiment.

Diamond Bank appreciated 20 per cent to top 25 other gainers this week, while Mcnichols dropped a whooping 30.51 per cent to emerge the higher decliner among 42 losers.

First City Monument Bank Plc, Access Bank Plc and Sterling Bank Plc were the most active stocks for the week in terms of volume, accounting for 695.396 million shares worth N2.000 billion in 3,494 deals, contributing 47.83 per cent and 13.10 per cent to the total equity turnover volume and value respectively.

Investors traded on 1.454 billion shares worth N15.263billion in 16,682 deals were traded this week, compared to a total of 1.380 billion shares valued at N15.149 billion that exchanged hands last week in 14,033 deals.

The Financial Services Industry led the activity chart with 1.220 billion shares valued at N9.480 billion traded in 10,520 deals; thus contributing 83.94 per cent and 62.11 per cent to the total equity turnover volume and value respectively.