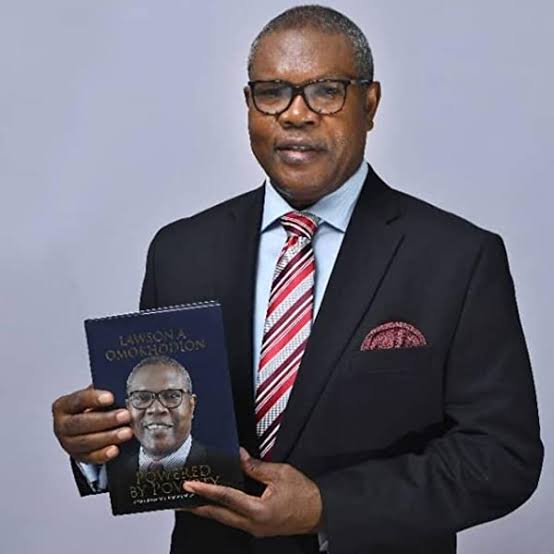

Headline

Today, Nigeria has become a crime scene – Lawson Omokhodion

Managing Director of defunct Liberty Bank Plc and former Pro-Chancellor/Chairman of Governing Council of Ambrose Ali University, Ekpoma, Chief Lawson Omokhodion, in this exclusive interview with Business Hallmark team expresses nostalgia about the Nigeria of his childhood, but regretted that years of corruption and impunity have brought the country to its knees. He, however, proffered solutions.

Excerpt;

Q. We like to start by asking how have you been coping with the life of retirement…,since you left the banking job very early as a young man, what have you been doing till now?

Thank you very much, I’m glad you’re here and sorry we delayed a little. Yes I retired very early from banking. It is the calamity of that kind of profession where in our days there were no compulsory contributory pension funds. Some unpopular variants existed at the time, and in the absence of pension contributions there was nothing to fall back on. But I was lucky. As I left being the Managing Director of Liberty Bank, I was engaged as Executive Director- Group Sales at Conoil Plc. I was in Conoil for less than a year but it taught me a skill and it was that skill that guided me into profitable entrepreneurship when I left the company.

I set up a small-scale downstream company called Ritsoil Petroleum & Gas Ltd, which specialised in procurement, sale and distribution of AGO. It’s been very engaging. It has kept me very busy. From 2006 when it was set up till a few years ago, it kept me really busy. But this government has visited woes on businesses and the times are very bad now.

The escalating price of the commodity, the downward trend of economic activities – everything has closed down, the poor economy, the poor Federal Government decision making, insecurity and the rest have slowed down everything. But at 70, I should go back home, play tennis and just sleep.

That’s what I’m preparing to do now – to return home, stay more with my wife and children, and those who’re around because most of them have left anyway. So it’s me and my girlfriend now in the house. That’s what I’ve been doing. And I’ve also been engaged in a lot of public-spirited activities – church, Edo State Government activities…

We’ve recently set up a foundation and I’m still trying to streamline it and make it a robust engagement. In a few months’ time, it will be ready to run. We call it Lawson and Funmi Omokhodion Foundation for Poverty Alleviation. And it’s something I will like to dedicate the rest of my life to making it work, driving people from their slumber to the limelight of life, to let them know that it’s not over until it is over.

In Reality – What Does COP26 Mean for Small Businesses?

Q. You mentioned a few things in your opening remark about economy and the rest. Just last week, the CBN rolled out some policies like interest rate hike and even CRR in a quite unusual manner. What, in your view, will be the immediate impact of these on businesses and life generally?

The impact will be mixed. There’s no life anymore. Businesses are dead. So they’re fighting an imaginary war by raising CRR to 32.5% and so on. So ordinarily, if you had economic activities, you will see an immediate reaction. Most people who’re borrowing are either dead in debt or they’ve managed to pay off. And once you pay off, your staff are at the mercy of the economic environment. Once you pay off, you’re not doing much business anymore.

Most businesses have lost close to 90 percent of their turnover. The small and medium enterprises are in dead waters, even the big companies are struggling to survive. It is strange when big companies buy AGO to fire their generators and cannot pay 4 months after purchase

So, whatever they do, that is just a monetary policy response to an environment that needs massive fiscal intervention- it may not work. So, once there’s no balance, as it is right now, there’s nothing anybody can do, except you create that balance that gives room to sensible fiscal intervention, as well as sensible monetary intervention. Exchange rate as at September was about N735/$. So what are you going to do? And it doesn’t make sense, but it’s being propelled by insecurity; it is being propelled by corruption; it is being propelled by theft of crude oil, it’s being propelled by lack of agricultural production; it’s being propelled by poor export drive; it’s being propelled by rudderless government. A rudderless federal government is propelling these debilitating circumstances.

Yes, the exchange rate is a debilitating circumstance. And for your exchange rate to move in the parallel market from N196/$ in 2015 to N735/$ in 2022, it means that your currency has been so massively devalued. That is nothing but calamity. That’s what it is. We have all been devalued with the currency.

Q. Chinua Achebe died a frustrated man because he kept shouting, singing and nothing changed. People of his age are dying frustrated. Do you envisage that for Nigerians of today?

Dying frustrated?

Yes and No…

I think something has happened. The October, 2020 EndSARS movement that brought the youths of Nigeria to the forefront of the struggle may help us. And I believe that’s what is driving one of the presidential candidates. It is that force that is propelling him. And that is Peter Obi and Ahmed Datti. That’s the force that is propelling them. Otherwise, all hopes would today have been lost, because, Nigeria is a captured state. A few greedy people have captured the Nigerian state. And they’ve deepened the corruption and greed, the avarice that has now become characteristic of their lives. And it is so everywhere – from federal, states to local government.

Have you ever heard of a local government constructing a road or drainage? There’re no cottage industries, nothing. As for states, they don’t even care anymore. Federal Government, as they release the money, it disappears. As they release funds, it disappears into private pockets and people share it. I do not know whether the Federal Government or, in fact, whether the President himself knows what’s happening. I still do not think the President has a love for money. But I believe the people around him are the ones creating this economic crisis by being self- serving. And they’re creating crisis because nobody is monitoring.There’s no supervision.

Nobody is asking questions; the President doesn’t even ask them questions. And so he’s complicit as it were. So that’s where we’ve found ourselves. We may just be lucky that we may not die of frustration as those in the era of Chinua Achebe. We might just be lucky. And the next election in 2023, if it does not give us the window, it may prepare the window for better relief come 2027. I see something happening.

Q. May I take you back a bit. What was the Nigerian dream like when you were growing up?

The Nigerian dream was beautiful. I was a happy Nigerian. I was glad that I was born in Nigeria. The government was transparent. The government was sympathetic. There was justice; there was fairness; there was equity and then there was love. As a young boy, as a student and as a young graduate…even the Federal Government sent me to school in the U.S.

When my colleagues and I were employed as management trainees in the Centre for Management Development, we were on a programme that culminated in a Masters programme in the UK, Canada or the U.S. it was sponsored by the Federal Government.

As a student, my parents didn’t have money for my university education. I was on a federal government student’s loan. That loan gave you N300-N500 per year and it covered everything. For me it was N300 for first year, second year, third year and we left with N900 loan as it were.

And when I became assistant General Manager at the Pan African Bank in 1987, it was then I saw that the Nigerian Student Loans Board had an account in the bank. So I got the address and sent a cheque of N1,200 to them. I’m not even sure it got there because my account was not even debited for that cheque.

So what I did nobody knew but I was grateful to the Nigerian system. You see, in our days Nigerians who returned from the U.S and the U.K taught us in our public primary school. Not private schools.

They taught us in public schools. Public schools then looked better than what private schools are today. We didn’t study in the classrooms with leaking roofs. The chairs were there, tables were there. The teachers were good. You didn’t have to spy; you didn’t have to cheat to do any exam. Then your ability carried you. If you went for a job interview after school – and the jobs were many then- it was your brain. Nobody got a note from a Commissioner or from a Minister or from a Senator or from somebody in the Prime Minister’s office or from the Government House or the Presidency. It was what you could put on the table that would determine whether you would get the job.

But today all that is gone. There is impunity right now.

Then the public sector was ruled by two things: general order and financial instruction. When I was in the Centre of Management Development, you could not misappropriate N1, because if you did, you’re in trouble. They’ll fire you or you go to jail. But today, the Accountant General took how much… about N108 billion; he took a lot of money. And many more take much more than that. The Governors steal, Ministers steal and those in the Presidency steal. So what else is left? Local government chairmen, in fact, they steal with reckless abandon. You give a job of N10 billion to construct a road, advance payment of N8 billion is made with the expectation that the road would be completed swiftly and on time.

The money disappears and the road will not be constructed and nobody does anything. So the Nigeria of today has become nothing but a crime scene. It is a calamity. Unlike the Nigeria of my youth when quality of education was good; health was good.

In 1963, I was taken to the hospital by my mother, and it was the General Hospital, Benin. There, all we needed to do was to stay in queue, get your card and I don’t know whether my mother paid one penny or two pennies, I don’t know. The next thing we saw a doctor. I had aches in my ear. The doctor just sat there, played with me. He asked the nurse to get the sunction pump and pumped fluid into my ears; I don’t know what magic it was and my ears opened. And after that, the next day I ran back to school happy. And there were some people at different levels of the economic spectrum- the old, the young, students and so on – waiting to see the doctor. They got help. And we didn’t pay for any drugs. They gave us what they could give us and we left; I was cured and I was fine. And that was how it was.

But now if you’re sick you’re dead if you don’t have money. But I’m happy that a state like Lagos has.primary health centres in so many areas, to the extent that some people don’t know that this is not common all over Nigeria.

So Nigeria was good, but Nigeria of today, no. If my type grew up in Nigeria of today we would never have gone to school, never.

Q Looking at the numbers, one simply sees that whoever emerges the next president is going to inherit a very bad economy from the present government. If you’re to advise the next president, what will you want him to consider as his early policy steps?

You see, there’s a dialogue that must take place in Nigeria. You see the dialogue that took place before the Structural Adjustment Programme, SAP, came into being in 1986 is still needed. We need a dialogue to review the Structural Adjustment Programme. Without that dialogue we’re not going anywhere. Any person who becomes president in Nigeria by 2023, in those intervening months between the election and the coming into office, should use those months very well. Those are the months when you can hold this dialogue I’m talking about. We need a dialogue that will ask a number of questions.

One, why must we have a floating exchange rate? Two, what do we do about privatisation? Why must we have privatisation? Three, why must we have federal, state and local governments that do nothing? Why must they withdraw from economic production, because that is critical to creating jobs for the youths, not just private sector? Why must we have the withdrawal of subsidies in all its ramifications? Why must we allow our commodity boards to remain abolished as was done in 1987/88, because the effect of that is that the export drive is dead as it were? Why must we have an educational system where children of 14, 15, 16, are going to university? We must return the HSC or A-Level or a variant of it, because it was that HSC that prepared quality candidates into the university and, therefore, it helped in maintaining high standards in the university. So, you now process the quality intake and you get quality output. So, there is a policy dialogue that is critical for us to have. And it is that policy dialogue that will enable the government, if it is serious, to now come out with its own framework for revitalizing Nigeria. Nigeria used to have the periodic National Development Planning Concept- the first, the second, the third, the fourth.

When the fifth development plan was due, Military President Ibrahim Babangida stopped it because the World Bank had told him that there will be no more development planning. As far as the World Bank was concerned, it is a centralised way of managing an economy. They wanted private sector, and the World Bank gave Babangida private sector and everything has been destroyed in Nigeria. So for me, that dialogue is important.

Two, there are certain constitutional provisions that have to change. We should restructure Nigeria. We must have state police. Without state police, you cannot cure the state of insecurity. The insecurity promoted by the day and night marauders have embedded themselves deep in the forest in every state and in every local government. To address local security problems you cannot be going to the Police IG in Abuja to give orders for those local criminals to be routed out. No; it is the local police force controlled from the capital which is responsible to the House of Assembly, answerable to state government and the people that can help us resolve such security problems. And look at the bad roads everywhere. I can’t go to my village in Ekpoma anymore, I can’t.

Apart from the insecurity, you now have a federal government that doesn’t even care. I’ve never seen the road to Ekpoma look as bad as it is today. The Federal Government doesn’t care. It is not just my road; it’s everywhere across the nation. Maybe, the government will simply score itself highly, saying we are doing well because it is building the Second Niger Bridge, we’re doing railway that goes to Maradi and nowhere. We’re doing well, we have people travelling up and down during the day. But if you travel at night you see you can’t go anywhere and many highways even day trips are deadly. There’s crisis everywhere. So, any government coming in must come to solve problems and should never throw up its hands in a state of hopelessness. The government is coming in because there are problems and the tenure of one government is ending constitutionally, and another must follow.

All the candidates contesting for the high office say they can solve the problem, and we agree. The problems can be solved. There are many variables that can just be reordered and the exchange rate will strengthen. There’s no agricultural production; the farmers have been driven away from their farms by fulani bandits and yet we want food. Look at it! you have to import it. When you import everything that you ordinarily should produce, you have to spend money (foreign exchange) to do it.

At independence, Nigeria inherited the Import Substitution Strategy of development. Public enterprises were established by federal, regional and state governments to produce and create jobs in every sector including vehicle assembly plants..

Remember that we had six vehicle assembly plants. We had Anambra Motor Manufacturing Company, ANAMMCO; we had Volkswagen; we had Peugeot, Leyland, etc. But now everything is imported.

How we are going to reverse that is going to be tough but without reversing it, the economy can’t go anywhere. I had mentioned commodity boards earlier. Do you know how much foreign exchange was being earned from cocoa export, rubber, cotton and palm produce? When I was in the Centre for Management Development, we were always in Nigeria Palm Produce Board, Calabar to work with the management and middle level staff on enhancing their production and level of productivity. Exports of these cash crops flowed freely and abundantly into Nigeria. As rubber was being processed in Iyanomo, palm produce was being processed in Calabar, groundnut was being processed in Kano, cocoa was being processed in the Western states. Textile industries were everywhere in Kano, Kaduna; Aba, Onitsha; Asaba and in Lagos (Aswani). These companies and public enterprises created millions of jobs. Why do you think we’re in crisis? All these enterprises, all these companies – both public and private companies are dead. You think you’ll have respite? No. Once the next government is serious, the roadmap is there. When we gained independence, the British left something good for us. They left regional governments and there was competition. Reviving Nigeria is doable. But something has to happen about corruption and impunity.

Q. As a former Pro-Chancellor/Council Chairman of Ambrose Ali University, Ekpoma, what is your position on the recurrent ASUU strike?

My position is very clear. Like I always told my colleagues, both at the council that I headed and my colleagues in the committee of pro-chancellors of state universities, the union called Academic Staff Union of Universities, ASUU, is a very important union. How did I come to this conclusion? I came to the conclusion because I did not go to Ambrose Ali University to make money. I went to Ambrose Ali University to work. If I had not disgraced myself for 67 years of my life by stealing money and be held before the cameras as a thief, why should I go to a university owned by my state, in my city and in my village and start embezzling money?

So, the management principle that I brought into Ambrose Ali University was total inclusiveness…, with ASUU, the JAC (joint action committee), JAC consists of three unions – National Association of Academic Technologists, Senior Staff Association of Nigerian Universities and Non Academic Staff Union. So, everybody was important. My council members were important, the students were important and the management staff of the university was equally important. In fact, in Ambrose Ali University, the first thing that hit me was that students would come to school and finish lectures and had nowhere else to stay between lectures. The university with a population of roughly 35, 000 students had hostel accommodation only for 2,000 students. So, my first determination was that I would create an environment where hostels would be rapidly built to accommodate a minimum of 10,000 students on campus. Then I would set up a students’ centre, where between lectures, students can go and relax. I was able to do that.

But when it came to the time to get funding and encourage developers, that is people to come and build hostels, I got Alhaji Aliko Dangote (may God bless him) to give the university a male and a female hostel. So the next thing was that we were to build with a bank loan, a hostel of 510 rooms. And that would take over 2,000 students because it was four students a room.

But when I saw the financial management of the university, I told the governor to hold on a bit and allow my Council to clean out the poor financial management practices in the university. I wanted the loan to be used efficiently without any diversions. UBA Plc granted us a loan of N600 million. And we would have been able to use it effectively and would have completed that project. We also had a number of others who were interested in the Build, Operate and Transfer, BOT, programe. But, you see, the government was not ready to help the council to clean out the financial malpractices. And when the Vice-Chancellor himself saw that he had an ally in government, he stirred up trouble and government took side with him.

Council kept asking government, we’ve reported to you certain financial malpractices, why don’t you take a decision on it instead of playing politics with council’s decisions? As Pro-Chancellor, I always told my colleagues that poor and indigent students have to be aided. My Council set up a 3-pronged scholarship scheme, for the brilliant students, indigent students and the disabled. But more importantly was the fact that I was actively canvassing the re-establishment of the Nigerian Student Loans Board, which we had in 1974. The board would give loans to students; universities would charge their tuition fees, the students would have money from their loans to pay the fees. With funds in the coffers of the universities, the schools would pay their lecturers and leave government out of the perennial salary crisis with ASUU. And then, for me, the approved autonomy for the universities should be activated.

Even with the autonomy approval, there is still a role for government – federal and states as the original owners, but those who should oversee the day to day supervision of the university should be the Council. To make matters of university governance easy, each university should have an establishment law, and that makes administering a university very easy, because the law tells you the dos and the don’ts. But government will never allow the law to operate without its interference. In fact, government will always take steps to compromise the law.

So, the only solution to ASUU crisis is a federal loan scheme, the type they have in Canada, U.K, USA, Sweden, Norway, South Korea, South Africa etc. We had it in 1974, but things never get better in Nigeria. The past is always better. They simply allowed it to die. But a few years ago the federal government said they wanted education bank, but creating it became a challenge. They, in fact, played with it.

Similarly, years ago, the Federal Government granted autonomy to universities. There’s a law granting university autonomy, but nobody is ready to put it into action. But this ASUU strike that has taken so many months to resolve and they’re still trying to resolve it should drive us to a point where we can have a permanent solution. This is because if ASUU says now we’ve agreed and government continues to pay them the way they’re doing, there will be fresh problems. How can a professor in Kebbi State University earn what a professor in University of Lagos earns. Or a professor in University of Ibadan earning, what a professor in Bauchi State University earns? It doesn’t make sense. The university Council must take its position properly and be allowed to do its work according to the law and the rules and regulations governing the university.

Q. So would you support universities charging commercial tuition, because ASUU will not allow that; students will not too….?

It’s not ASUU’s business to tell government how to generate funds to run the universities. Children of most ASUU members are in private universities, do you know? Remember I was a Pro-Chancellor and I have information. Many of the children of federal and state university professors as well as lecturers are in private universities in Nigeria. So what are you saying? Even the state universities are already paying fees. So why won’t the federal universities pay fees? You see, what I believe is that because private university owners set up universities as business ventures, the fees they will charge is going to be quite high so that they can meet their target financial returns.

There is a lot of debt funding in private universities. Even if you’re using equity funding, there’s an opportunity cost. On bank loans, you have interest expenses of loans in private university funding, so they have to pay the interest. And they can only pay it through fees – tuition, accommodation, dining and miscellaneous. If a private university charges N2 million per session, a state university should not charge more than N200,000 or N250, 000. But you will get quality education. With a large number of students the revenue to the universities will be huge. Total revenue will vary according to the students’ number. If the number is say 35,000, and you’re charging N200, 000 a year, my God, you’re hitting Seven billion naira (N7 billion). If the number is 5,000 and you’re charging N200,000 a year, it is low but it is still some N1 billion enough to augment salaries. Because the needs of a university with 30, 000 students will differ from the needs of a university with 5, 000 students. But the universities will have money to meet recurrent needs.

So there’s a room for internal revenue generation. You can set up a book shop; that was the last thing we were trying to do. Instead of students running to different cities to go and buy books, they will buy books in their local university. Those are general enterprises that you can set up in the university. You can set up a fish pond in the university. We had a bakery in the university. But because it was corruption laden, my Council leased it out to a private operator. And the private operators began to pay the university. So a bakery that had been making losses started making money. And the water plant that was making losses started making money. So, there’re opportunities that can generate funds in universities, but if they generate funds and they’re not monitored, the management – Vice-Chancellors and their men, will embezzle all the money. The richest people in Nigeria are individuals in government, and they include Vice-Chancellors who are generally richer than senators.

Are you aware that there was a university where a visitation panel went for investigations and the VC was able to hide N10 billion from the visitation panel? He concealed it.

That’s why they’re very…very rich, very wealthy. But these are monies that could be used to grow the universities. But if government says I want to pay your salaries, but whatever you do, use it for yourself, you’re joking, because there will be no accountability. There’ll be corruption. But if government now says, okay, give me a budget, what’s your revenue? For capital projects, okay, TETFUND help the universities; research grants, okay, research institutes in Nigeria please participate in funding research. You know we had a lot of research institutes in Nigeria in yester years, each commodity board had a research institute attached to it.

But today they’re no more. That time, you would be able to get the research institute to help; and other agencies of government can help to provide roads and housing infrastructure. I believe the federal government makes huge financial provisions for universities. It’s not very true when they tell you that government is not doing anything in funding universities. Government funds universities massively. Most public universities in Nigeria would be like public primary schools of today but for Federal Government’s TETFUND (Tertiary Education Trust Fund). So, for me, ASUU is a useful and necessary union. If they sit on council in the university, maybe, let’s say the president of ASUU in any university sits as a member of university council, they will query the VC and ask him questions to make the university better.

Q. Let’s look at your former constituency, banking,. Your time and now – when you were there we had so many banks, about 80 plus if not more than 100. How do you look at what you did then and what we’re doing now in the sector and what is your reading of what is happening going forward?

The only thing that is constant in life is change. Our era has changed. The industry in my era was not what the industry is today. The industry in my era had a lot more room for competition; a lot more room for diversification; a lot more room for differentiation. When the consolidation came, the banks were about 89. So when you now reduced it to 25 banks and N25 billion, the argument then was what did they need N25 billion for….the economy would not support it? So, the banks got N25 billion and went into share/margin trading. That’s what created crisis for many and the shares were artificially held up until they collapsed like dominoes. And they also went into funding vessels and tonnes and tonnes of petroleum products. And when the crisis of collapsing crude oil prices came, they abandoned the ships offshore and everybody ran away. So, that led to the crisis that came with Sanusi Lamido Sanusi as the Governor of Central Bank and the subsequent takeover and sale of previously consolidated banks.

The consolidation itself was poorly conceptualized and poorly implemented. It created more problems. And you saw a few months ago what the Federal High Court said.It ruled that the Central Bank of Nigeria and NDIC (Nigeria Deposit Insurance Corporation) should pay a certain amount to the boys and girls who went to court to challenge the consolidation agenda that made them jobless. You see, the court fined the CBN and NDIC for the fiasco of consolidation. But what is the matter today? The matter today is that there’s even nothing because the economy on its own has collapsed under the weight of the Federal Government.

The small and medium enterprises are either dead or dying. They had microfinance banks and most of those who borrowed from microfinance banks disappeared. Almost always when there is redevelopment of an area, particularly those places near the markets, and then you bring down their shops, you’ve brought down a microfinance bank because the debtors will disappear. So the banks are still there, but when they were 89 and more, if you discovered that you didn’t find this bank convenient, you go to another one as the case may be. But today, it’s not the same. Yes, they’re very big banks now; those days the biggest bank had about 200 branches. In fact, the smallest bank now has 200 branches and it reflects the new era.

But the solution really has started to emerge gradually. When the former CBN Governor, Prof Soludo refused the suggestion to segment or categorise the banks, he made a big blunder. Banks, just like anything else cannot be of the same size. You will have the small, the medium and the big. He needed to have done that, but we’ve started doing that now. But many people who would ordinarily stake their capital today, when they remember what happened when they lost lots of money to consolidation will refrain from investing in any category of banks. The proprietors lost money; the staff lost their means of livelihood; the customers lost money; the service providers lost opportunities. It was a devastating experience. It was almost like when Structural Adjustment Programme came into Nigeria.

When SAP came in 1986, for about three/four years, it was death to the poor. A packet of sugar that probably was sold for N2 became N20. That was what happened in banks. By the time everybody else loses his opportunity to earn money, to get dividends, to get a loan, to provide a service, then you’ve created a new problem. The problems that came with banks’ consolidation are still being gradually resolved.