Business

Over 90% of insured depositors of Heritage Bank reimbursed — NDIC

The Nigeria Deposit Insurance Corporation (NDIC) saya it has successfully reimbursed 94% of insured depositors from the defunct Heritage Bank.

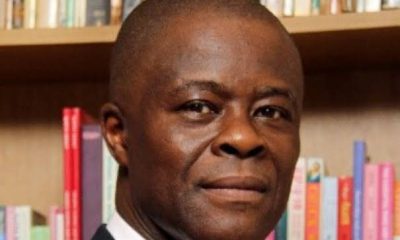

Mr. Bello Hassan, the Managing Director of the corporation, made this announcement on Thursday at the FICAN workshop in Lagos, with the theme “Strengthening Nigeria’s Financial Safety – Set: The role of NDIC.”

The Central Bank of Nigeria (CBN) revoked the bank’s license on June 3, 2024, due to its consistent failure to meet its obligations to depositors, despite multiple interventions by financial regulatory authorities.

Hassan stated that the corporation began settling insured depositors with balances below N5 million within four days of the bank’s closure, setting a new benchmark for swift action. However, the corporation blamed the delay in settling the remaining depositors on administrative constraints such as irregular records, Bank Verification Number (BVN) irregularities, and unavailable alternate accounts, among other issues.

The corporation has restated that deposits exceeding N5 million will be paid once the asset verification, recovery, and disposition processes of the defunct bank are completed.

Hassan emphasized that in today’s rapidly evolving financial landscape, maintaining the stability of Nigeria’s banking sector remains a top priority for the NDIC.

He said the handling of depositors’ claims from the defunct Heritage Bank was a testament to the NDIC’s crucial role in maintaining stability within the nation’s financial sector.

Hassan explained that the NDIC is indispensable in safeguarding depositors and fostering trust in the banking system, and the corporation employed innovative mechanisms to ensure the success of this effort, preventing any erosion of public confidence in the financial system.

He also mentioned that the corporation used bank verification numbers as a unique identifier to locate depositors’ alternate accounts with other banks without the need to fill out forms or visit NDIC offices.

Hassan further stated that this innovative approach has enabled the payment of more than 80 percent of depositors’ BVN-linked accounts to date. ‘’The prompt payment of depositors, coming at a time when the corporation had also recently increased the deposit insurer’s coverage from N500,000 to N5 million in deposit money banks, significantly cushioned the negative impact of bank failure, especially during the current challenging economic climate. This achievement is consistent with the provisions of the International Association of Deposit Insurers Co-Principle 15, which emphasizes the timely payout of depositors of failed banks.’’

He also emphasized that having largely reimbursed depositors their insured deposits, the corporation is committed to ensuring that depositors with balances exceeding N5 million are also paid the balance of their deposits.

“Its efforts to protect depositors with balances exceeding the insured amount of five million naira, through the liquidation of assets and debt recovery from failed banks, exemplifies its long-term commitment to financial stability.

“Confidence is key in maintaining the financial system’s stability, and the role of deposit insurance cannot be overemphasized,” the MD remarked, highlighting how NDIC continues to build trust in Nigeria’s banking system through timely and effective interventions.’’

He emphasized the importance of finance journalists in raising public awareness about the NDIC’s role and shaping perceptions of financial institutions. The MD mentioned that the corporation organized a workshop for members of the Finance Correspondents Association of Nigeria (FICAN) across all media platforms to deepen their understanding of how deposit insurance supports financial stability.

“Your dedication in promoting the understanding of the NDIC’s mandate and activities has been pivotal in deepening public trust in Nigeria’s banking system. By equipping finance journalists with the knowledge needed to accurately report on the sector, NDIC hopes to foster greater transparency and trust in Nigeria’s financial institutions.

“In turn, a well-informed public will be better positioned to navigate the complexities of the banking sector and make informed decisions about their finances,” he said.

The Director of Communications and Public Affairs, Bashir Nuhu also noted that the 2-day workshop provided a platform to discuss the prospects of deposit insurance in Nigeria.

“As the financial system continues to evolve, NDIC is committed to innovation, ensuring that its services keep pace with global best practices,” Nuhu added.