Business

Nigeria’s oil market slump threatens fiscal stability, puts 2026 budget at risk

Nigeria’s economic and fiscal outlook is under threat as the country struggles to find buyers for its crude oil amid a global supply glut, a situation mirrored by Angola, raising fresh concerns about government revenue and the sustainability of the 2026 budget.

Analysts warn that the inability to sell substantial volumes of crude is exacerbating existing fiscal pressures and increasing Nigeria’s reliance on borrowing.

Sources in the oil trading community told Reuters that West African crude sellers are facing difficulty offloading cargoes scheduled for late December and January due to stiff competition from cheaper and more accessible alternative supplies. As of Thursday, around 20 million barrels of Nigerian oil remained unsold, while Angola’s December–January programme still had five to six cargoes available.

“The overhang of West African cargoes partly reflects the broader global crude supply surplus emerging in Q1,” said Victoria Grabenwoger of analytics firm Kpler, noting that both seasonal factors and shifting buyer preferences are driving market softness.

Analysts point out that light and medium-density West African grades are struggling to compete with supplies from the Middle East, Russia, Argentina, and Brazil. India’s oil imports from Russia, despite Western sanctions, continue to displace medium-heavy West African crudes, while Asian buyers favour Middle Eastern supplies for shorter shipping distances and lower official selling prices.

The oil market slump comes at a critical time for Nigeria’s public finances. Finance Minister Wale Edun revealed that the Federal Government recorded a revenue shortfall of roughly N30 trillion in the 2025 fiscal year. Total inflows are now expected to reach only about N10.7 trillion, far below the projected N40.8 trillion, placing severe constraints on budget execution, debt servicing, and economic stability.

Edun attributed the shortfall largely to subdued oil and gas revenues, particularly Petroleum Profit Tax and Company Income Tax from oil companies, alongside underperformance in non-oil revenue streams. “Based on current trends, total federal revenues for the year are likely to end at around N10.7 trillion, far below the N40.8 trillion projected,” he told the House of Representatives Committees on Finance and National Planning.

The revenue gap has forced Nigeria to rely heavily on borrowing. The 2025 budget, originally set at N54.9 trillion, required about N14.1 trillion in loans to remain partially funded. Former presidential candidate Peter Obi condemned plans for an additional N20 trillion borrowing in 2026 as “fiscal rascality,” warning that excessive debt without boosting domestic production endangers long-term economic stability.

“The nation cannot continue mortgaging the future of our children with needless loans,” Obi said, urging a shift towards expanding production and strengthening non-oil revenue rather than repeated borrowing.

The oil sales slump has also complicated the 2026–2028 Medium-Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP). Lawmakers stepped down consideration of the framework after disputes arose over crude oil price benchmarks and revenue assumptions. The joint committee recommended reducing the 2026 benchmark oil price from $64.85 to $60 per barrel due to geopolitical tensions and global market volatility.

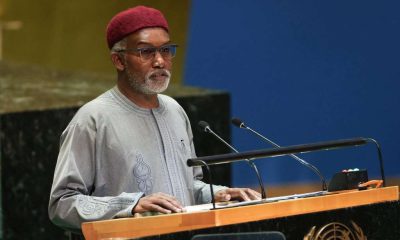

Speaker of the House Tajudeen Abbas warned that lowering the benchmark without adjusting other figures could distort the entire framework, while Deputy Speaker Benjamin Kalu noted that the move would inevitably create a revenue gap requiring either higher domestic revenue or more borrowing.

Economists say that unless Nigeria regains competitiveness in the global oil market, unsold crude and persistent fiscal deficits could threaten economic recovery. Delays in funding critical infrastructure, social programmes, and security initiatives could worsen economic hardship for millions of Nigerians.

Domestic factors, including reduced refinery demand, also compound the challenge. Africa’s largest refinery, the Dangote plant, is scheduled for maintenance in January, further limiting Nigeria’s ability to market its crude effectively.

“The combination of global oversupply, competition from alternative grades, and domestic refinery shutdowns has created a perfect storm for Nigeria’s oil-dependent economy,” said Francisco Gutierrez, an analyst at OilX, to Reuters.

The West African oil market’s current predicament underscores the urgent need for policy reform. Observers say Nigeria must diversify export markets, improve pricing competitiveness, and strengthen non-oil revenue collection to protect public finances from global market volatility.

As the 2026 budget is finalised, the government faces the dual challenge of aligning spending with realistic revenue projections while addressing structural fiscal vulnerabilities. Failure to act decisively could deepen fiscal instability, increase borrowing costs, and undermine investor confidence.