Business

Economy crumbling over President Tinubu’s reforms

More than 17 months into the life of the administration of President Bola Tinubu, trajectories of critical economic indices are raising more misgivings than hopes that the reforms of the former Lagos State governor will ultimately produce the economic rebound he promised.

Upon assumption of office, Mr. Tinubu announced an ambitious plan to grow Nigeria’s economy to $1 trillion by 2030, a significant leap from the 2022 GDP of $472.6 billion (World Bank). The vision was built on three key pillars of broad-based reforms, shared prosperity, and inclusive economic transformation.

The administration took off with a number of policy decisions, including the removal of fuel subsidies, liberalization of the foreign exchange regime, banking sector recapitalisation, the removal of electricity subsidies, and the clearing of foreign exchange backlogs.

The objectives were, among other things, to enhance government revenues, stabilize the business environment, boost investor confidence, restore price and currency stability in a stronger economy with minimum unemployment and poverty.

However, the reforms have created unintended consequences, with soaring energy prices, runaway inflation, a collapsed national currency, rising insecurity, woeful education, and health infrastructure amidst a cost-of-living crisis that has left more people in poverty.

According to the National Bureau of Statistics (NBS) monthly inflation report, Nigeria’s inflation rate surged to 33.88 percent in October 2024, up from 32.70 percent in September

The naira now exchanges at an average of N1,700 per dollar, down from N460 in May 2023. Interest rates have skyrocketed to 26.75 per cent, compared to 11 per cent over the past two years. The unemployment rate rose to 5.3 per cent in Q1 2024, up from 5.0 per cent in Q3 2023, further exacerbating economic challenges.

Also, rising debt, coupled with dwindling oil revenues, has severely constrained the government’s ability to fund critical infrastructure and development projects, forcing an increased reliance on borrowing.

Despite the country’s Gross Domestic Product (GDP) remaining around $472bn, according to World Bank estimates, Nigeria’s debt has ballooned to N127tn, according to the Debt Management Office (DMO) as of June 2024, raising sustainability concerns.

Nigeria also struggles on the security front, as banditry worsens daily, particularly in the North-West and North-Central regions, where attacks on farmers, schools, and rampant kidnappings for ransom have maintained a disturbing trend, despite the military’s determined efforts. The escalating insecurity in these regions, which produce more than 50 per cent of the country’s staple foods, including rice, beans, maize, and yam, has further aggravated Nigeria’s food crisis.

Bleeding sectors

Almost all the critical sectors of the economy are having their fair shares of the harsh impacts of the reforms in form of rising cost of production, declining patronage, job losses, shrinking profitability, and in some cases total business shutdown.

Manufacturing

A disturbing pointer to the sorry state of the economy emerged last week when the Manufacturers Association of Nigeria (MAN), revealed that its unsold manufactured goods have reached a record N1.24tn, as its unsold inventories increased by 357.57 per cent in the first half of 2024.

In its latest report on the country’s economic performance, MAN attributed this sharp increase in unsold goods to the declining purchasing power in the country caused by escalating inflation, subsidy removal, and naira devaluation.

Its President, Francis Meshioye, explained, “The inventory of unsold finished products in the manufacturing sector surged by 357.57 per cent year-on-year, reaching N1.24tn in H1 2024.

“This alarming increase is attributed to declining consumer purchasing power due to escalating inflation, subsidy removal, and the devaluation of the naira.

“The high levels of unsold inventories reflect the challenges faced by consumers and the need for interventions to stimulate demand and improve the sector’s performance.”

Meshioye noted that in addition to the increase in unsold goods, employment generation within the manufacturing sector dropped significantly, as only 2,606 jobs were created in H1 2024, a 37.83 percent decline year-on-year.

Other key findings from the report showed that while the manufacturing sector saw a 30.38 percent nominal increase in production value to N5.34tn due to rising prices, real manufacturing output declined by 1.66 percent year-on-year, falling to N1.34tn in H1 2024.

Capacity utilization in the manufacturing sector also dropped slightly to 56.4 percent in H1 2024 from 56.5 percent in the same period in 2023, highlighting ongoing struggles to optimise production amid economic challenges.

Energy

The decline in real manufacturing output is due to elevated energy costs, forex scarcity, and declining consumer demand, which increased production costs and hindered growth in the sector, MAN’s economic performance report further revealed.

Energy costs remain a major burden on manufacturers as the report revealed a 200 percent increase in electricity tariffs, significantly raising operational expenses.

Meanwhile, manufacturers spent N238.31bn on alternative energy sources, a 7.69 per cent increase from the previous period, driven by unreliable national grid supply and rising diesel and gas prices.

Last week, the Chairman of the Economic and Financial Crimes Commission (EFCC) , Ola Olukoyede, attributed the country’s epileptic power supply to corruption within the power sector.

“As I am talking to you now, we are grappling with electricity. If you see some of the investigations we are carrying out within the power sector, you will shed tears”, Olukoyede told members of the House Committee on Anti-Corruption and Financial Crimes in Abuja,

“People, who were awarded contracts to supply electricity equipment, instead of using what they call 9.0 guage, they will buy 5.0. So, every time you see the thing tripping off gets burnt, and all of that, It’s part of our problems.” The national grid has collapsed for about 12 times since the beginning of this year.

Transportation

Both air and road transportation is also seriously plagued by low patronage occasioned by fare hikes necessitated by skyrocketed fuel prices and foreign exchange revaluation.

In the last few months, air fares across local destinations have continued to rise as a result of rising operational cost. Airlines sell tickets in naira but do maintenance and repairs, buy spares and carry out aircraft insurance in foreign currencies, especially, dollar.

Business Hallmark learnt that domestic airlines are deploying various strategies to cushion effects of low patronage including flight delays, which sometimes are done intentionally to enable passengers, who are supposed to be on another flight join the delayed passengers, so they can have a full aircraft.

Another strategy which has become common among airlines is helping one another airlift passengers going to the same destination. Airlines now have an agreement amongst themselves to help lift passengers going to the same destination, especially in cases where an airline has few passengers.

Road transporters of interstate categories are also deploying similar strategies to minimize losses in the light of about 60 percent reduction in the number of travelers, according to a management staff of God is Good Motors, who spoke with our correspondent.

“We can barely load two buses for destinations, where we used to load about three buses”, he said pleading anonymity as he is not authorized to speak on such issues.

Health

Many Nigerians now rely on traditional medicine to take care of their health needs, as they can no longer afford hospital bills, which are now hitting the roofs. This has left healthcare facilities in a tough condition, with some yet to be substantiated reports claiming that about 50 percent of private hospitals in the country have shut down.

Last week, the National Pension Commission (PenCom), revealed that in the first half of 2024, 14, 179 holders of Retirement Savings Accounts (RSAs), withdrew a significant 25 percent of their pension funds, totaling N23.4 billion, to meet pressing financial needs.

The development, commentators say, reflects a disturbing trend of increasing number of laid-off workers depending on retirement funds to sustain themselves and their families.

Professor of Capital Market, Uche Uwaleke, jn his intervention, suggested that the administration should rethink its agenda by prioritizing food security to ensure that food prices decrease while continuing the implementation of reforms.

He believes efforts in this direction should include tackling insecurity through community policing, providing access to inputs and credit for farmers, and improving rural roads that link farms to markets.

This, he noted, should be done in conjunction with state and local governments. “By doing so, the adverse impact of the reforms will be significantly cushioned,” he stated.

In his reaction, economist and business development consultant, Dr. Boniface Chizea, stressed the need for Nigeria’s monetary and fiscal authorities to direct their policy steps towards encouraging productivity, saying that is the only sure way to rein in the nation’s rising inflation.

‘’If you remove subsidy the way we did it, that’s one of the things that can make inflation escalate in Nigeria and, in fact, in any environment. Because once you did that, the effect it has will run completely through the entire system”, Chizea said.

No cause for alarm

However, the World Bank has warned that reversing the Federal Government’s economic policies will spell doom for Nigeria. Its Country Director for Nigeria, Dr. Ndiame Diop, who gave the warning recently during the launch of the Nigeria Development Update (NDU), report titled ‘Staying the Course: Progress amid Pressing Challenges’, said while the reforms might bring hardship, they were necessary for Nigeria’s long-term stability.

He stated: “Reversing these reforms would be detrimental and would spell doom for Niger[ia”.

According to him, the recent increase in the Federal Government’s revenue in the first half of the year was largely due to the removal of fuel and forex subsidies, hence the need to sustain the reforms.

‘Significant strides’

But the President is hailing the progress made through his administration’s reforms, urging stronger collaboration to steer Nigeria’s economy toward sustained growth and stability.

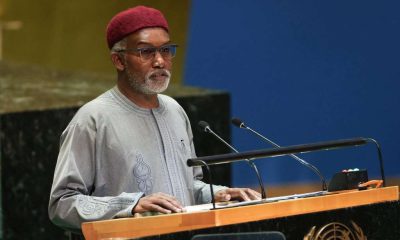

Tinubu, who was represented by Vice President Kashim Shettima during the 30th Nigerian Economic Summit held in Abuja recently, said:“ Like many other nations, Nigeria has experienced significant economic turbulence over the past few years. The challenges have been global and domestic—ranging from the COVID-19 pandemic and fluctuating oil prices to internal security issues, inflation, and structural weaknesses in our economy, such as over-reliance on oil revenue and lack of economic diversification…

“I am pleased to report that we are making significant strides in addressing several key issues, including regulatory bottlenecks and ease of doing business challenges. This progress should instill confidence in our collective ability to overcome these challenges,” he stated.