Business

Economic weakness, political risk keep equities down

By FELIX OLOYEDE

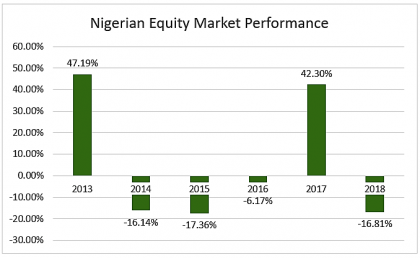

Falling equity prices have become standard fare on the floor of the Nigerian Stock Exchange as large sell offs by foreign and local investors continue to put downward pressure on the bourse. The All Shares Index has dropped -19.27 per cent year-to-date, making it one of the worse performing markets poor in the world.

The NSE All-Share Index and Market Capitalization dipped-2.54 per cent to close the week at 30,874.17 points and N11.27 trillion respectively, underpinned on -5.12 per cent and -4.26 per cent fall in the oil and gas sector and NSE premium index respectively. The banking sector did not fare better as it weakened -2.99 per cent, while the industrial goods sector shed -3.36 per cent last week. On Friday, the market gained 0.86 per cent to halt downtrend of five consecutive trading days.

The country’s economic growth has weakened in the first two quarters of 2018, declining from 2.11 per cent at the end of 2017 to 1.95per cent in Q1 2018 and further dropped to 1.51 per cent in June 2018. And there is no sign that it would improve when the National Bureau of Statistics (NBS) releases the third quarter data later this month.

The country’s economic growth has weakened in the first two quarters of 2018, declining from 2.11 per cent at the end of 2017 to 1.95per cent in Q1 2018 and further dropped to 1.51 per cent in June 2018. And there is no sign that it would improve when the National Bureau of Statistics (NBS) releases the third quarter data later this month.

“There are two things basically affecting the market. First is the weaknesses in the economy. The economic growth we have been having has not been impressive. We have not had growth that is above 2 per cent since we were out of recession,” said Moses Ojo, Head, Research and Business Development, PanAfrican Capital Holdings. He argued that the 1.5 per cent GDP growth recorded in Q2 2018 was not encouraging and there is no hope that it would be better in Q3.

“Secondly, the forthcoming election has made political risk to weigh in on the equity market. And the elections get closer, we will be seeing negative sentiment towards the market. The remaining foreign portfolio investors are actually cashing out ahead of the elections, because of the uncertainties that surround the political environment,” Ojo maintained.

The woes of the Nigerian market have been further compounded by crude oil price which has slid -22.63 per cent in the last one month to $58.73 per cent as the US continues to flood the market.

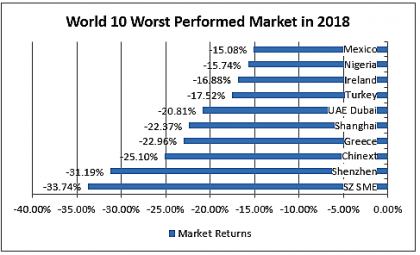

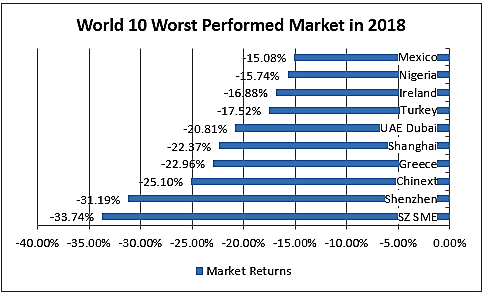

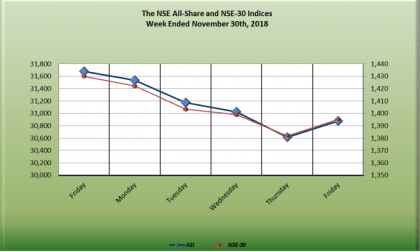

The Nigerian market which was of the best performed market globally last year after posting 42.3 per cent return, was ranked by the World Market Index as the market with worst return in November 2018, dipping -9.1 per cent during this period. Data obtained from the Exchange showed that it has shed-19.27 per cent year-to-date, making it the ninth worst performed market between January 2 and November 30, 2018, with Small and Medium Enterprise Board of the Shenzhen Stock Exchange (SZ SME), which has dipped -33.74 per cent YTD, topping the worst performed markets list for this year.

The Nigerian market which was of the best performed market globally last year after posting 42.3 per cent return, was ranked by the World Market Index as the market with worst return in November 2018, dipping -9.1 per cent during this period. Data obtained from the Exchange showed that it has shed-19.27 per cent year-to-date, making it the ninth worst performed market between January 2 and November 30, 2018, with Small and Medium Enterprise Board of the Shenzhen Stock Exchange (SZ SME), which has dipped -33.74 per cent YTD, topping the worst performed markets list for this year.

Political uncertainty is the problem plaguing the Nigerian equity market, argued Dr. Adi Bongo, economist and Faculty Member, Lagos Business School, adding that news about the country in the international media has been favourable, citing the recent one which discouraged foreign investors from investing in the Nigeria.

He also faulted the way the President Muhammedu-led government responded to the pull-out of HSBC and UBS from the country, saying that it sent a negative signal about the safety of investments in Nigeria. “Markets are moved not by concrete actions, but actually by rumours, by news which may be fake. This is what is called animal spirit. What drives the capital market is sometimes empty fictitious information,” he explained.

Bongo noted that the MTN-government altercation over capital repatriation has not put the country in a positive light, combined with political uncertainties and frustration of reforms in Nigeria, has made investors to look away from the country to put their money in safer environments.

“I believe we are still going to witness further pull-out from our capital market because of what is happening to crude oil prices. If by the U.S. continues to flood the market with crude oil, the only way the oil price can go now is the downhill,” he asserted.

Ayodele Akinwunmi, Head, Research, FSHD Merchant Bank attributed the downtrend in the Nigerian equity market to pull back by foreign investors, weak economic performance, weak corporate earnings and election consideration.

Although the Monetary Policy Committee of the CBN at the end of its two-day meeting penultimate week, acknowledged poor performance of the bourse, it however, noted that “These developments largely reflect the sustained profit taking activities by portfolio investors as foreign yields become increasingly more attractive abroad. The MPC, however, believes that this trend will reverse in the medium term given the current efforts at further improving investor confidence and the relative stability in the Investors and Exporters (I&E) window of the foreign exchange market.”

The MPC with retained benchmark interest rate at 14 per cent for the 28th month, maintained the asymmetric corridor of +200/-500 basis points around the MPR; CRR at 22.5 per cent; and Liquidity Ratio at 30 per cent, explained that “that by holding its policy position constant, it has confidence in the various policies and administrative measures deployed by the Bank which have resulted in the moderation in domestic price levels and stability in the foreign exchange rate. Thus, a hold position is an expression of confidence in the policy regime, given the gradual improvements in both output growth and price stability. On this premise, the downside risks to growth and upside risks to inflation appears contained.”

There are fears that will the plunged in oil price and continued exit from foreign portfolio investors from the equity market, the pressure on the country’s external reserves would be further exasperated. The country’s foreign reserves has plunged -13.11 per cent from $47.79 billion on June 29, 2018 to $41.52 billion as at November 22, 2018.