Business

CAP Plc innovative marketing grows profits by 17% pays 235 kobo total dividend in 2014

By Dennis Okonne

The Chemical and Allied Products (CAP) Plc posted an impressive performance in its audited result for 2014 where its turnover rises from N6.195 billion in the preceding year to N6.987 billion, translating to an increase of 13%. Similarly, it also grows profits by 17% to N2.442 billion from N2.086 billion previously. Consequently, the board proposes and got approval at its recently concluded Annual General Meeting, a final dividend of 85 kobo per share, having appropriated an interim dividend of N1.50 kobo per share earlier, making a total dividend of N2.35 kobo per share in 2014. The company’s impressive performance was linked to its aggressive and innovative marketing campaigns. It has also made significant expansion of sales outlets by opening 11 new Dulux shops across the country.

The Company is a subsidiary of UAC Nigeria Plc, which holds 50.09% of its equity. It evolved from Imperial Chemical Industries (ICI) Plc in 1957 under ICI Exports Limited. In 1965, ICI Exports limited changed its name to ICI Nigeria limited. However, in 1977, ICI Nigeria limited sold 60% of its shares to Nigerian public as a result of the indigenization decree, and change its name to Chemical and Allied Products Plc. in 1992, the remaining 40% shareholding was acquired by UAC of Nigeria and it currently holds about 50.09% of the equity. Today, CAP Plc operates in coatings business and provides a wide range of quality products and services, and its brands have become household names.

The principal activities of the company are the manufacture and sale of paints. It is an ISO certified company, operating in coating business and providing quality products and services to their numerous customers. Products are strategically distributed through Dulux colour Centres (DCCs). DCC is an innovation introduced to bridge the gap between Dulux and its consumers. It’s issued and fully paid share capital consists of 700,000,000 ordinary shares of 50 kobo each, out of which, 350,652,700 units were held by UAC Nigeria Plc.

Flagship Brand: CAP Plc manufactures and markets DULUX. It is a household name in the paints market in Nigeria. Dulux is the undisputable leader in the decorative paints segment because of its uniqueness and quality. It is a premium quality paint that combines durability and beauty in colours and creativity. DULUX paints offers the following product range namely- Dulux Trade, Dulux Emulsion, Dulux Silk Emulsion, Dulux Weathershield, Dulux Gloss, Dulux Eggshell, Dulux Primer, Dulux Trade Ecosure, Hammerite metal paint and CAPLUX Paints.

Shareholding Structure:

Total Number of shareholding = 700,000,000 shares

UAC of Nigeria Plc = 350,652,700 (50.09%)

Other shareholders = 349,347,300 (49.91%)

Market Statistics:

Shares in issue= 700,000,000

52 Weeks High= N43.00

52 Weeks Low= N34.00

52 Weeks Change= 26.47%

Last Price= N41.00

P/E Ratio= 17.26

EPS =2.37489

Price/Book Value= 24.31

Dividend = N2.35 kobo per share.

Financial Highlights: Despite the overwhelming macroeconomic challenges of the year under review, the company posted outstanding financial profile. It is clearly the market leader in the Chemicals & Paints sector by way of product turnover and other parameters.

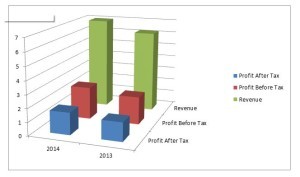

- Revenue grew from N6.195 Billion in the preceding year to N6.987 Billion, translating to an increase of +13%. Profit before tax rose from N2.086 Billion previously to N2.442 Billion, an increase of +17%. Similarly, its profit after tax also leapt by +17% from N1.416 billion to N1.662 billion.

- Consequently, a dividend of 235 kobo per share was appropriated. Of this sum, an interim dividend of 150 kobo per share was doled out to shareholders earlier in November, 2014 and a final dividend of N85 kobo per share will be paid in June, 2015. In the preceding year, a total dividend of 225 kobo was appropriated, an increase of +4.44% pay-out.

- Earnings per Share (EPS) grew by +17.33% to N2.37 from N2.02 last year.

The company’s growth in revenue is attributable to the significant expansion of sales outlets as it opened 11 new Dulux shops across the country as well as aggressive and innovative marketing campaigns.

Audited Result (FY 2014) Snapshot

| 2014 (N) | 2013 (N) | % Change | |

| Revenue | 6.987 B | 6.195 B | +13 |

| Cost of Sales | (3.389 B) | (3.040 B) | +11.48 |

| Gross Profit | 3.597 B | 3.155 B | +14 |

| Profit Before Tax | 2.442 B | 2.086 B | +17 |

| Profit After Tax | 1.662 B | 1.416 B | +17 |

| Retained Earnings | 811.319 M | 898.894 M | -9.74 |

| Net Assets | 1.180 T | 1.268 T | -6.94 |

| Dividend Per Share (K) | 235 K | 225 K | +4.44 |

| Number of Staff | 219 | 213 | +2.82 |

T=Trillion; B= Billion; M=Million; N=Naira.

Price resurgence on the Stock Exchange was as a result of its impressive first quarter 2015 result where-

Price resurgence on the Stock Exchange was as a result of its impressive first quarter 2015 result where-

- Its revenue grew by +3.5% to N1.808 billion compared from N1.747 billion same period in 2014

- Profit before tax increased by +20.8% to N715.031 million compared from N591.948 million previously and

- Profit after tax rose by +20.7% to N485.675 million compared from N402.525 million recorded in 2014.

- Earnings per Share (EPS) is 69 kobo from 58 kobo, an increase of +19%

- Net Assets leapt by 41.2% to N1.666 billion from N1.180 billion.

Corporate Governance: The company has a robust board comprising of 6 (Six) members made up of 4(four) executive director. Board Chairman is Mr. Larry Ephraim Ettah. He is also the Group Managing Director /CEO of UAC Nigeria Plc; and the Non-Executive Chairman of Portland Paints Plc. Mrs. Omolara Elemide MD/CEO of CAP Plc. Other Directors are Mrs. Adeline Ogunfidodo, Mr. Solomon Aigbavboa, Mr. Opeyemi Agbaje and Ambassador Kayode Garrick.

Mr. Larry Ephraim Ettah, Chairman, CAP Plc.

Mrs. Omolara Elemide; M/D, CAP Plc.

CAP PLC 5 YEAR FINANCIAL SCORECARD.

| 2014(N) | 2013(N) | 2012(N) | 2011(N) | 2010(N) | |

| Share Capital | 350.000 M | 350.000 M | 280.000 M | 280.000 M | 140.000 M |

| Turnover | 6.987 B | 6.195 B | 5.231 B | 4.312 B | 3.644 B |

| Profit Before Tax | 2.442 B | 2.086 B | 1.661 B | 1.361 B | 1.457 B |

| Taxation | (779.715 M) | (670.198 M) | (545.627 M) | (313.518 M) | (256.158 M) |

| Profit After Tax | 1.662 B | 1.416 B | 1.115 B | 1.048 B | 1.200 B |

| Retained Earnings | 811.319 M | 898.894 M | 819.098 M | 1.299 B | 920.922 M |

| Dividend Per Share (K) | 235 K | 225 K | 195 K | 160 K | 300 K |

| Earnings Per Share (EPS) | 237 | 202 | 159 | 187 | 164 |

| No. of Employees | 219 | 213 | 210 | 199 | 195 |

B= Billion; M=Million; N=Naira; K=Kobo.

Share Price Movement in First Quarter (April- June, 2015) illustrated below:

Market Sensitivity/ Perception: The broker recommendation is to “BUY” CAP Plc shares. The broker believes the company is in a prime position to capitalise on the continued sharp rise in cost of its products as well as its turnover. The broker is impressed with the audited result which revealed that profits were ahead of market expectations as well as the mouth-watering dividend appropriated. They described CAP Plc as stock “with enormous potential” for growth as reflected in its stock performance and audited financial report.

Mr. Willy Ndata, the Doyen of stockbroker, said “it is the undisputable leader in the paints industry because its product brand, Dulux, which is of durable quality. It has been in the field of paint manufacturing for a long time and consistent in payment of dividend in the last 7 years. As the consumers’ preference among others, it is a good “buy” for investors in its shares any day.” The broker believes in the Company’s ability to continue as a going concern and have no reason to believe it will not remain a going concern in the year ahead.

The chemical and paints industry has been in existence for a number of years. The industry has gone through various levels of development from the manual based processes to more technologically advanced production methods. However, the level of development of the sector in Nigeria is still low when compared to other countries with more advanced technical know-how. The Nigerian paint sector is a highly competitive one. There is free entry and exit due to the rather friendly capital required to set up the business.

One major critical success factor for chemical and paints operators in Nigeria is quality control. Manufacturers in Nigeria are classified into tiers on the basis of the quality of their final products. An effective and efficient distribution network is also a key requirement for the success of paint manufacturers in Nigeria. Since paints are in high demand in virtually all areas of the country, it is pertinent that the end product gets to the final consumer as at when needed.