Business

Naira losses steam at FX market

- remains in life-support

Intense pressure is expected to mount on the Naira throughout 2019 as the Central Bank of Bank (CBN) would have to intensify its support of the local currency for it to maintain its current relative stability, financial experts have posited.

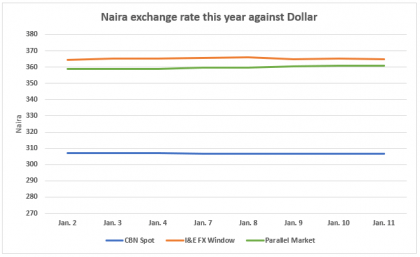

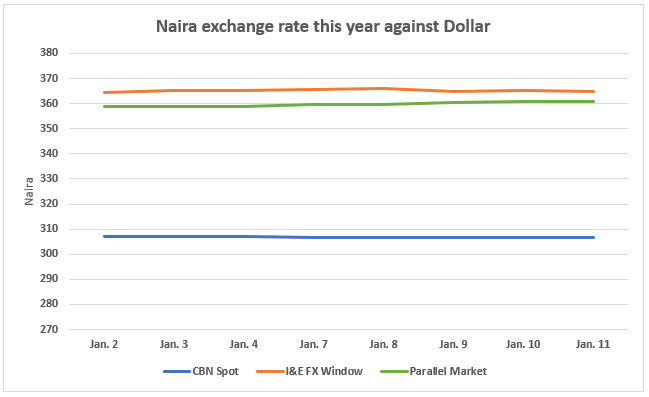

Although the Naira appreciated 1.16 per cent against the Dollar to close $/N358.8 at the parallel segment of the foreign exchange market in 2018, helped by the huge intervention of the apex bank in the market and government promotion of import substitution, it however, depreciated 0.94 per cent to $/N364.41 at the Investors’ and Exporters’ end and shed 0.47 per cent to $/N306.95 at the Interbank segment. But the Naira appreciated 0.05 per cent to $/N 364.94 and 0.06 per cent to $/N360.80 at Investors and Exporters (I&E) forex window and parallel market respectively on Friday but remained unchanged at N306.90 at inter-bank rate.

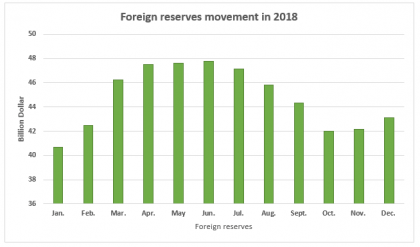

The 38.44 per cent decline in crude oil prices between October and December last year adversely impacted the Naira, propelling the central bank to further massively intervene in the market. The regulator injected over $12 billion into the forex market in 2018, causing the country’s external reserves to deplete almost 10 per cent from its $47.8 billion peak in June 25, 2018 to $43.12 billion at the end of the year.

“Given our expectations for slower (Foreign Portfolio Investment)FPI inflows and examination of forward traded rates in the OTC futures market, we anticipate a marginal depreciation of the Naira in H1 19. We however expect the CBN to sustain its aggressive interventions across all market segments to ensure stability of the Naira. We expect the naira to gain marginally in H2 19, given expectations for renewed FPI inflows from receding political risks post the general elections,” analysts at Zedcrest Capital in their 2019 fixed income outlook.

“Given our expectations for slower (Foreign Portfolio Investment)FPI inflows and examination of forward traded rates in the OTC futures market, we anticipate a marginal depreciation of the Naira in H1 19. We however expect the CBN to sustain its aggressive interventions across all market segments to ensure stability of the Naira. We expect the naira to gain marginally in H2 19, given expectations for renewed FPI inflows from receding political risks post the general elections,” analysts at Zedcrest Capital in their 2019 fixed income outlook.In the same vein, analysts at FSDH Merchant Bank believe there would likely be a drop in the supply of foreign exchange into Nigeria, resulting in a possible depreciation or devaluation of the Naira as a result of probable drop in the country’s crude oil production and dip in the global crude oil price.

It then advised Nigeria to limit or eliminate its foreign debt, particularly if it does not have foreign exchange receivables as a way of alleviating the possible foreign exchange risk.

The country’s capital importation (foreign investment into the country) shrank 31.12 per cent to $2,855.21 million in the third quarter of 2018 on the back of foreign portfolio investors, who took to flight from the equity market due to the country’s elevated political risk, causing foreign portfolio investment (FPI) to drop 37.74 per cent during this period.

The National Bureau of Statistics is due to release the capital importation figures for the four quarter on February 27, which is expected to further dip.

Meanwhile, Bismarck Rewane, Managing Director, Financial Derivative Company projected that the country’s forex market structure is heading towards full convertibility and a likely weakening of the local currency, underpined on the disturbance in the oil-rich Niger-Delta region and drop in oil prices in 2019.

He predicted that the Naira may be devalued in the course of the year, especially after the general election as the central bank will maintain a tight monetary policy to mop up the excess liquidity in the system from election spending and wage increment, which is expected to take place in the first quarter of the year. He expects the currency to slide to $/N385-395

Nigerian crude oil production averaged at 1.9 million barrel per day in 2018, but the government has projected 2.3 million barrel per day at $60 per barrel. Brent was sold for $60.48 and Light traded $51.59 on Friday. But Rewane feels OPEC would crack, which would propel oil price to crash, encumbering government’s projections.

“I think we have come to some kind of psychological equilibrium of the Naira. What we have not addressed is the cost of keeping it there. The cost of subsidizing the Naira is still very high. Almost every week the CBN will intervene in the market. I think they have come to the comfort level that is what it should be,” Professor Leo Ukpong, a Financial Economist and Dean, School of Business, University of Uyo told Business Hallmark in a telephone conversation.

He foresees the apex bank continuing to manage the value of the local currency in the short-term should President Muhammedu Buhari win the forthcoming election, but in the long-run, the country would have to embrace import substitution to cut down the cost of subsidizing the Naira.

However, it is expected that the country’s capital importation would improve after the general elections, when the heightened political risk would have alleviated, although the winner of the presidential election would determine the extent of faith foreign investors would have in the Nigerian market.

“The monetary authority has stated that price stability will be their focus going forward. Therefore, we expect the domestic currency to remain fairly stable this year. But this depends on the ability of the CBN to defend the Naira, which also depends on the level of reserves which is consequent to the prices of crude oil in the global market,” Moses Ojo, Head, Research and Business Development, Pan-African Capital told Business Hallmark.

The country may also benefit from expectation the U.S. Federal Reserves may have restrained from further rate hike as investors who left Nigeria to take advantage of U.S. rate adjustment in 2018, may return to the country, which bond yields still average over 15 per cent.

The Monetary Policy Committee (MPC) of the central bank would be meeting January 21-22 and the country’s forex market and interest rate would top its agenda.

.

Continue Reading