Business

OPEC+ freezes output hikes amid glut, eyes fallout from Venezuela crisis

The Organisation of Petroleum Exporting Countries and its allies, OPEC+, have agreed to pause planned oil supply increases through the first quarter of 2026, choosing to keep production at current levels as global markets grapple with oversupply and uncertainty surrounding Venezuela’s future output.

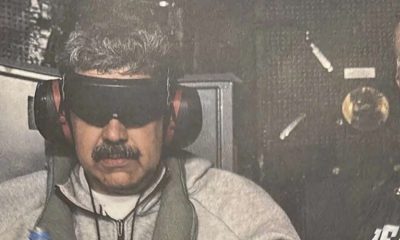

The decision was taken at a brief virtual meeting on Sunday led by the group’s dominant producers, Saudi Arabia and Russia, according to a Bloomberg report. Delegates said the group opted for caution, citing weak price momentum and the need for clarity on geopolitical developments, particularly the reported capture of Venezuelan leader Nicolás Maduro by United States forces.

According to Bloomberg, OPEC+ members agreed that it would be premature to adjust supply policy in response to the Venezuela situation, even though the country’s output outlook could become a significant factor in the coming months.

“OPEC+ stuck with plans to pause supply increases in the first quarter at a meeting on Sunday, as global markets face a surplus and the group awaits clarity on whether the shock US capture of Venezuelan leader Nicolas Maduro will impact supplies,” the report said, citing delegates who spoke on condition of anonymity.

The meeting reportedly lasted less than 10 minutes, with no detailed deliberations on Venezuela, as members agreed that any immediate supply reaction would be hasty. Key producers confirmed that collective output levels would be maintained at least until the end of March 2026.

The cautious stance reflects mounting pressure in global crude markets, which have been weighed down by excess supply. Oil futures fell by about 18 per cent last year, marking their steepest annual decline since the COVID-19-induced crash in 2020. Forecasts for 2026 also point to a widening supply glut as production growth from both OPEC+ and non-OPEC producers continues to outpace demand.

Venezuela, which holds the world’s largest proven oil reserves, currently produces about 800,000 barrels per day—less than one per cent of global supply and far below its historical peak. While a long-term recovery could eventually add meaningful volumes to the market, analysts say such a turnaround would take years, even if sanctions are eased and foreign investment returns.

US President Donald Trump has said American oil companies could invest billions of dollars to rebuild Venezuela’s dilapidated energy infrastructure following the military operation that led to Maduro’s capture. However, sources cited by Bloomberg said key oil facilities were not damaged during the operation, reducing the likelihood of an immediate supply shock.

The latest decision comes after a strategic shift by OPEC+ in April 2025, when the group began rapidly unwinding production cuts introduced in 2023. That move was widely interpreted as an attempt to reclaim market share lost to competitors such as US shale producers, despite signs that global supply was already abundant.

Before Sunday’s meeting, OPEC+ had agreed to restore about two-thirds of the 3.85 million barrels per day previously cut, leaving roughly 1.2 million barrels per day yet to be brought back to the market. However, actual supply increases have lagged behind targets due to capacity constraints in some member countries and compensatory cuts by others that had earlier overproduced.

For oil-dependent economies such as Nigeria, the decision to freeze output increases carries significant implications. As Africa’s largest crude producer and a member of OPEC, Nigeria’s fiscal position remains highly sensitive to global oil prices and export volumes.

By maintaining current production levels in an already oversupplied market, OPEC+ is likely to keep crude prices stable but subdued in the near term, limiting upside revenue potential for exporters. Oil earnings account for the bulk of Nigeria’s foreign exchange inflows and a substantial share of government revenue, making OPEC+ policy decisions critical for budget planning, debt servicing and exchange rate stability.

Nigeria has also struggled to fully meet its OPEC production quota in recent years due to oil theft, pipeline vandalism and prolonged underinvestment, reducing its ability to benefit even when output caps are relaxed.

Analysts warn that an extended period of weak oil prices could further strain Nigeria’s public finances, widen budget deficits and increase pressure on the naira. In response, the Federal Government has continued to push reforms aimed at boosting crude output, improving domestic refining capacity and accelerating diversification away from oil through non-oil exports and stronger domestic revenue mobilisation.

OPEC+, which comprises the 13-member OPEC bloc and allies including Russia, controls a significant share of global oil supply, giving its production decisions outsized influence over oil prices and the economic fortunes of oil-producing nations such as Nigeria.