Business

Stock market sustains downtrend in Independence week, sheds 1.17%

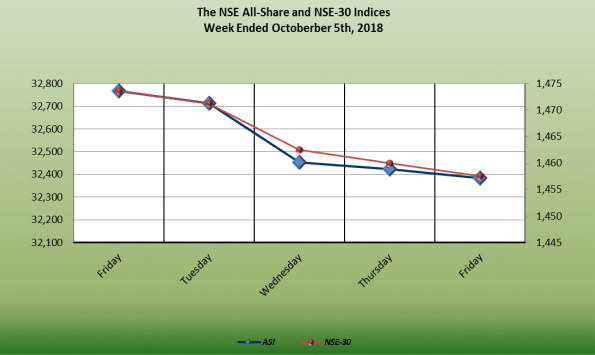

Though all Nigerian celebrated the 58th Independence anniversary this week, investors had little to rejoice over as the equity market continued its downtrend, contrasting -1.17 per cent week-on-week to 32,766.37 index points.

Portfolio investors continued to sell their stocks and head for safety as Nigeria approaches the 2019 general election, which would hold in February next year, because they are worried about the likely outcome of the elections.

This caused the All Share Index and market capitalization to dip -1.17 per cent to close at 32,383.15 and N11.822 trillion respectively.

This caused the All Share Index and market capitalization to dip -1.17 per cent to close at 32,383.15 and N11.822 trillion respectively.

A total turnover of 639.317 million shares worth N7.842 billion in 10,477 deals were traded this week, compared to 924.546 million shares valued at N14.194 billion that exchanged hands last week in 14,119 deals.

Meanwhile, the bourse shed 0.12 per cent to take the decline to four consecutive trading days. The downtrend was majorly aided by sell-off Dangote Cement, Zenith bank, UBA among others.

Market breadth closed positive, recording 21 gainers and 15 losers.

This week, the Financial Services Industry (measured by volume) led the activity chart with 517.865 million shares valued at N4.654 billion traded in 5,977 deals; thus contributing 81.00 per cent and 59.35 per cent to the total equity turnover volume and value respectively.

The Consumer Goods Industry followed with 54.733 million shares worth N2.526 billion in 1,703 deals. The third place was Conglomerates Industry with a turnover of 14.752 million shares worth N25.560 million in 452 deals.

Trading in the Top Three Equities namely – First City Monument Bank, Fidelity Bank Plc and Guaranty Trust Bank Plc, (measured by volume) accounted for 267.466 million shares worth N2.592 billion in 1,733 deals, contributing 42.00 per cent and 33.05 per cent to the total equity turnover volume and value respectively.

Trading in the Top Three Equities namely – First City Monument Bank, Fidelity Bank Plc and Guaranty Trust Bank Plc, (measured by volume) accounted for 267.466 million shares worth N2.592 billion in 1,733 deals, contributing 42.00 per cent and 33.05 per cent to the total equity turnover volume and value respectively.

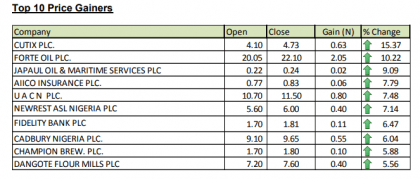

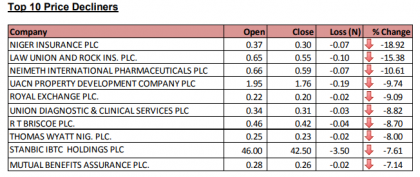

A total of 27 equities appreciated in price during the week, lower than 28 in the previous week, while 32 stocks declined in price, lower than 41 equities of the previous week and 110 equities remained unchanged higher than 100 equities recorded in the preceding week.

A total of 27 equities appreciated in price during the week, lower than 28 in the previous week, while 32 stocks declined in price, lower than 41 equities of the previous week and 110 equities remained unchanged higher than 100 equities recorded in the preceding week.