Headlines

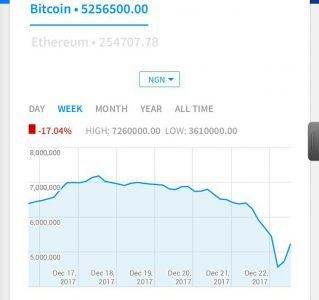

Anxiety as bitcoin plummets 33% in one week before rallying Friday

By Obinna Ezugwu

Volatility, the major characteristic of bitcoin and other sister crytocurrencies means that they are often unpredictable; rising and falling in value within minutes. It is a well known feature, but not even the most astute trader of the new digital currency could have predicted a free fall in the value of the currency to less than N4million from N7.2million between Sunday and Friday, and already concerns have begun to mount over its future.

Today’s price movements

Within the week, bitcoin shed 17 percent of value, but on Friday alone, between 9am and 10 am (WAT), it lost 16 percent, falling to N3.6 million before rallying back to N5.5 million in the afternoon hours.

There are concerns. For those who had planned to make quick money ahead of the yuletide, it is probably dashed hope… nothing is certain when it comes to bitcoin. Instructively, the recent fall was largely expected, and hardly comes as a surprise to some. It was similar to what happened in the same period in 2016. Prior to December 2016, bitcoin sold for N415,000, sometimes even higher, but between December 18 and 22, it plummeted to N350,000. However, in January 2017 after the yuletide, it rallied up to N500,000.

Thus, with the previous year’s experience, some investors say there is little to worry about. In fact, for some, this is the right time to invest.

Price movements for the week

“For anyone who has money, this is the time to invest,” said Ugwu-Otti Ken, an investor and banker. “The price will still go up, it is not about the price; it is about the adoption of bitcoin derivatives by the mainstream.”

Another investor, Omeje Adol explains that the dip is mainly because some of the major players are closing stock for the year. “When the year ends, normally people close stock for the year,” he said. “It is normal even in other businesses. It could be to put money in other ventures or to simply take a break and take stock of profits.

“The major reason for the dip is that major players are closing stock and profit taken. For investors, this is the time to take advantage,” he concluded.

Since bitcoin started recording huge successes, other crytocurrencies have emerged, and continues to emerge to rival it. This, Mr Mayowa Oloyede, a banker and analyst said partly explains the sudden fall in price. “First, because of the season we are in, and second because other cryptocurrecies are waging war on bitcon.

“Bitcoin ripples launched last week, there is also an American version that has come on board. Again, you know that anythingAmerica has no grip on, they would often want to sabotage it. Bitcoin represents a threat to the dollar so I believe America is concerned.”

Like others nonetheless, he too predicts a rise next year. “By next year, the price will rise, he said. “It is very likely.”

For potential investors nonetheless, the general warning still is that bitcoin is unregulated, very volatile and therefore risky. But it is gaining acceptance by the day.

The strength and sustainability of bitcoin generally depends on acceptability. This acceptability has grown significantly, and just last week, CBOE Global Markets, a Chicago based exchange group, became the first exchange to launch bitcoin futures. A product that will allow investors to bet on the coin’s future price and could open the door to wider-participation in the market by retail investors and institutions.

price movements for the month

Bitcoin’smarket cap is presently over $287.6billion, more than twice that of Goldman Sachs ($89.2billion). It is now bigger than Buffett, Boeing and the economy of New Zealand.