Business

Sterling Bank ends year on a high

At a time most banks have found it hard to grow loans and advances and non-interest incomes such as digital service fees, Sterling Bank Plc has done a decent job of propping up profitability.

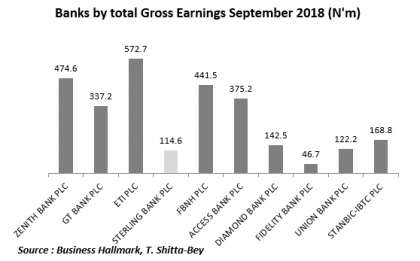

The banks 9-month result for 2018 shows that Sterling Bank’s net interest income went up marginally by 9 per cent, while gross earnings leaped 21 per cent from N 94.6 billion in the first 9 months of 2017 to N114.6 billion in the contemporary period of 2018. The bank’s loans and advances grew by a marginal 11 per cent on a year-on-year basis as local Nigerian banks generally  found themselves feeling better investing in short-dated government treasury bills rather than in dodgier loan-related assets. Indeed, with returns on government bills perched between 12 and 13.5 per cent in the course of the first three quarters of the year, the T-bill route was seen as the preferred option for several domestic money lenders.

found themselves feeling better investing in short-dated government treasury bills rather than in dodgier loan-related assets. Indeed, with returns on government bills perched between 12 and 13.5 per cent in the course of the first three quarters of the year, the T-bill route was seen as the preferred option for several domestic money lenders.

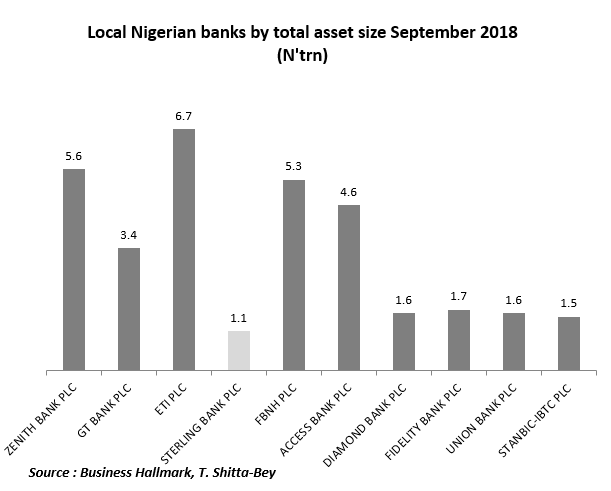

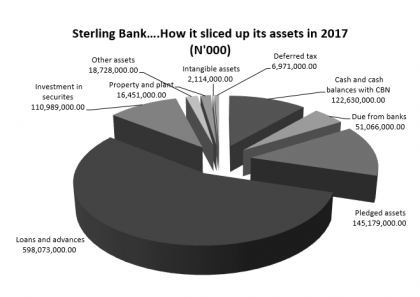

Fixed income strategies have become even more important these days to local banks in the face of a sliding domestic equities market and a tough operating environment for listed companies. The Nigerian stock markets All Shares Index (ASI), a measure of the average market value of stocks, has so far slumped 19.8 per cent year-to-date and 15.7 per cent year-on-year. This has chiseled down the value of bank financial investments and weakened the asset side of their balance sheets. Sterling bank’s Investment in equity securities has glided downwards from N110 billion in December 2017 to N3.2 billion in September 2018, representing a 97 per cent slump; this was in stark contrast to the N96bilion investment in sundry fixed income assets such as treasury bills (T-bills) and corporate commercial papers (CPs) over the period. However, the bank compensated for the plunge in investment values by wrestling down impairment charges on loans by a handsome 47.4 per cent, dropping from N7.6 billion in September 2017 to N4.2 billion in September 2018.

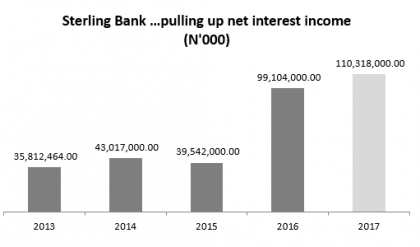

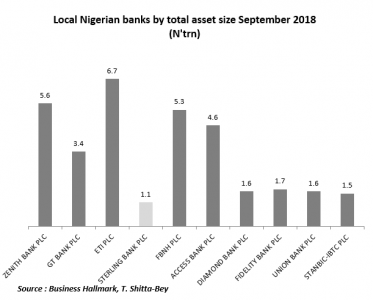

Stock market analysts note that the banks five year compound average annual growth in net interest income, a measure of its underlying profitability, has been stable at 32.2 per cent and its compound average growth in operating profit at minus 2.14 per cent (admittedly a damper), making Sterling one of the best-in-class money lenders in the country by way of profitability. However, there are some niggling worries about the bank. Sterling Bank’s current cash to debt coverage ratio, a measure of how much immediate cash or near-cash it has on hand to cover short term liabilities was minus 9.64 in September 2017 (suggesting an extremely difficult liquidity position) but 0.01 in September 2017 (improved but still troubling) . This suggests weak flexibility in its balance sheet. The bank would need to bring on board more cash to meets its short-term deposit obligations. The bank’s cash to deposit coverage ratio was negative 15 per cent in September 2017 and barely one per cent in September 2018, this measure of operating cash flow to deposit liabilities, looks frail. A number of analysts express the opinion that they would prefer that the bank posted a ratio that was above 20 per cent. ‘’By getting above the magic trigger figure of 20, investors begin to feel reasonably comfortable about a banks liquidity situation’’, says Segun Atere, chief market analyst at Apel Assets and Trust Limited, one of the largest traders on the floor of the market.

Stock market analysts note that the banks five year compound average annual growth in net interest income, a measure of its underlying profitability, has been stable at 32.2 per cent and its compound average growth in operating profit at minus 2.14 per cent (admittedly a damper), making Sterling one of the best-in-class money lenders in the country by way of profitability. However, there are some niggling worries about the bank. Sterling Bank’s current cash to debt coverage ratio, a measure of how much immediate cash or near-cash it has on hand to cover short term liabilities was minus 9.64 in September 2017 (suggesting an extremely difficult liquidity position) but 0.01 in September 2017 (improved but still troubling) . This suggests weak flexibility in its balance sheet. The bank would need to bring on board more cash to meets its short-term deposit obligations. The bank’s cash to deposit coverage ratio was negative 15 per cent in September 2017 and barely one per cent in September 2018, this measure of operating cash flow to deposit liabilities, looks frail. A number of analysts express the opinion that they would prefer that the bank posted a ratio that was above 20 per cent. ‘’By getting above the magic trigger figure of 20, investors begin to feel reasonably comfortable about a banks liquidity situation’’, says Segun Atere, chief market analyst at Apel Assets and Trust Limited, one of the largest traders on the floor of the market.

Cash flows from operating activities for the bank at the end of September 2017 were negative but switched to a more comfortable positive position by the end of the same month in 2018; operating cash flow rose from a deficit of N100 billion in September 2017 to N7.7 billion in September 2018 mainly because of a significant change in the bank’s exposure to loans and advances which fell from an outflow of N82 billion in September 2017 to a lower outflow of N67 billion in 2018 or an 18.3 per cent fall in credit exposure and a subsequent improvement in cash flow from operations, with last year’s negative outflow of deposits of minus N30.3 billion being reversed to a sizably more impressive inflow of N38.4 billion.

Cash flows from operating activities for the bank at the end of September 2017 were negative but switched to a more comfortable positive position by the end of the same month in 2018; operating cash flow rose from a deficit of N100 billion in September 2017 to N7.7 billion in September 2018 mainly because of a significant change in the bank’s exposure to loans and advances which fell from an outflow of N82 billion in September 2017 to a lower outflow of N67 billion in 2018 or an 18.3 per cent fall in credit exposure and a subsequent improvement in cash flow from operations, with last year’s negative outflow of deposits of minus N30.3 billion being reversed to a sizably more impressive inflow of N38.4 billion.

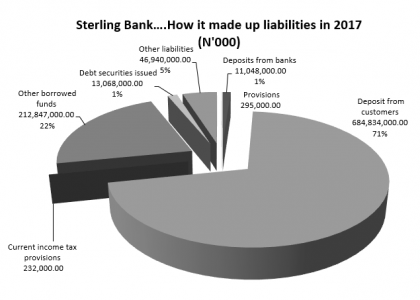

Even though the banks deposit liabilities from customers are rising (it grew from N684.8 billion in September 2017 to N723.3 in September 2018 or a short jump of 6 per cent on a year-on-year basis), the bank is still asphyxiating as it is yet to pull in enough deposits to support a comfortable liquidity position, a situation Professor Martin Ike-Muonso, Chief Transformation Strategist at Investment Banking Group,GTI, would prefer to call, ‘’oxygenation’’. As good as Sterling Bank’s September 2018 profit after tax of N8.2 billion is; analysts note that if the bank is to ease liquidity pressure its operating cash flow must rise significantly by as much as between N80 billion and N100 billion by year end. This is unlikely to happen. Nevertheless, the Second-Tier bank will still have to push for a lower cost- to- income ratio and a higher bottom line to indicate a commitment towards strengthening its books going forward into the New Year 2019.

Does Sterling Banks operating earnings signify better times ahead? Maybe, but a lot depends on the banks plans for its forward operating cash flow. The banks nine month operating cash flow relative to its operating earnings in 2018 is 0.13, a number financial analysts believe is fairly low and would need to be improved in the coming year. According to one analysts who declined being mentioned in print, ‘’Sterling Bank has quite good staff and an interesting strategic thrust, but it appears to be hampered by weak underlying financials. This is your typical case of potential being stronger than reality’’.

Does Sterling Banks operating earnings signify better times ahead? Maybe, but a lot depends on the banks plans for its forward operating cash flow. The banks nine month operating cash flow relative to its operating earnings in 2018 is 0.13, a number financial analysts believe is fairly low and would need to be improved in the coming year. According to one analysts who declined being mentioned in print, ‘’Sterling Bank has quite good staff and an interesting strategic thrust, but it appears to be hampered by weak underlying financials. This is your typical case of potential being stronger than reality’’.

Nevertheless, the bank seems to have nicely weathered the battle of stability, but may have to win the war of sustainability.