Business

CBN N300bn for agric lending in 2016: Another ruse?

DON OKERE| The Central Bank of Nigeria (CBN) and Deposit Money Banks (DMBs) have reportedly set aside N300 billion for agricultural lending in 2016 apparently in an effort to grow and diversify the economy from oil that has seen its price plummet painfully. The oil price is in its deepest downturn.

Oil fell below $33 a barrel on Thursday for the first time since April 2004. Oil prices have fallen by around 70 percent since mid-2014, hurting oil companies and governments that rely on crude revenue, like Nigeria. Stakeholders seem to agree that it will be years before oil returns to $90 or $100 a barrel. That is bad news for Nigeria that depends on oil as its major source of income.

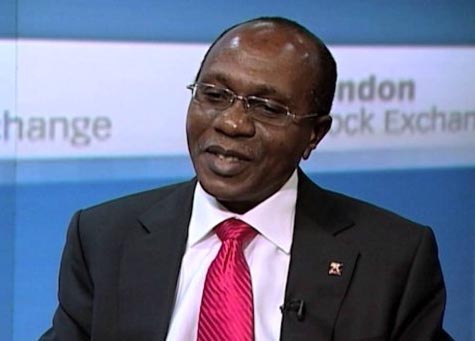

The N300 billion for agricultural lending, according to Godwin Emefiele, governor of CBN, at the end of the seventh annual Bankers’ Committee retreat in Lagos would accommodate not only the small and medium enterprises (SMEs), also large-scale farming companies in the agricultural sector.

Emefiele explained that the increase in lending to the agriculture sector would translate to reduction in the demand of foreign exchange that would help conserve Nigeria’s foreign reserves and strengthen its currency.

The N300 billion for agricultural lending is a commendable development especially now that the country is seeking creative ways to diversify the economy from oil. According to an analyst, setting aside “N300 billion for agricultural lending is an effort at creative fiscal expansion”. He said “the agricultural sector has been in fine fettle over the last four years as the former agriculture minister and now managing director of African Development Bank (AfDB), Akinwumi Adesina, took the sector to new and enviable heights of productive output”. However, he said the sector “is still in need of a massive injection of funds to improve not just output but also productivity or output per person”.

The analyst noted that “the N300 billion additional expenditure commitment to the sector would significantly help in growing the sector further provided the additional spending relates to improved access to loans by genuine farmers (as distinct from the traditional fleet-footed ‘farm fund’ pirates) and improvement in farm storage facilities and farm gate road infrastructure.”

Importantly, like those loan before it, implementation will be key. Implementation includes condition for borrowing.

It would be recalled that when CBN floated the N200 billion Commercial Agricultural Credit Scheme (CACS) loan, many low-scale/peasant and large-scale commercial farmers complained bitterly about their inability to access the funds. Even though the idea behind the scheme was seemingly noble and well-thought-out, most farmers were of the opinion that the criteria set to access the funds seemed unrealistic and the awareness poor. This is the same with other loans either by the CBN or direct from the Federal Government, stakeholders reckon.

Farmers registered under Goshen Potato Farmers’ Cooperative at the time said there was no way they could have accessed the N200 billion CACS loan if the Federal Government did not review the conditions for borrowing, noting that the conditions were stringent. Some other farmers lamented over the guidelines, describing them as somewhat unrealistic and elitist. Some analysts said this N300 billion loan for agricultural lending in 2016 will still be dogged with the same fate.

Stakeholders in the industry were of the view that the guidelines of the N200 billion CACS loan consciously marginalized low-scale farmers, who constitute over 80 percent of the country’s farming population. Even if the focus of the fund is to develop commercial agriculture, how many commercial farms in Nigeria could have been really qualified with asset base of N350 million? They queried. The N350 million asset base was part of the condition for accessing the loan.

According to the leadership of the Goshen Potato Farmers’ Cooperative, the group tried some banks but they refused to lend. It said the farmers were met with very stiff conditions for borrowing when they went to the banks to access the loan, noting that the lenders told them the money was meant for big commercial farmers.

Some stakeholders have said that frequent recourse to hand-outs, which is what some see the N300 billion loan facility as, are bound to have an inflationary impact on the economy. They say the problems of Nigeria’s agricultural sector are so many that a N300 billion loan facility will amount to just a drop of water in the ocean. According to them, the money can never make any meaningful impact.

Some fear that in the disbursement of the loan the choice of businesses to benefit from it could also be a problem, noting that part of the guidelines of accessing some of these loans are sometime tied to the business not being less than a certain whopping amount of money. They reckoned that except the few farms owned and managed by expatriates, it is always difficult for indigenous firms to get such loans in the sector.

In order not to fall into the pit in the disbursement of the loan like others before it, an analyst said that “to get the fiscal spending to achieve the desired objectives of agricultural sector expansion, the government may need to find institutional frameworks outside the conventional banking channels”, noting that “using conventional bank lending operational procedures could hobble the speed and breadth of lending execution. This means that the lending channels should be such that they are decentralized and managed at the level of case study officers at local agricultural lending desks of microcredit agencies such as Lift Above Poverty (LAPO) and Accion Microfinance Banks.” He noted that “the problem with standard commercial bank credit administration processes is that they are slow, ponderous and invariably designed to reject agricultural loan applications by default. Much of the problem has a lot to do with the inherent risks of the sector and the lack of firm land title documents by farmers.”

It is important to state that the aim of this N300 billion loan for agricultural lending, among other things, must be to provide credit facilities to commercial agriculture enterprises perhaps at single digit interest rate; enhance national food security by increasing food supply and effectively lower the prices of agricultural produce and products; reduce cost of credit in agricultural production, enable farmers exploit the full potentials of the sector; and, increase output, generate employment, diversify the revenue base of the economy, increase foreign exchange earnings and provide input for the industrial sector on a sustainable basis.

In Nigeria, agricultural development plays a vital role for economic survival and as an alternative source of revenue for government, aside petroleum, especially now that revenue from the oil sector has emaciated drastically. It is important that the CBN liberalizes the loan guidelines of the N300 billion so that farmers can access it. It is preposterous to put out such a loan and also sprinkle obstacles on the way of farmers who want to access it. It is tantamount to subterfuge. To say the least the CBN may be failing in its vision to “promote sustainable economic development” with such inflexible guidelines.